Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Which of the following statements is TRUE? A) Stocks typically have very predictable future cash flows whereas bonds do not. B) The limited liability

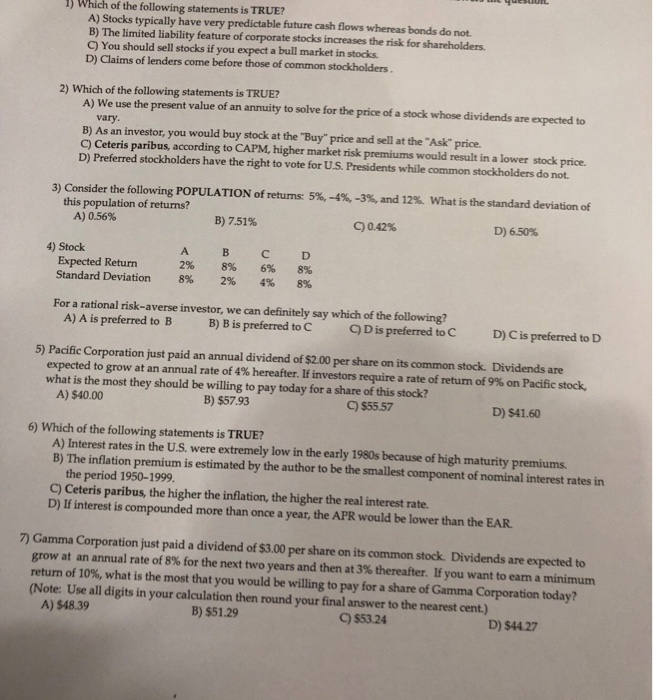

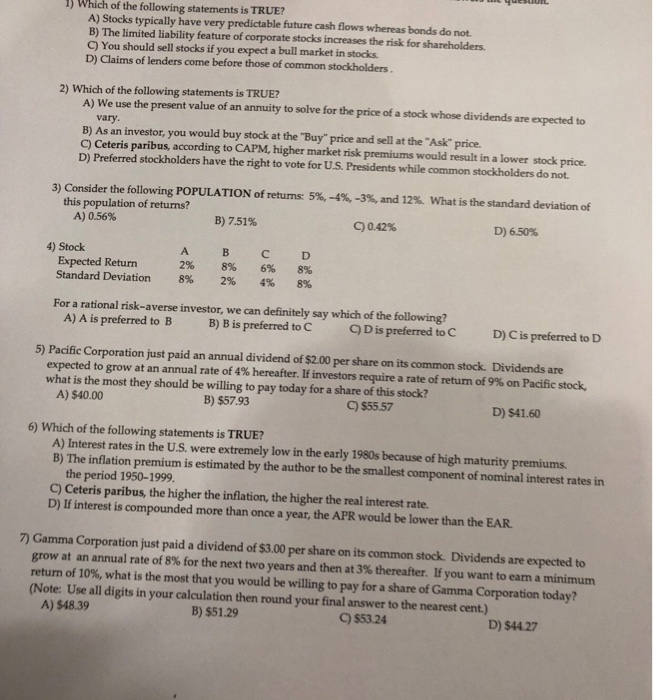

1) Which of the following statements is TRUE? A) Stocks typically have very predictable future cash flows whereas bonds do not. B) The limited liability feature of corporate stocks increases the risk for shareholders C) You should sell stocks if you expect a bull market in stocks. D) Claims of lenders come before those of common stockholders 2) Which of the following statements is TRUE? A) We use the present value of an annuity to solve for the price of a stock whose dividends are expected to vary B) As an investor, you would buy stock at the "Buy" price and sell at the "Ask price. C) Ceteris paribus, according to CAPM, higher market risk premiums would result in a lower stock price. D) Preferred stockholders have the right to vote for U.S. Presidents while common stockholders do not 3) Consider the following POPULATION of returns 5%, 4%-3%, and 12% what is the standard deviation of this population of returns? A) 0.56% B) 7.51% C) 0.42% D)650% A 2% 8% BCD 8% 6% 8% 2% 4) Stock Expected Return Standard Deviation 4% 8% For a rational risk-averse investor, we can definitely say which of the following? A) A is preferred to B B) B is preferred to C C) D is preferred to C D) Cis preferred to D 5) Pacific Corporation just paid an annual dividend of $2.00 per share on its common stock. Dividends are expected to grow at an annual rate of 4% hereafter. If investors require a rate of return of 9% on Pacific stock, what is the most they should be willing to pay today for a share of this stock A) $40.00 B) $57.93 C) $55.57 D) $41.60 6) Which of the following statements is TRUE? A) Interest rates in the U.S. were extremely low in the early 1980s because of high maturity premiums B) The inflation premium is estimated by the author to be the smallest component of nominal interest rates in the period 1950-1999. C) Ceteris paribus, the higher the inflation, the higher the real interest rate. D) If interest is compounded more than once a year, the APR would be lower than the EAR 7) Gamma Corporation just paid a dividend of $3.00 per share on its common stock. Dividends are expected to grow at an annual rate of 8% for the next two years and then at 3% thereafter. If you want to eam a minimum return of 10%, what is the most that you would be willing to pay for a share of Gamma Corporation today? (Note: Use all digits in your calculation then round your final answer to the nearest cent.) A) $48.39 B) $51.29 C)$53.24 D) $44.27

1) Which of the following statements is TRUE? A) Stocks typically have very predictable future cash flows whereas bonds do not. B) The limited liability feature of corporate stocks increases the risk for shareholders C) You should sell stocks if you expect a bull market in stocks. D) Claims of lenders come before those of common stockholders 2) Which of the following statements is TRUE? A) We use the present value of an annuity to solve for the price of a stock whose dividends are expected to vary B) As an investor, you would buy stock at the "Buy" price and sell at the "Ask price. C) Ceteris paribus, according to CAPM, higher market risk premiums would result in a lower stock price. D) Preferred stockholders have the right to vote for U.S. Presidents while common stockholders do not 3) Consider the following POPULATION of returns 5%, 4%-3%, and 12% what is the standard deviation of this population of returns? A) 0.56% B) 7.51% C) 0.42% D)650% A 2% 8% BCD 8% 6% 8% 2% 4) Stock Expected Return Standard Deviation 4% 8% For a rational risk-averse investor, we can definitely say which of the following? A) A is preferred to B B) B is preferred to C C) D is preferred to C D) Cis preferred to D 5) Pacific Corporation just paid an annual dividend of $2.00 per share on its common stock. Dividends are expected to grow at an annual rate of 4% hereafter. If investors require a rate of return of 9% on Pacific stock, what is the most they should be willing to pay today for a share of this stock A) $40.00 B) $57.93 C) $55.57 D) $41.60 6) Which of the following statements is TRUE? A) Interest rates in the U.S. were extremely low in the early 1980s because of high maturity premiums B) The inflation premium is estimated by the author to be the smallest component of nominal interest rates in the period 1950-1999. C) Ceteris paribus, the higher the inflation, the higher the real interest rate. D) If interest is compounded more than once a year, the APR would be lower than the EAR 7) Gamma Corporation just paid a dividend of $3.00 per share on its common stock. Dividends are expected to grow at an annual rate of 8% for the next two years and then at 3% thereafter. If you want to eam a minimum return of 10%, what is the most that you would be willing to pay for a share of Gamma Corporation today? (Note: Use all digits in your calculation then round your final answer to the nearest cent.) A) $48.39 B) $51.29 C)$53.24 D) $44.27

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started