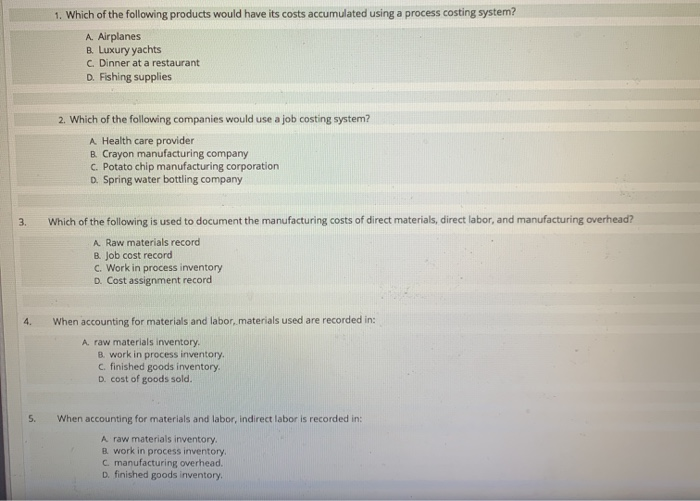

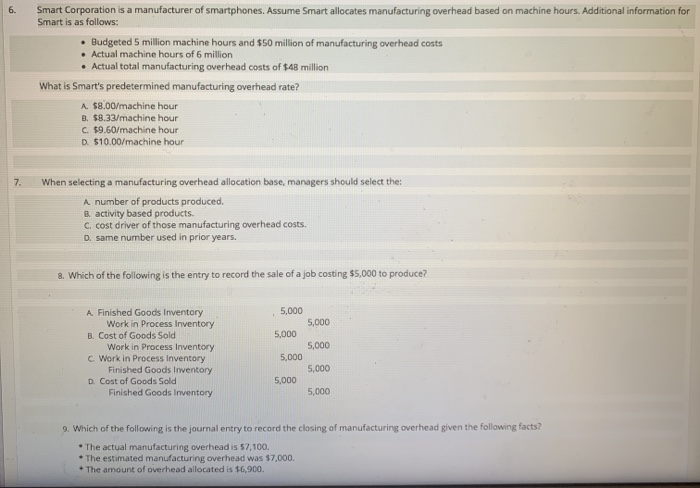

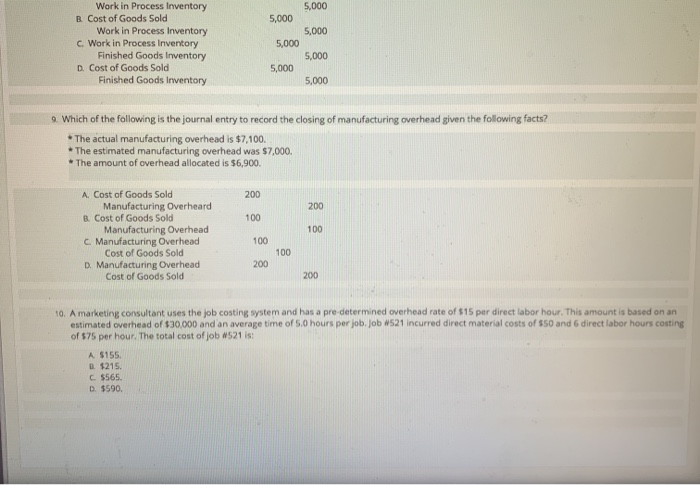

1. Which of the following products would have its costs accumulated using a process costing system? A. Airplanes B. Luxury yachts C. Dinner at a restaurant D. Fishing supplies 2. Which of the following companies would use a job costing system? A Health care provider B. Crayon manufacturing company C. Potato chip manufacturing corporation D. Spring water bottling company 3 Which of the following is used to document the manufacturing costs of direct materials, direct labor, and manufacturing overhead? A Raw materials record B. Job cost record C. Work in process inventory D. Cost assignment record 4. When accounting for materials and labor, materials used are recorded in: A. raw materials inventory. B. work in process inventory C. finished goods inventory D. cost of goods sold. 5. When accounting for materials and labor, indirect labor is recorded in: A raw materials inventory. B. work in process inventory c manufacturing overhead. D. finished goods inventory 6. Smart Corporation is a manufacturer of smartphones. Assume Smart allocates manufacturing overhead based on machine hours. Additional information for Smart is as follows: Budgeted 5 million machine hours and $50 million of manufacturing overhead costs Actual machine hours of 6 million Actual total manufacturing overhead costs of $48 million What is Smart's predetermined manufacturing overhead rate? A. $8.00/machine hour B. $8.33/machine hour C. $9.60/machine hour D. $10.00/machine hour 7. When selecting a manufacturing overhead allocation base managers should select the: A number of products produced B activity based products. C. cost driver of those manufacturing overhead costs. D. same number used in prior years. 8. Which of the following is the entry to record the sale of a job costing $5,000 to produce? 5,000 A Finished Goods Inventory Work in Process Inventory B. Cost of Goods Sold Work in Process Inventory c Work in Process Inventory Finished Goods Inventory D. Cost of Goods Sold Finished Goods Inventory 5,000 5,000 5,000 5,000 5.000 5,000 5,000 9. Which of the following is the journal entry to record the closing of manufacturing overhead given the following facts? The actual manufacturing overhead is 57,100. The estimated manufacturing overhead was $7,000. The amount of overhead allocated is $6,900. 5.000 5,000 5,000 Work in Process Inventory B Cost of Goods Sold Work in Process Inventory c Work in Process Inventory Finished Goods Inventory D. Cost of Goods Sold Finished Goods Inventory 5,000 5,000 5,000 5,000 9. Which of the following is the journal entry to record the closing of manufacturing overhead given the following facts? * The actual manufacturing overhead is $7,100. * The estimated manufacturing overhead was 7,000. * The amount of overhead allocated is $6,900. 200 200 100 100 A. Cost of Goods Sold Manufacturing Overheard B. Cost of Goods Sold Manufacturing Overhead C. Manufacturing Overhead Cost of Goods Sold D. Manufacturing Overhead Cost of Goods Sold 100 100 200 200 10. A marketing consultant uses the job costing system and has a pre determined overhead rate of $15 per direct labor hour. This amount is based on an estimated overhead of $30,000 and an average time of 5.0 hours per job. Job N521 incurred direct material costs of $50 and 6 direct labor hours costing of $75 per hour. The total cost of job w521 is: A $155 $215. C5565 D$590