1. Wondering if someone could walk me through each of these JEs and explain specifics? For example, for the first JE, how do we know that APIC is 6,000 and Preferred Stock is 3,000?

2. Generally confused, any clarification will help

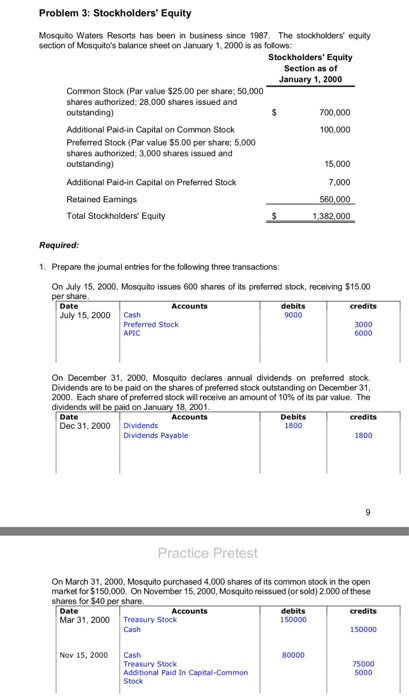

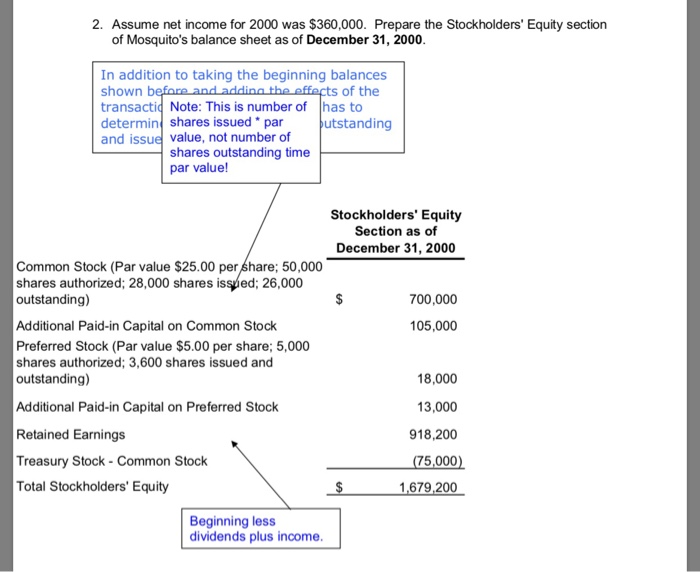

Problem 3: Stockholders' Equity Mosquito Waters Resorts has been in business since 1987. The stockholders' equity section of Mosquito's balance sheet on January 1, 2000 is as follows: Stockholders' Equity Section as of January 1, 2000 Common Stock (Par value $25.00 per share: 50.000 shares authorized: 28,000 shares issued and outstanding) 700.000 Additional Paid-in Capital on Common Stock 100,000 Preferred Stock (Par value $5.00 per share: 5,000 shares authorized: 3,000 shares issued and outstanding) 15,000 Additional Paid-in Capital on Preferred Stock 7,000 Retained Earnings 560.000 Total Stockholders' Equity 1,382,000 Required: 1. Prepare the journal entries for the following three transactions: On July 15, 2000, Mosquito issues 600 shares of its preferred stock, receiving $15.00 per share Date Accounts debits credits July 15, 2000 Cash 9000 Preferred Stock 3000 APIC 6000 On December 31, 2000, Mosquito declares annual dividends on preferred stock Dividends are to be paid on the shares of preferred stock outstanding on December 31 2000. Each share of preferred stock will receive an amount of 10% of its par value. The dividends will be paid on January 18, 2001. Accounts Debits Dec 31, 2000 Dividends Dividends Payable 1800 Date Credits 1800 Practice Pretest On March 31, 2000, Mosquito purchased 4,000 shares of its common stock in the open market for $150,000. On November 15, 2000, Mosquito reissued (or sold) 2.000 of these shares for $40 per share. Date Accounts debits credits Mar 31, 2000 Treasury Stock 150000 Cash 150000 Nov 15, 2000 80000 Cash Treasury Stock Additional Paid In Capital-Common Stock 75000 5000 2. Assume net income for 2000 was $360,000. Prepare the Stockholders' Equity section of Mosquito's balance sheet as of December 31, 2000. In addition to taking the beginning balances shown before and adding the effects of the transactio Note: This is number of has to determin shares issued * par u tstanding and issue value, not number of shares outstanding time par value! Stockholders' Equity Section as of December 31, 2000 700,000 105,000 Common Stock (Par value $25.00 per share; 50,000 shares authorized; 28,000 shares issued; 26,000 outstanding) Additional Paid-in Capital on Common Stock Preferred Stock (Par value $5.00 per share; 5,000 shares authorized; 3,600 shares issued and outstanding) Additional Paid-in Capital on Preferred Stock Retained Earnings Treasury Stock - Common Stock Total Stockholders' Equity 18,000 13,000 918,200 (75,000) 1,679,200 Beginning less dividends plus income