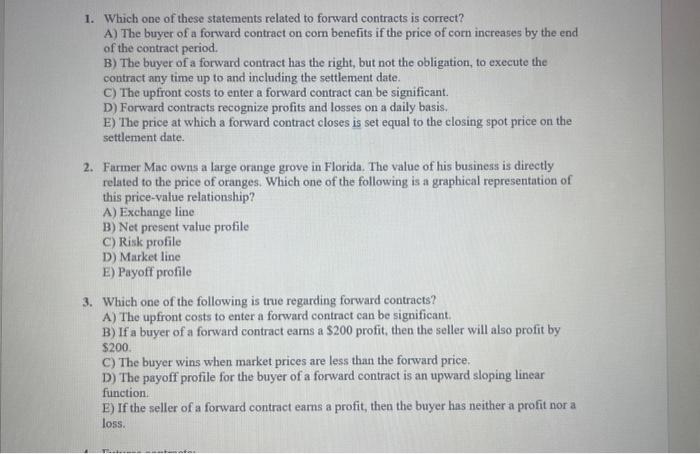

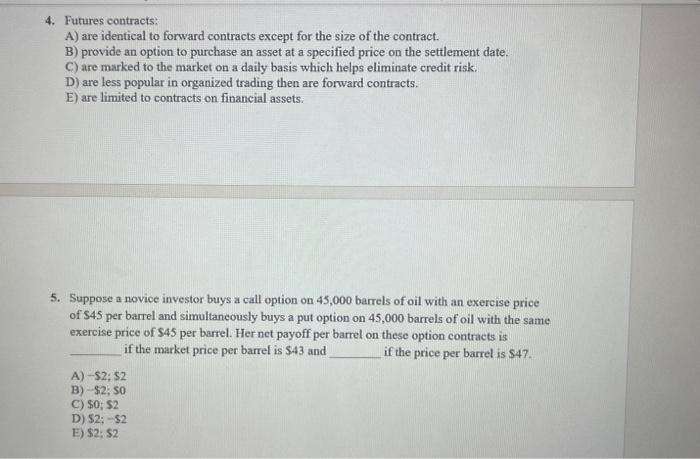

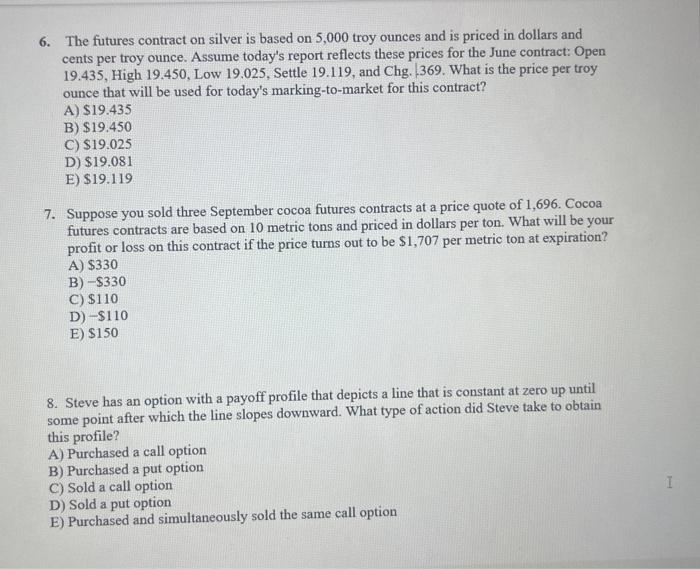

1. Which one of these statements related to forward contracts is correct? A) The buyer of a forward contract on corn benefits if the price of corn increases by the end of the contract period. B) The buyer of a forward contract has the right, but not the obligation, to execute the contract any time up to and including the settlement date. C) The upfront costs to enter a forward contract can be significant. D) Forward contracts recognize profits and losses on a daily basis. E) The price at which a forward contract closes is set equal to the closing spot price on the settlement date. 2. Farmer Mac owns a large orange grove in Florida. The value of his business is directly related to the price of oranges. Which one of the following is a graphical representation of this price-value relationship? A) Exchange line B) Net present value profile C) Risk profile D) Market line E) Payoff profile 3. Which one of the following is true regarding forward contracts? A) The upfront costs to enter a forward contract can be significant. B) If a buyer of a forvard contract eams a $200 profit, then the seller will also profit by $200. C) The buyer wins when market prices are less than the forward price. D) The payoff profile for the buyer of a forward contract is an upward sloping linear function. E) If the seller of a forward contract eams a profit, then the buyer has neither a profit nor a loss. 4. Futures contracts: A) are identical to forward contracts except for the size of the contract. B) provide an option to purchase an asset at a specified price on the settlement date. C) are marked to the market on a daily basis which helps eliminate credit risk. D) are less popular in organized trading then are forward contracts. E) are limited to contracts on financial assets. 5. Suppose a novice investor buys a call option on 45,000 barrels of oil with an exercise price of $45 per barrel and simultaneously buys a put option on 45,000 barrels of oil with the same exercise price of $45 per barrel. Her net payoff per barrel on these option contracts is if the market price per barrel is $43 and if the price per barrel is $47. A) $2;$2 B) 52;50 C) $0;$2 D) 52;52 E) $2;$2 6. The futures contract on silver is based on 5,000 troy ounces and is priced in dollars and cents per troy ounce. Assume today's report reflects these prices for the June contract: Open 19.435, High 19.450, Low 19.025, Settle 19.119, and Chg. 369. What is the price per troy ounce that will be used for today's marking-to-market for this contract? A) $19.435 B) $19.450 C) $19.025 D) $19.081 E) $19.119 7. Suppose you sold three September cocoa futures contracts at a price quote of 1,696 . Cocoa futures contracts are based on 10 metric tons and priced in dollars per ton. What will be your profit or loss on this contract if the price turns out to be $1,707 per metric ton at expiration? A) $330 B) $330 C) $110 D) $110 E) $150 8. Steve has an option with a payoff profile that depicts a line that is constant at zero up until some point after which the line slopes downward. What type of action did Steve take to obtain this profile? A) Purchased a call option B) Purchased a put option C) Sold a call option D) Sold a put option E) Purchased and simultaneously sold the same call option