Question

1. Which statement is true when the direct method is used to record inventory at net realizable value?* A. A loss is recorded directly by

1. Which statement is true when the direct method is used to record inventory at net realizable value?*

A. A loss is recorded directly by crediting inventory

B. The net realizable value for ending inventory is substituted for cost and the loss is buried in cost of goods sold

C. There is a direct reduction in estimated selling price that results in a loss

D. Only the portion of loss attributable to inventory sold during the period is recorded.

2. The following are basic assumptions of the gross profit method except*

A. The total amount of purchases and the total amount of sales remain relatively unchanged from the comparable previous period.

B. The beginning inventory plus the purchases equal total goods to be accounted for.

C. Goods not sold must be on hand.

D. If the sales, reduced to the cost basis, are deducted from the sum of the opening inventory plus purchases, the result is the amount of inventory on hand.

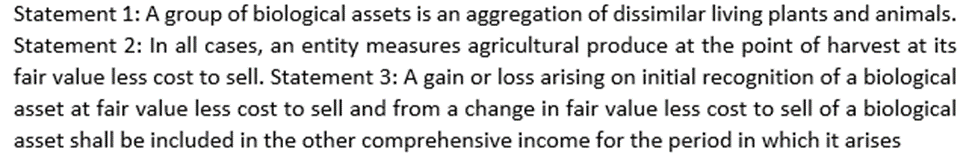

3. DEE Inc. purchased 600 milking cows on January 1, 2020 for P2,700,000. During 2020, the change in fair value due to physical and price changed amounted is P45,000 and the change in fair value due to harvest is (P5,000). Milk harvested but not yet sold had a net realizable value of P125,000. What is the correct entry to record the net gain from the change in fair value of biological asset.*

A. Debit biological asset, credit gain from biological asset - P45,000

B. Debit biological asset, credit gain from biological asset - P165,000

C. Debit biological asset, credit gain from biological asset - P40,000

D. Debit inventory, credit gain from biological asset - P125,000

4.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started