Question

1. Which of the followings is/are General Partner(s) (GP) for this fund structure? a) Western Hotels PE (WHPE) b) CALPER pension plan c) Dutch Barns

1. Which of the followings is/are General Partner(s) (GP) for this fund structure?

a) Western Hotels PE (WHPE)

b) CALPER pension plan

c) Dutch Barns (Netherlands)

d) Mr. Bob Gates

2. Which of the followings is/are Limited Partner(s) (LP) for this fund structure?

a) Western Hotels PE (WHPE)

b) CALPER pension plan

c) Dutch Barns (Netherlands)

d) Mr. Bob Gates

3. Calculate the annual management fee paid to WHPE by the fund?

4. Calculate the total management fee paid to WHPE by the fund over the entire fund period?

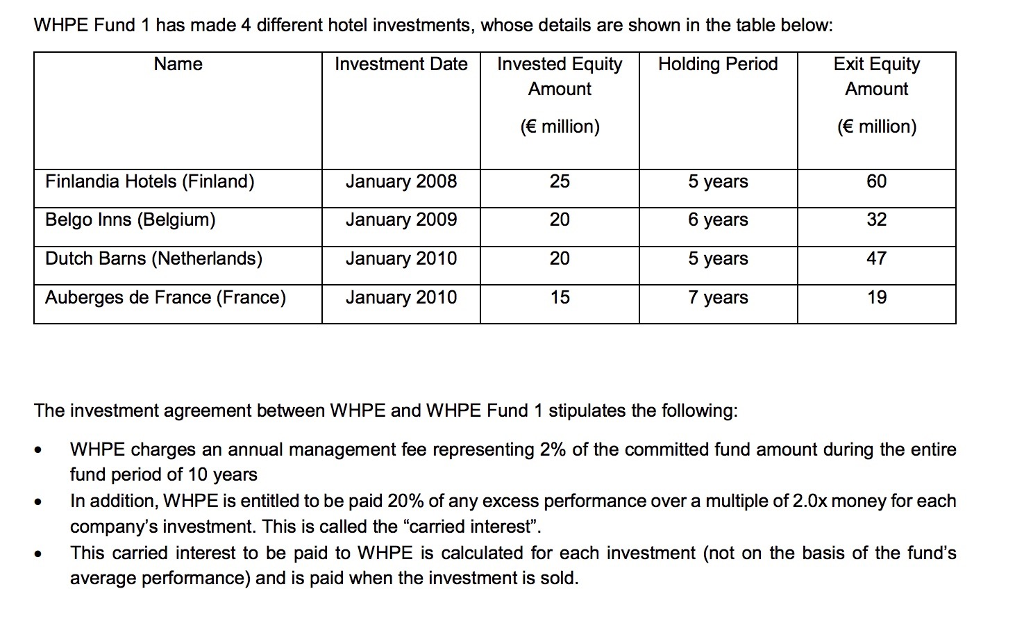

5. For each of the 4 investments made by WHPE Fund 1, calculate the investment IRR (before carried interest and annual management fees). You find the investment dates for each fund in table B.

IRR for Finlandia Hotels:

IRR for Belgo Inns:

IRR for Dutch Barns:

IRR for Auberges de France:

6. For each of the 4 investments made by WHPE Fund 1, calculate the investment money multiple (before carried interest and annual management fees).

MM for Finlandia Hotels:

MM for Belgo Inns:

MM for Dutch Barns:

MM for Auberges de France:

7. Calculate the carried interest amount paid to WHPE for each investment.

Carried interest for Finlandia Hotels:

Carried interest for Belgo Inns:

Carried interest for Dutch Barns:

Carried interest for Auberges de France:

8(a). Establish the funds cash flows by drawing a cash-flow table in the Excel file. You must take into account (i) invested and returned equity amounts (before carried interest and management fees) (ii) annual management fees paid to WHPE, and (iii) carried interest paid to WHPE Answer the following questions: What is the net Funds cash flow in 2008?

a) -27m

b) -42m

c) -37m

d) -38m

8(b). In which of the following years is funds cash flow the highest?

a) 2015

b) 2016

c) 2017

d) None of the above

9. If we look at the gross fund performance, what is the IRR?

a) 5.3%

b) 5.4%

c) 5.5%

d) None of the above

10. What is the Money Multiple based on Fund's investment cash flows only (excluding management fees and carried interest)?

a) x1.8

b) x1.9

c) x2.5

d) None of the above

11. Looking at the overall net fund performance to investors, what is the IRR? (now taking into account management fees and carried interest paid to WHPE)?

12. And what is the money multiple, taking into account management fees and carried interest paid to WHPE?

13. How much total money does WHPE make as fund manager of WHPE 1 in management fees and carried interested over the 10-year period?

