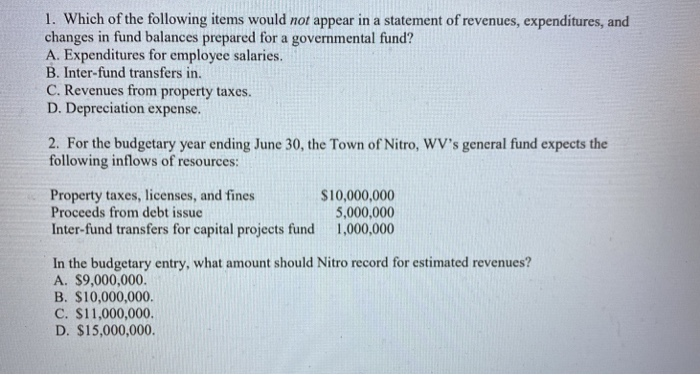

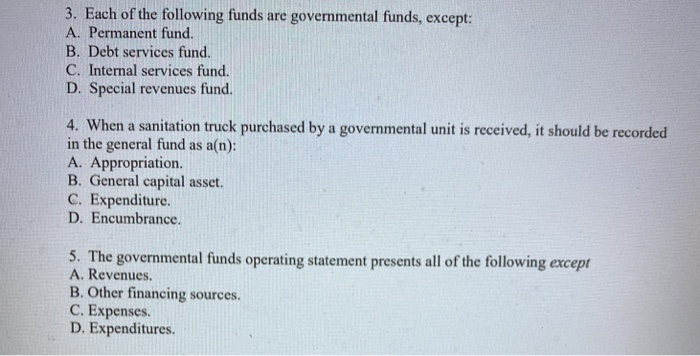

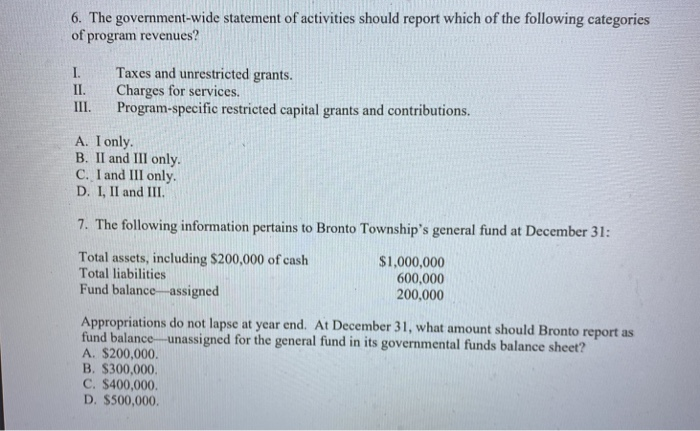

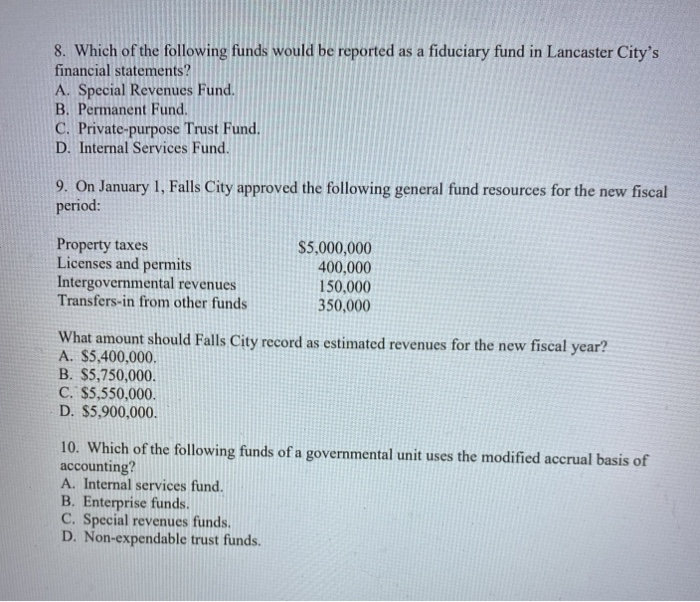

1. Which of the following items would not appear in a statement of revenues, expenditures, and changes in fund balances prepared for a governmental fund? A. Expenditures for employee salaries. B. Inter-fund transfers in. C. Revenues from property taxes. D. Depreciation expense. 2. For the budgetary year ending June 30, the Town of Nitro, WV's general fund expects the following inflows of resources: Property taxes, licenses, and fines Proceeds from debt issue Inter-fund transfers for capital projects fund $10,000,000 5,000,000 1,000,000 In the budgetary entry, what amount should Nitro record for estimated revenues? A. $9,000,000 B. $10,000,000 D. $15,000,000 3. Each of the following funds are governmental funds, except: A. Permanent fund. B. Debt services fund. C. Internal services fund. D. Special revenues fund. 4. When a sanitation truck purchased by a governmental unit is received, it should be recorded in the general fund as a(n): A. Appropriation. B. General capital asset. C. Expenditure. D. Encumbrance. 5. The governmental funds operating statement presents all of the following except A. Revenues. B. Other financing sources. C. Expenses. D. Expenditures. 6. The government-wide statement of activities should report which of the following categories of program revenues? I. II. III. Taxes and unrestricted grants. Charges for services. Program-specific restricted capital grants and contributions. A. I only. B. II and III only. C. I and III only. D. I, II and III. 7. The following information pertains to Bronto Township's general fund at December 31: Total assets, including $200,000 of cash Total liabilities Fund balance assigned $1,000,000 600,000 200,000 Appropriations do not lapse at year end. At December 31, what amount should Bronto report as fund balance unassigned for the general fund in its governmental funds balance sheet? A. $200,000. B. $300,000 C. $400,000 D. $500,000 8. Which of the following funds would be reported as a fiduciary fund in Lancaster City's financial statements? A. Special Revenues Fund. B. Permanent Fund. C. Private-purpose Trust Fund D. Internal Services Fund 9. On January 1, Falls City approved the following general fund resources for the new fiscal period: Property taxes Licenses and permits Intergovernmental revenues Transfers.in from other funds $5,000,000 400,000 150,000 350,000 What amount should Falls City record as estimated revenues for the new fiscal year? A. $5,400,000 B. $5,750,000. C. $5,550,000. D. $5,900,000. 10. Which of the following funds of a governmental unit uses the modified accrual basis of accounting? A. Internal services fund. B. Enterprise funds. C. Special revenues funds. D. Non-expendable trust funds