Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Which of the following should not be included as an application of the rate of return concept? a. rate of return measures the overall

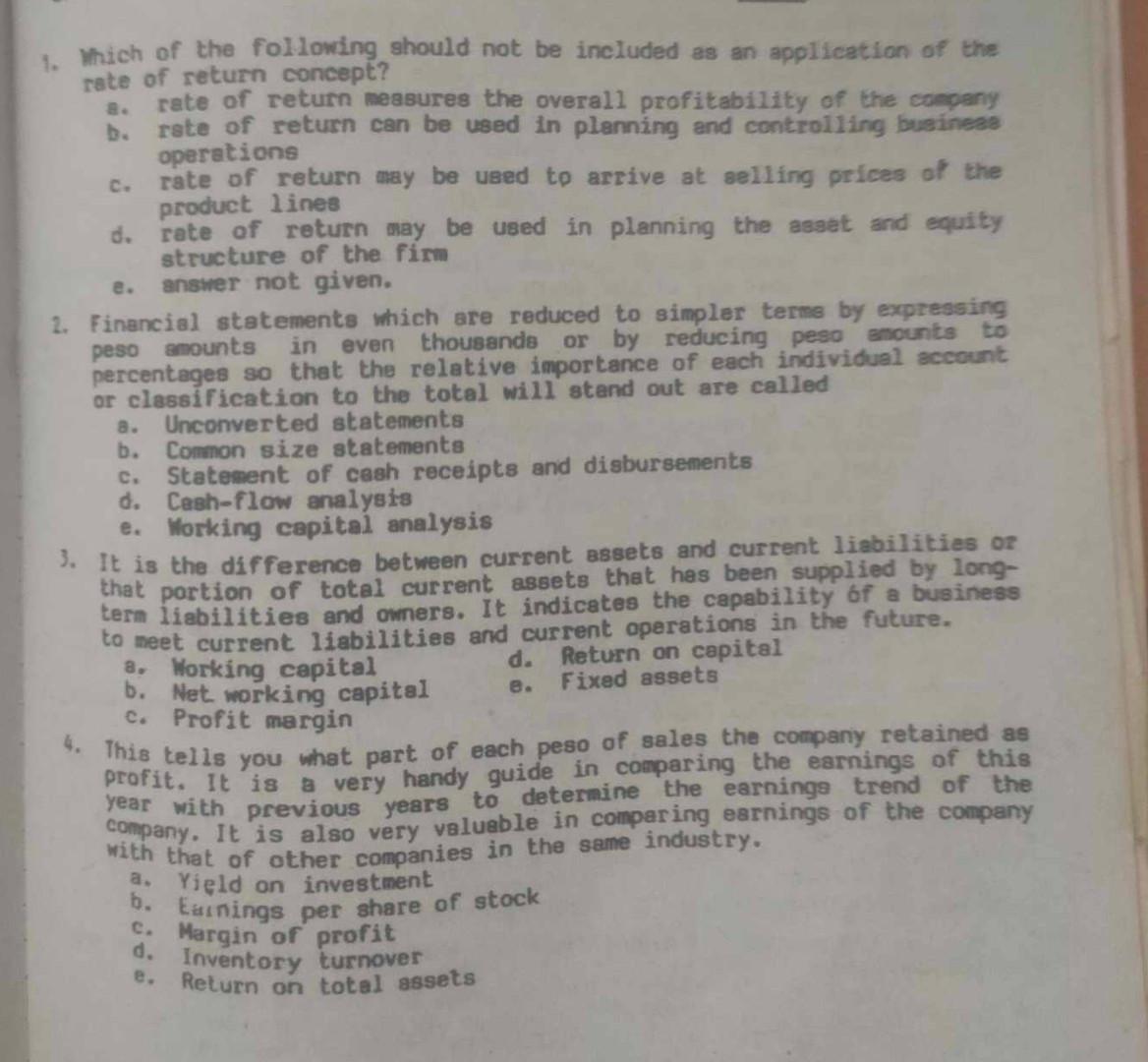

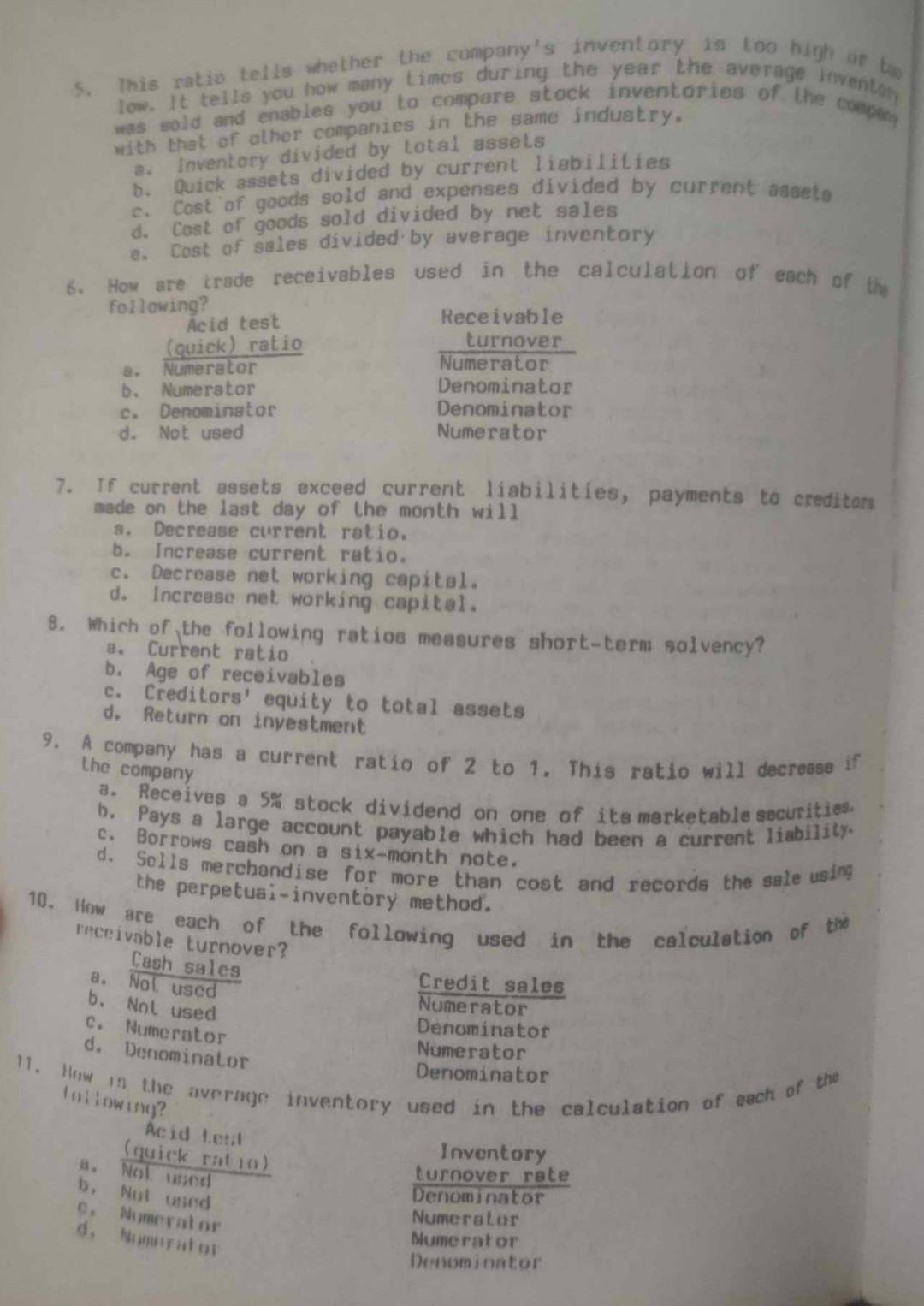

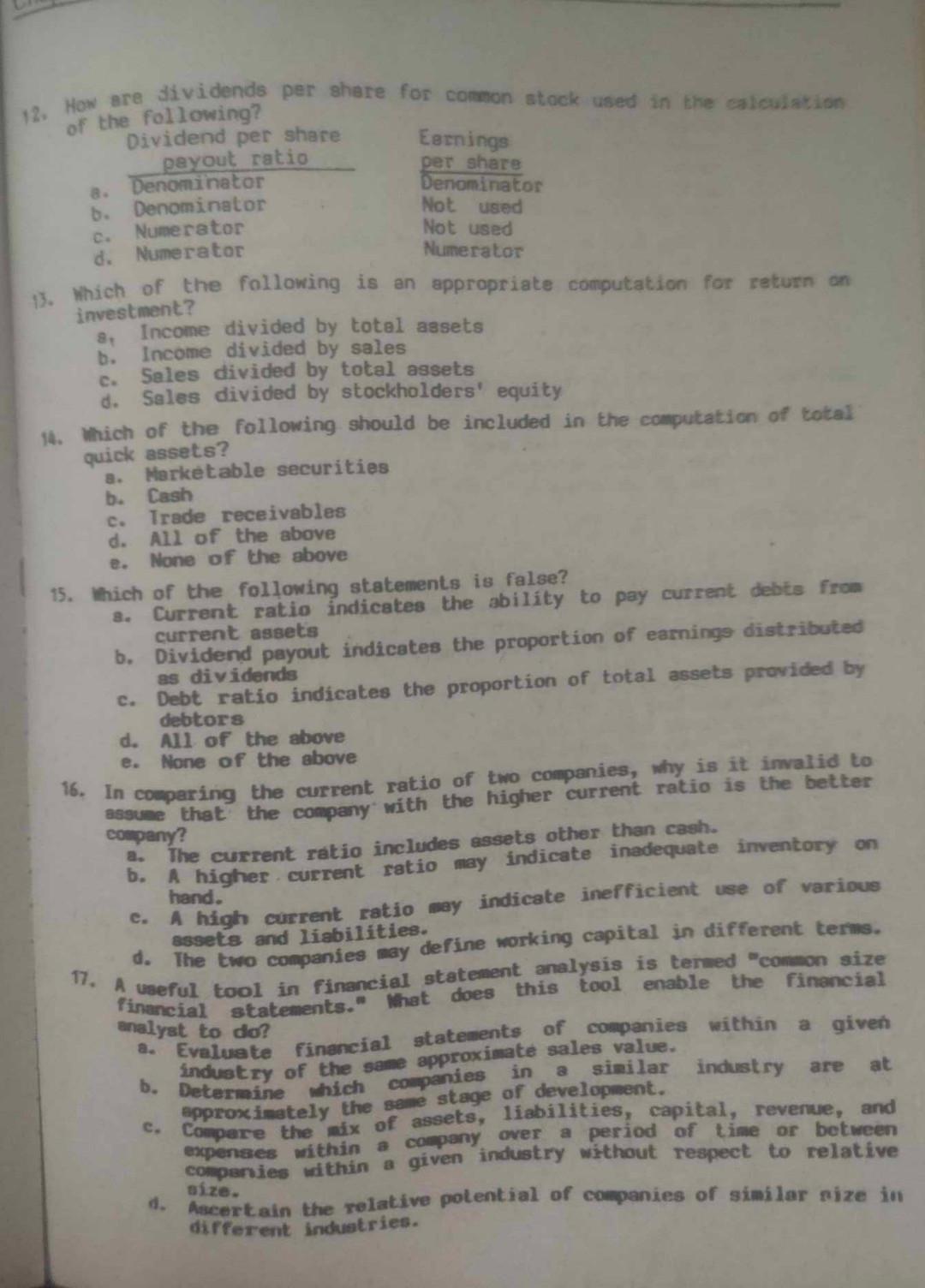

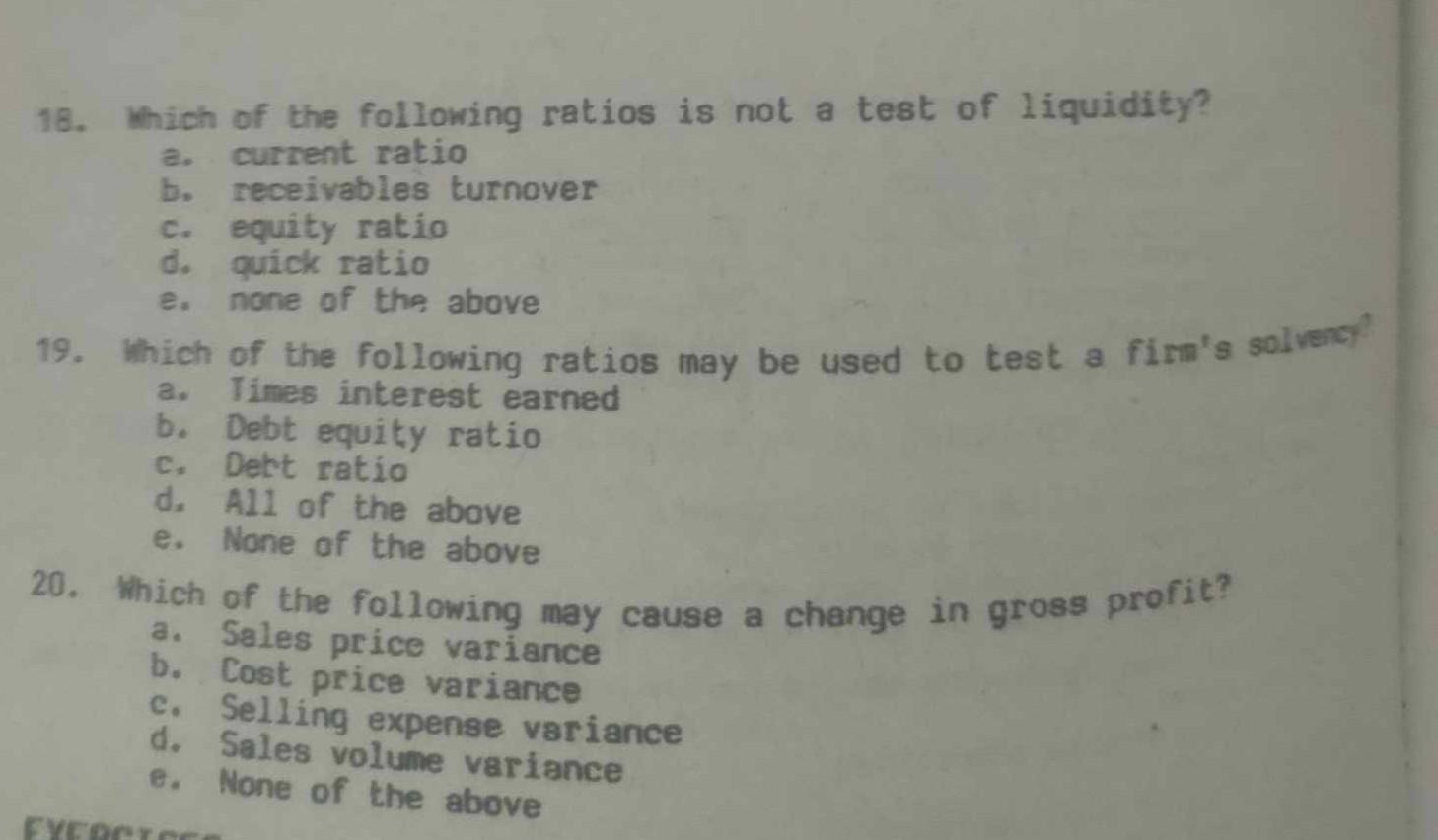

1. Which of the following should not be included as an application of the rate of return concept? a. rate of return measures the overall profitability of the comeny b. rate of return can be used in planning and controlling businese operations c. rate of return may be used to arrive at selling prices of the product 1 ines d. rate of return way be used in planning the asset and equity structure of the firm e. answer not given. 2. Financial statements wich are reduced to simpler terms by expressing peso amounts in even thousands or by reducing peso snounts to percentages so that the relative importance of each individual account or classification to the total will stand out are called a. Unconverted statements b. Common size statements c. Statement of cesh receipts and disbursements d. Cash-flow analysis e. Working capital analysis 3. It is the difference