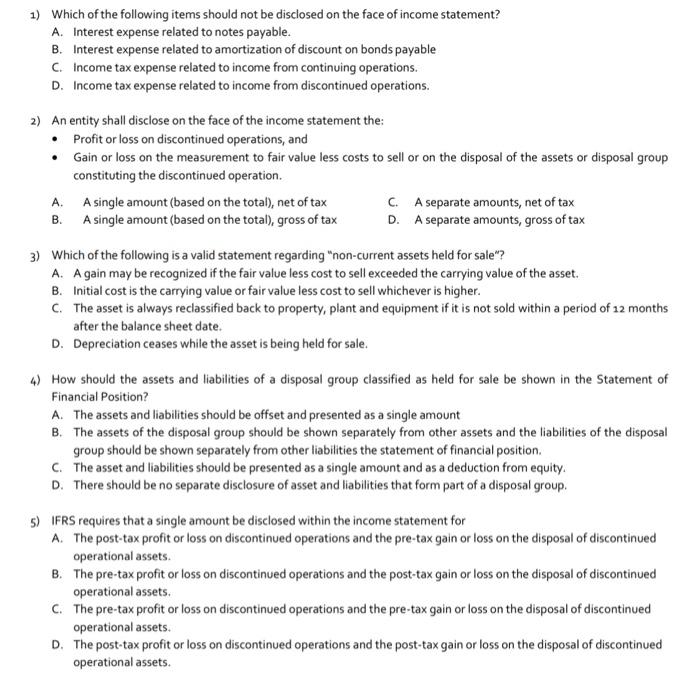

1) Which of the following items should not be disclosed on the face of income statement? A. Interest expense related to notes payable. B. Interest expense related to amortization of discount on bonds payable C. Income tax expense related to income from continuing operations. D. Income tax expense related to income from discontinued operations. 2) An entity shall disclose on the face of the income statement the: Profit or loss on discontinued operations, and Gain or loss on the measurement to fair value less costs to sell or on the disposal of the assets or disposal group constituting the discontinued operation. A single amount (based on the total), net of tax C. A separate amounts, net of tax A single amount (based on the total), gross of tax D. A separate amounts, gross of tax A. B. 3) Which of the following is a valid statement regarding "non-current assets held for sale"? A. A gain may be recognized if the fair value less cost to sell exceeded the carrying value of the asset. B. Initial cost is the carrying value or fair value less cost to sell whichever is higher. C. The asset is always reclassified back to property, plant and equipment if it is not sold within a period of 12 months after the balance sheet date. D. Depreciation ceases while the asset is being held for sale. 4) How should the assets and liabilities of a disposal group classified as held for sale be shown in the Statement of Financial Position? A. The assets and liabilities should be offset and presented as a single amount B. The assets of the disposal group should be shown separately from other assets and the liabilities of the disposal group should be shown separately from other liabilities the statement of financial position. C. The asset and liabilities should be presented as a single amount and as a deduction from equity. D. There should be no separate disclosure of asset and liabilities that form part of a disposal group. 5) IFRS requires that a single amount be disclosed within the income statement for A. The post-tax profit or loss on discontinued operations and the pre-tax gain or loss on the disposal of discontinued operational assets. B. The pre-tax profit or loss on discontinued operations and the post-tax gain or loss on the disposal of discontinued operational assets. C. The pre-tax profit or loss on discontinued operations and the pre-tax gain or loss on the disposal of discontinued operational assets. D. The post-tax profit or loss on discontinued operations and the post-tax gain or loss on the disposal of discontinued operational assets