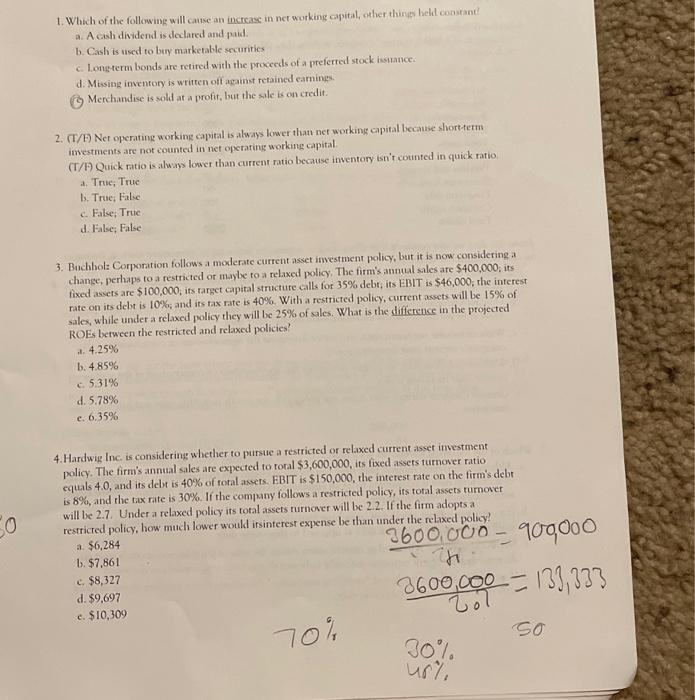

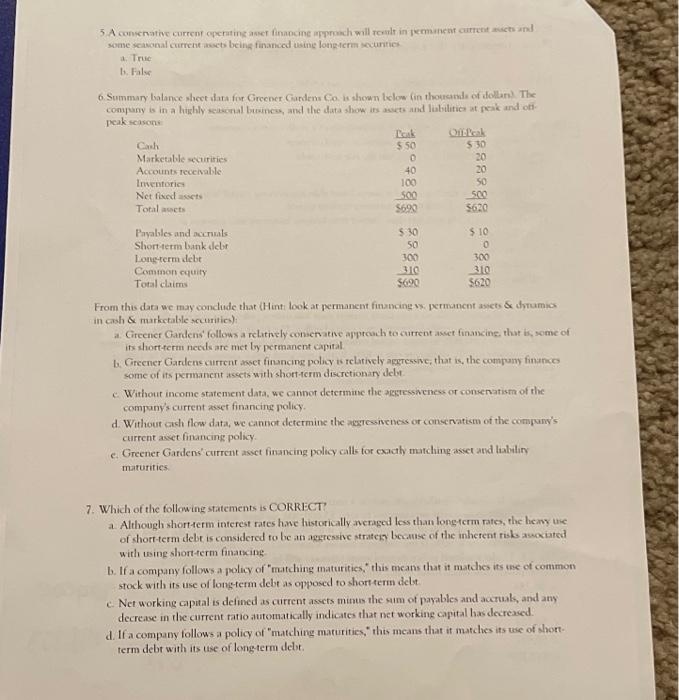

1. Which of the following will causc an incrase in ner working ipitah, orher things beht cocstant a. A cash dividend is declared and paid. b. Cash is used to bay marketable securitics c. Longterm bonds are retired with the proceeds of a preferted stock isuance. d. Mising imentoty is written ofl against retained earnings. (9) Merchandise is sold at a profit, but the sale is on credit. 2. (T/E) Net operating working capital is always lower that net wotking capital because short-term imestrents are not counted in net operating working capital (T/A Quick ratio is always lower than current ratio because inventory isn't cotnted in quick ratio a. Truc; True 1. True; Fale c. False, True d. False; False 3. Bachhol Corporation follows a moderate current asset imestment policy, but it is now considering a change, perhaps ro a restricted or maybe to a relaxed policy. The firm's annual sales are $400,000; its fixed assers are $100,000, its rarget capital structure calls for 35% debt; its EBIT is $46,000, the interest rate on its debt is 10%, and its tax rate is 40%. With a restricted policy, current assets will be 15% of sales, while under a relaxed policy they will be 25% of ales. What is the difference in the projected ROEs berween the restricted and relaxed policies? .1. 4.25% b. 4.85% c. 5.31% d. 5.78% c. 6.35% 4. Hardwig Inc. is considering whether to pursue a restricted or relaxed current asset imvestment policy. The firm's anntal sales are expected to ronal $3,600,000, its fixed ascers turnover natio equals 4.0 , and its debt is 40% of rotal asets. EBIT is $150,000, the intetest rate on the firm's debr is 8%, and rhe tux rate is 30%. If the company follows a restricted policy, its tonal assets rumover will be 2.7. Under a relaxed policy its total assets turnower will be 2.2 . If the firm adopts a restricted policy, how much lower would itsinterest expense be than under the relaxed policy? a. $6,284 b. $7,861 103600,000=900 c. $8,327 d. $9,697 c. $10,309 some seawonal current woses being financed using longherm securtics a. True 1. Falwe compuny is in a hughly sescial buremes, and the data shom irs avets and lisbilitio at pokk and of: peakseaschs From this data we may condlude that (Hint look at permanent financing vs. permanent avets \& thrumico in cosh & marketable scuritica): a. Gireener Gardens' follows a relatively consenatte agpteahh to current anset financine, that is, some of its shortferm needsare met ly permanent capital. b. Greener Gardens current asser finsncing poliny is relarikely aegressinc, that is, the conpumy financo some of its permanert issets with shotterm discretionary dely c. Without income statement data, we cannot determine the agstessieness or consenatism of the company's current aoer financing policy. d. Without cad flow data, we cannot determine the acgrewiveness or conservatism of the compuny's current asket financing policy. e. Greener Gardens' current asset financing policy calls for ceacty matching aset and lablitiry maturitics. 