between current sssets and current liabilities of that portion of total current assets that has been supplied by longtern liabilities and owners. It indicates the capability of a business to meet current liabilities and current operations in the future. a. Working capital d. Return on capital b. Net. working capital e. Fixed assets c. Profit margin 4. This tells you what part of each peso of sales the company retained as profit. It is a very handy guide in comparing the earnings of this year with previous years to deternine the earnings trend of the company. It is also very valuable in comparing earnings of the company with that of other companies in the same industry. a. Yield on investment b. Euinings per share of stock c. Margin of profit d. Inventory turnover e. Return on total assets 18. Which of the following ratios is not a test of liquidity? a. current ratio b. receivables turnover c. equity ratio d. quick ratio e. none of the above 19. Which of the following ratios may be used to test a fim's solvenct? a. Iimes interest earned b. Debt equity ratio c. Debt ratio d. All of the above e. None of the above 20. Which of the following may cause a change in gross profit? a. Sales price variance b. Cost price variance c. Selling expense variance d. Sales volume variance e. None of the above 5. This ratio tells whether the cumpany's inventory is too high af to low. It tells you how many times during the year the average inventay was sold and enables you to compare stock inventories of the company. with that of other conpan by total assets a. Inventory div divided by current liabilities c. Cost of goods sold and expenses divided by current aaseto d. Cost of goods sold divided by net sales e. Cost of sales divided by uverage inventory 6. How are irade receivables used in the calculation of each of the following? Acid test (quick) ratio a. Numerator b. Numerator c. Denominator d. Not used Receivable turnover Numerator Denominator Denominator Numerator 7. If current assets exceed current liabilities, payments to crediton asede on the last day of the month will a. Decrease current ratio. b. Increase current ratio. c. Decrease net working capital. d. Increase net working capital. 8. Which of the following ratios measures short-term solvency? a. Current ratio b. Age of receivables c. Creditors' equity to total assets d. Return on investment 9. A company has a current ratio of 2 to 1 . This ratio will