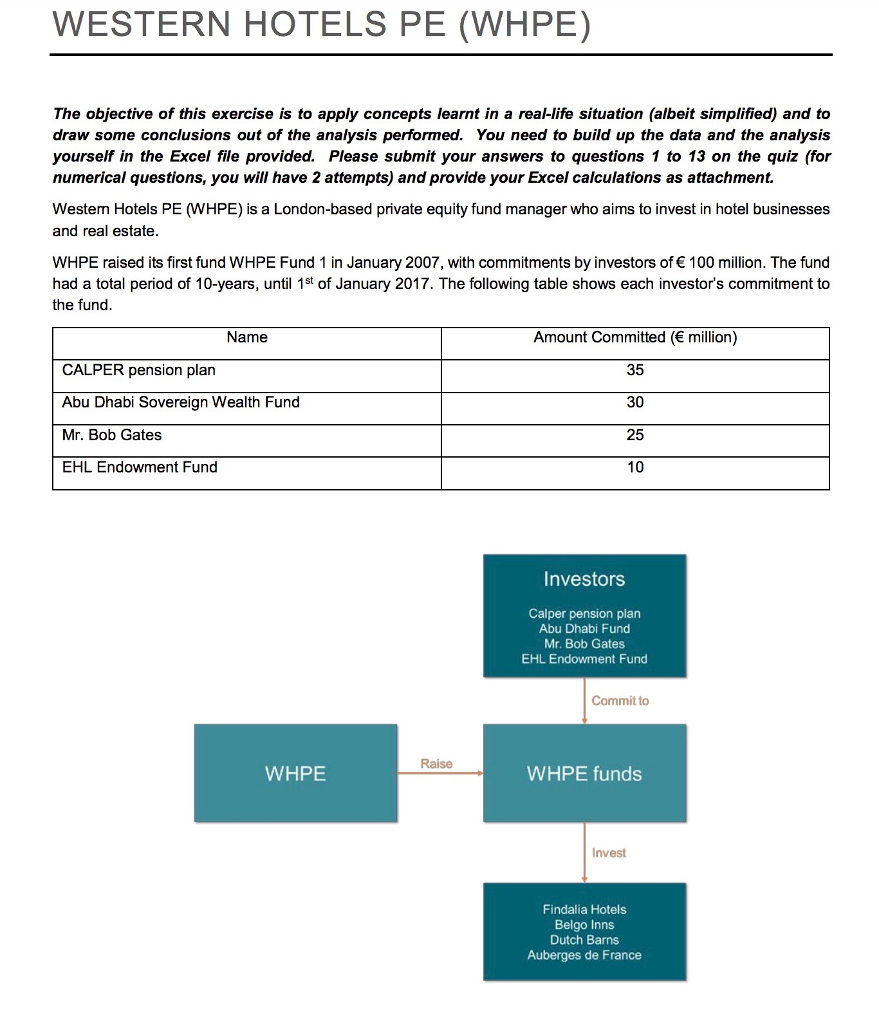

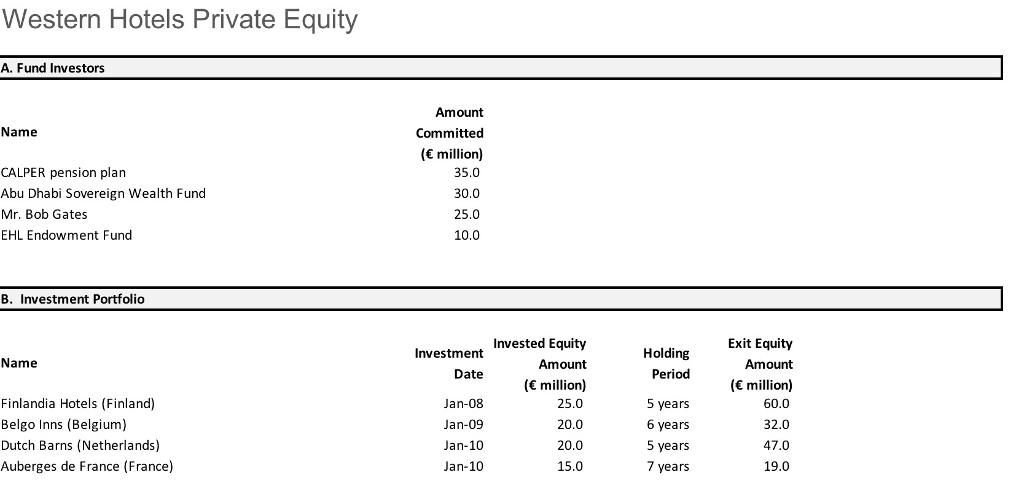

WESTERN HOTELS PE (WHPE) The objective of this exercise is to apply concepts learnt in a real-life situation (albeit simplified) and to draw some conclusions out of the analysis performed. You need to build up the data and the analysis yourself in the Excel file provided. Please submit your answers to questions 1 to 13 on the quiz (for numerical questions, you will have 2 attempts) and provide your Excel calculations as attachment. Westem Hotels PE (WHPE) is a London-based private equity fund manager who aims to invest in hotel businesses and real estate WHPE raised its first fund WHPE Fund 1 in January 2007, with commitments by investors of 100 million. The fund had a total period of 10-years, until 1st of January 2017. The following table shows each investor's commitment to the fund Name CALPER pension plan Abu Dhabi Sovereign Wealth Fund Mr. Bob Gates EHL Endowment Fund Amount Committed ( million) 35 30 25 Investors Calper pension plan Abu Dhabi Fund Mr. Bob Gates EHL Endowment Fund Commit to Raise WHPE WHPE funds Invest Findalia Hotels Belgo Inns Dutch Barns Auberges de France

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started