Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Which of the following statement is correct? In the Modigliani-Miller world with frictionless markets and no corporate taxes, the firm weighted average cost of

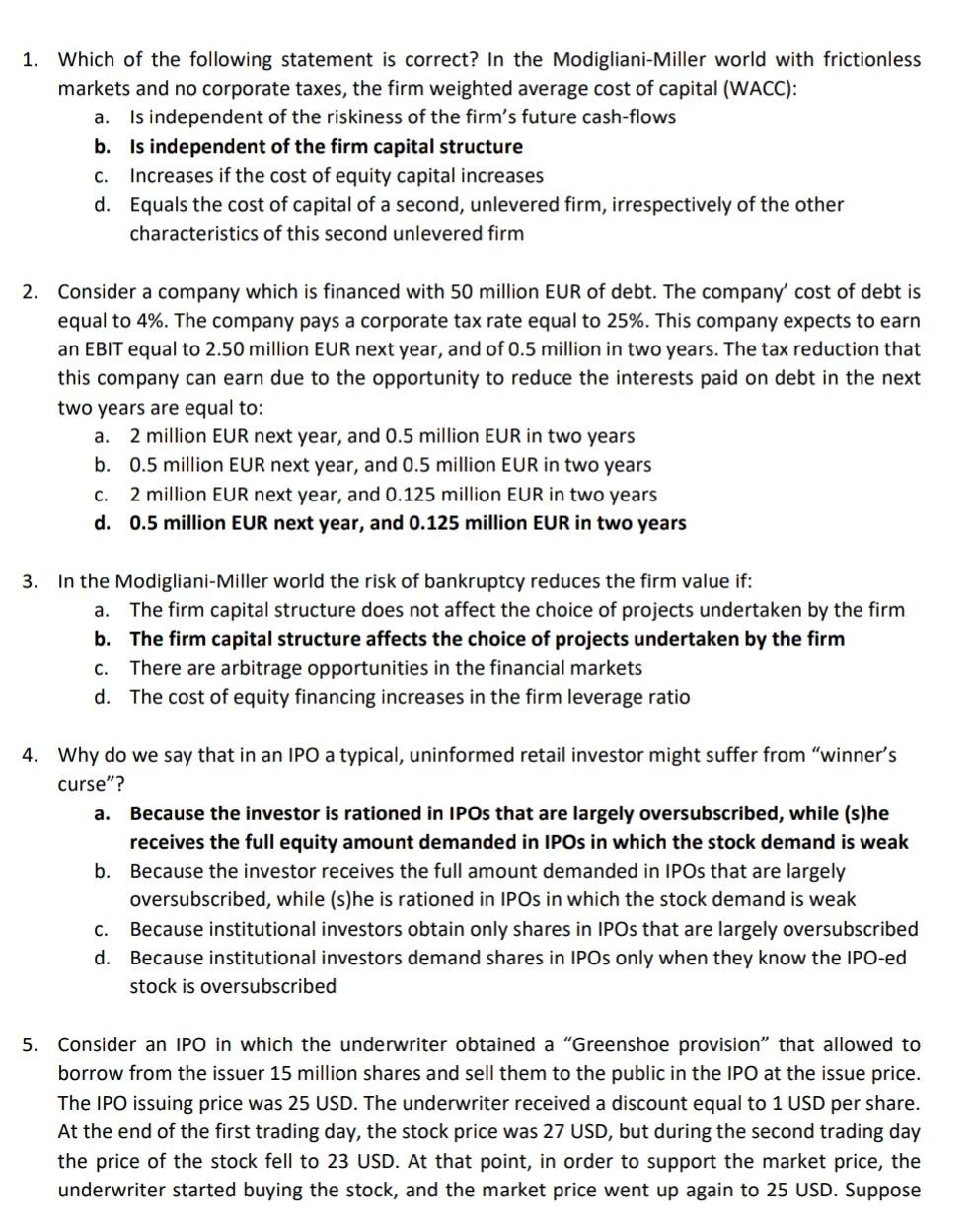

1. Which of the following statement is correct? In the Modigliani-Miller world with frictionless markets and no corporate taxes, the firm weighted average cost of capital (WACC): a. Is independent of the riskiness of the firm's future cash-flows b. Is independent of the firm capital structure C. Increases if the cost of equity capital increases d. Equals the cost of capital of a second, unlevered firm, irrespectively of the other characteristics of this second unlevered firm 2. Consider a company which is financed with 50 million EUR of debt. The company' cost of debt is equal to 4%. The company pays a corporate tax rate equal to 25%. This company expects to earn an EBIT equal to 2.50 million EUR next year, and of 0.5 million in two years. The tax reduction that this company can earn due to the opportunity to reduce the interests paid on debt in the next two years are equal to: a. 2 million EUR next year, and 0.5 million EUR in two years b. 0.5 million EUR next year, and 0.5 million EUR in two years 2 million EUR next year, and 0.125 million EUR in two years d. 0.5 million EUR next year, and 0.125 million EUR in two years C. a. 3. In the Modigliani-Miller world the risk of bankruptcy reduces the firm value if: The firm capital structure does not affect the choice of projects undertaken by the firm b. The firm capital structure affects the choice of projects undertaken by the firm There are arbitrage opportunities in the financial markets d. The cost of equity financing increases in the firm leverage ratio C. 4. Why do we say that in an IPO a typical, uninformed retail investor might suffer from "winner's curse"? a. Because the investor is rationed in IPOs that are largely oversubscribed, while (s)he receives the full equity amount demanded in IPOs in which the stock demand is weak b. Because the investor receives the full amount demanded in IPOs that are largely oversubscribed, while (s)he is rationed in IPOs in which the stock demand is weak Because institutional investors obtain only shares in IPOs that are largely oversubscribed d. Because institutional investors demand shares in IPOs only when they know the IPO-ed stock is oversubscribed C. 5. Consider an IPO in which the underwriter obtained a "Greenshoe provision that allowed to borrow from the issuer 15 million shares and sell them to the public in the IPO at the issue price. The IPO issuing price was 25 USD. The underwriter received a discount equal to 1 USD per share. At the end of the first trading day, the stock price was 27 USD, but during the second trading day the price of the stock fell to 23 USD. At that point, in order to support the market price, the underwriter started buying the stock, and the market price went up again to 25 USD. Suppose

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started