decrease if the company a. Receives a \5 stock dividend on one of its marketable securities. b. Pays a large account payable which had been a current liability. c. Borrows cash on a six-month note. d. Solis merchandise for more than cost and records the sale using the perpetuai-inventory method. 10. How are each of the following used in the calculation of the receivable turnover? Cash sales a. Not used b. Nni used c. Numerator d. Deriominator Credit sales Numerator Denominator Numerator Denominator 11. How in the lobinwing? 12. How sre jividends per ghere for comon stock used in the calculation of the following? Earnings per share a. Denominator Denominator b. Denominator Not used c. Numerator Not used d. Numerator Numerator 13. Which of the following is an appropriate computation for return on investment? 8. Income divided by total assets b. Income divided by sales c. Sales divided by total assets d. Sales divided by stockholders' equity 14. Which of the following should be included in the computation of total quick assets? a. Nerketable securities b. Cash c. Trade receivables d. All of the above e. None of the above 15. Which of the following statements is false? a. Current ratio indicates the ability to pay current debts from current assets b. Dividend payout indicates the proportion of earninge distributed c. Debt ratio indicates the proportion of total assets provided by debtors d. All of the above e. None of the above 16. In comparing the current ratio of two companies, why is it invalid to assuere that the company with the higher current ratio is the better company? a. The current ratio includes assets other than cash. b. A higher current ratio may indicate inadequate inventory on hand. c. A high current ratio indicate inefficient use of variove d. The two compantes andies. 17. A. useful tool in conpanies define working capital in different terms. analyst to do? a. Evaluate financial statements of companies within a giveh b. Industry of the same approximate sales value. b. Determine hich companies in a similar industry are at c. approximately the stage of development. Conpere the dix of assets, liabilities, capital, revenue, and expenses within a company over a period of time or between comersies within a given industry without respect to relative d. Aacertain the relative potential of companies of siailar size in different induetries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started