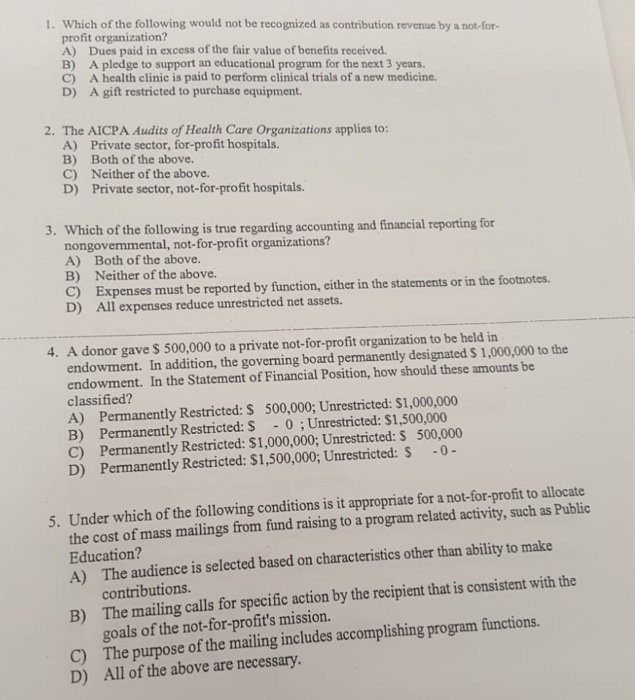

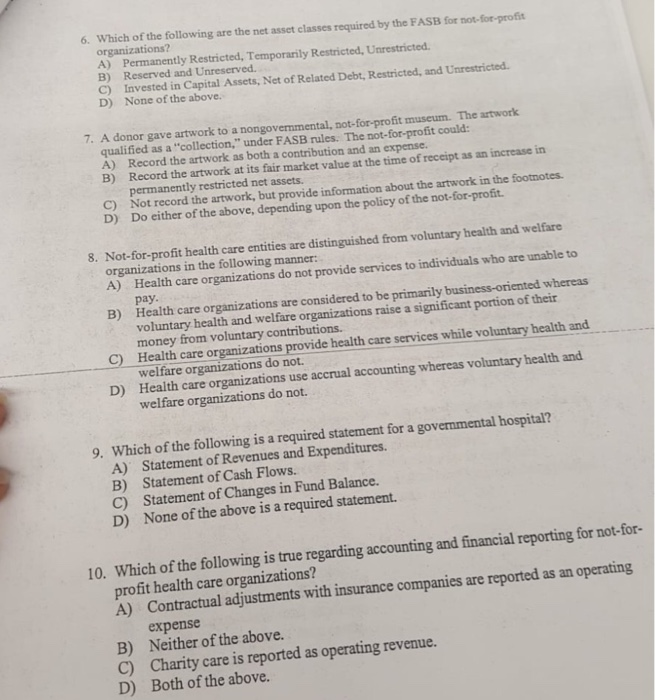

1. Which of the following would not be recognized as contribution revenue by a not-for- profit organization? A) Dues paid in excess of the fair value of benefits received B) A pledge to support an educational program for the next 3 years. C) A health clinic is paid to perform clinical trials of a new medicine. D) A gift restricted to purchase equipment 2. The AICPA Audits of Health Care Organizations applies to: A) Private sector, for-profit hospitals B) Both of the above. C) Neither of the above. D) Private sector, not-for-profit hospitals. 3. Which of the following is true regarding accounting and financial reporting for nongovemmental, not-for-profit organizations? A) Both of the above. B) Neither of the above. C) Expenses must be reported by function, either in the statements or in the footnotes. D) All expenses reduce unrestricted net assets 4. A donor gave $ 500,000 to a private not-for-profit organization to be held in endowment. In addition, the governing board permanently designated S 1,000,000 to the endowment. In the Statement of Financial Position, how should these amounts be classified? A) Permanently Restricted: S 500,000; Unrestricted: $1,000,000 B) Permanently Restricted: $ 0Unrestricted: $1,500,000 C) Permanently Restricted: $1,000,000; Unrestricted: S 500,000 D) Permanently Restricted: $1,500,000; Unrestricted: S -0- 5. Under which of the following conditions is it appropriate for a not-for-profit to allocate the cost of mass mailings from fund raising to a program related activity, such as Public Education? A) The audience is selected based on characteristics other than ability to make contributions. The mailing calls for specific action by the recipient that is consistent with the goals of the not-for-profit's mission. The purpose of the mailing includes accomplishing program functions. All of the above are necessary. B) C) D) 6. Which of the following are the net asset classes required by the FASB for not-for-proft organizations? A) Permanently Restricted, Temporarily Restricted, Unrestricted B) Reserved and Unreserved C) Invested in Capital Assets, Net of Related Debt, Restricted, and Unrestricted None of the above. 7. A donor gave artwork to a nongovemmental, not-for-profit museum. The artwork qualified as a "collection," under FASB rules. The not-for-profit could: A) Record the artwork as both a contribution and an expense. B) Record the artwork at its fair market value at the time of receipt as an increase in permanently restricted net assets Not record the artwork, but provide information about C) D) Do either of the above, depending upon the policy of the not-for-profit the artwork in the footnotes 8. Not-for-profit health care entities are distinguished from voluntary health and welfare organizations in the following manner: A) Health care organizations do not provide services to individuals who are unable to pay. B) Health care organizations are considered to be primarily business-oriented whereas voluntary health and welfare organizations raise a significant portion of their money from voluntary contributions. Health care organizations provide health care services while voluntary health and welfare organizations do not Health care organizations use accrual accounting whereas voluntary health and welfare organizations do not. C) D) 9. Which of the following is a required statement for a governmental hospital? A) Statement of Revenues and Expenditures. B) Statement of Cash Flows. C) Statement of Changes in Fund Balance. D) None of the above is a required statement. Which of the following is true regarding accounting and financial reporting for not-for- profit health care organizations? A) Contractual adjustments with insurance companies are reported as an operating 10. expense B) Neither of the above. C) Charity care is reported as operating revenue D) Both of the above