7. Which of the following statements is CORRECT? a. Although shorterm interest rates hine historically aceraged less than fongerm rates, the hemy ue, of short-term debe is considered to be an aggressive straten becalse of the inherent risk awoxiated with wing shorterm finatxing b. If a company follows a policy of "matching maturitics," this means that it matches its ue of common stock with its use of longterm debt as opposed to shorterm delt. c. Net working captal is defined as current assers munts the sum of payables and acruak, and any decrease in the current ratio automatically indicates that net working capital has decreased. d. If a company follows a policy of "matching maturities," this means that it matches its the of shortterm debt with its use of longterm debt. a. Acohdivitenat bstectied and thak b. Cach is uecd to boy natketable wecueines d. Mosine invemery b written wif weainst retained earnites. (9) Merchandie is sold at a prolis, biat the ale bon aredit. 2. (T/A) Ner openatiog wotkine capinal is alains bwer than net wotking capial hecause shorterai imeatmethts are not counted in net opstating working capital T/F Quick ratio is alaws lower than aiment ratio locause inentoty isn't counted in quick ratia a. True, True b. Tnas Fale 12. Falie, True d. Faber Fatic 3. Bochhols Corporation follows a mosketate cutrent aset ineitment policy, lat it is now conoikhering a change, letheps to a testricted of moyle to a relased policy. The tirm' annual sales ate $400.000, its Foid avees are 5100,600 , its target capial sacture call for 35% debti its EBIT is $46,000, the interest walcs, while unter a relaked policy thcy will be 2585 of ales. Whar th the difference in the projected ROFs berween the restriced and relaxed policies? a. 425% 1. 4.85%2 c. 531% d 5.78% c. 6.35% cquals 40 , and in delo is 40 Wo of toral asecs. HIMT is $150,000, the intetest rate on the firmb debe will be 2.7. Under a relased policy its toal asen furnower will be 22. Il the fitm adopes a a. 56,284 (i. 57,861 c. $8,327 d 59.697 c. 510,309 3. Trie b. Hale iti extro fe marketalde actatitice) 1. Eucenet Curdenscument anet finaming foliny is retatwely agorenswe, that is, thic compamy firances its ahsot-erm! needs are met by permanent cayntal. cocipany i aurrent asert finanging nolcy: e. Circcocr Gardensi amment ohet firuncine policy calis for exachly mutdaing awet and hability: cartrit anct financing nolicy. mestititick. 7. Which of the followine atatcments is CWRRECT? with using thottecm fauancine. wick witli it use of hotekerem detit as gbfoucd to ahurtecmus delot. Heweac in the camment ratio abtomatically indiates that iset whakinc cajtal has decreocet icra dibr with ins lise of lomererim delt