Question

Additional information: Page 72 There was virtually no beginning inventory of raw material, work in process and finished goods. At the end of the month,

Additional information:

Page 72

-

There was virtually no beginning inventory of raw material, work in process and finished goods.

-

At the end of the month, 10 per cent of the materials purchased remained on hand, work in process amounted to 20 per cent of the manufacturing costs incurred during the month, and finished goods inventories were negligible.

-

The factory occupies 80 per cent of the premises, the sales area 15 per cent and administration 5 per cent.

-

Most of the equipment is used for manufacturing, with only 5 per cent of the equipment being used for sales and administrative functions.

-

Almost all of the electricity is consumed in the factory.

-

The truck is used to deliver finished goods to customers.

-

Michael Hall spends about one-half of his time on factory management, one-third in the sales area and the rest on administration.

Required:

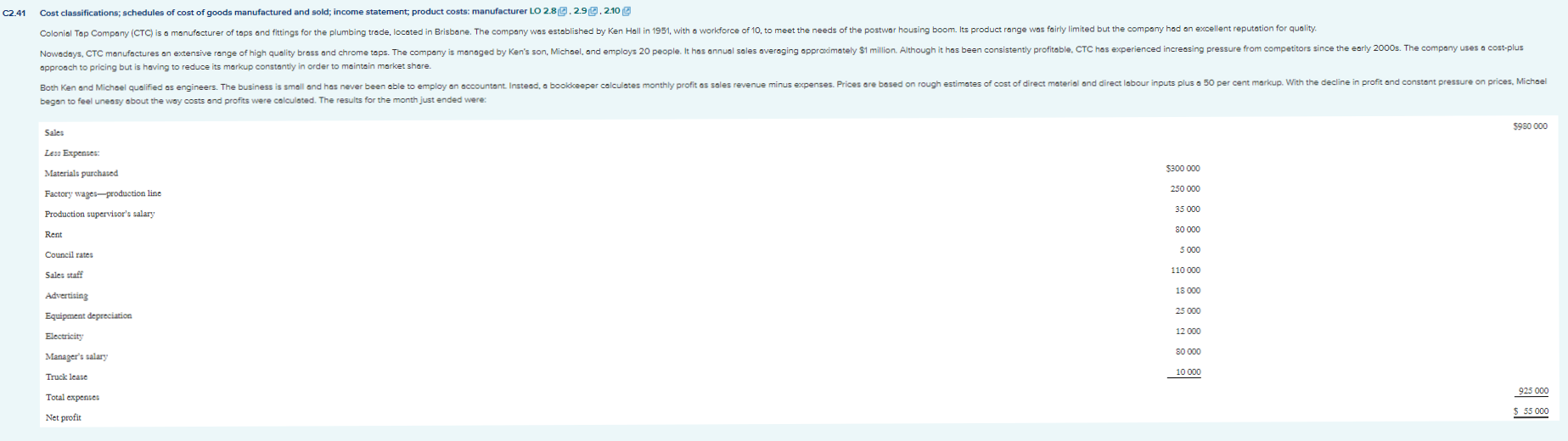

Michael Hall asks you to review the results for the month and evaluate the companys approach to estimating product costs. In doing so, you should:

-

Comment on the cost classifications used in CTCs income statement.

-

Estimate the cost of goods manufactured and sold.

-

Prepare a revised income statement for the month.

-

Explain the differences between your income statement and the one above.

-

If possible, suggest a more useful format for analysing costs than that used in your revised income statement.

-

Evaluate the usefulness of product costs based on direct materials and direct labour for determining selling prices.

-

Make recommendations for changes to be made to the companys approach to product costing and reporting profit.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started