Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Write short notes on: (a) Immature Share (b) Bearish Market (c) Turnover Leader (d) DSE, and (e) CDBL 2. Briefly identify the accounting,

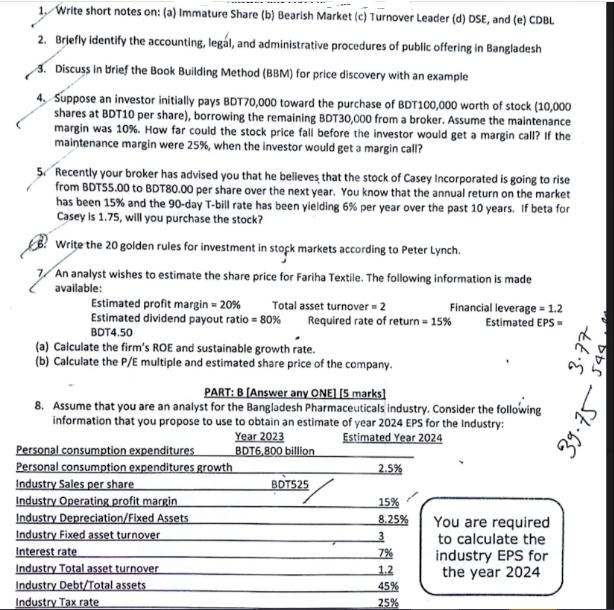

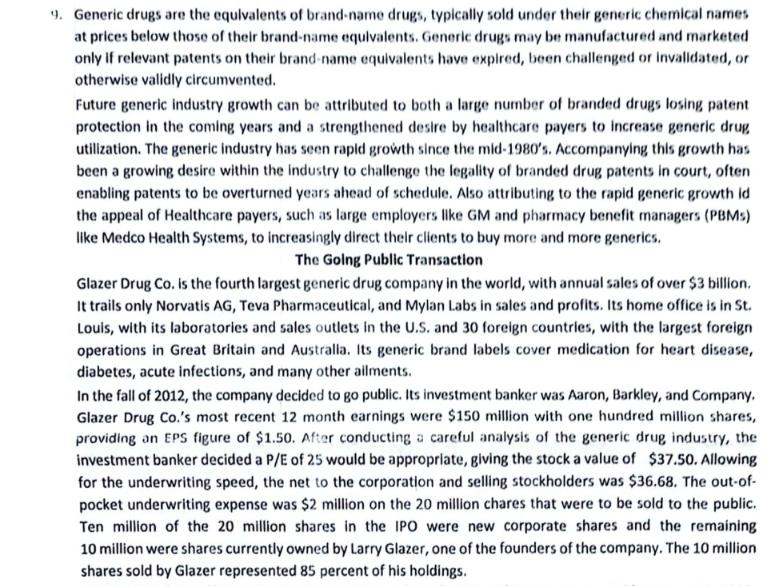

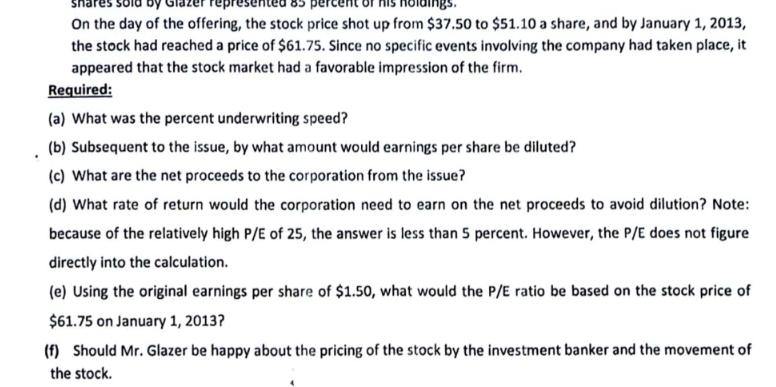

1. Write short notes on: (a) Immature Share (b) Bearish Market (c) Turnover Leader (d) DSE, and (e) CDBL 2. Briefly identify the accounting, legal, and administrative procedures of public offering in Bangladesh 3. Discuss in Brief the Book Building Method (BBM) for price discovery with an example 4. Suppose an investor initially pays BDT70,000 toward the purchase of BDT100,000 worth of stock (10,000 shares at BDT10 per share), borrowing the remaining BDT30,000 from a broker. Assume the maintenance margin was 10%. How far could the stock price fall before the investor would get a margin call? If the maintenance margin were 25%, when the investor would get a margin call? Recently your broker has advised you that he believes that the stock of Casey Incorporated is going to rise from BDTS5.00 to BDT80.00 per share over the next year. You know that the annual return on the market has been 15% and the 90-day T-bill rate has been yielding 6% per year over the past 10 years. If beta for Casey is 1.75, will you purchase the stock? Write the 20 golden rules for investment in stock markets according to Peter Lynch. An analyst wishes to estimate the share price for Fariha Textile. The following information is made available: Estimated profit margin = 20% Total asset turnover = 2 Financial leverage 1.2 Required rate of return = 15% Estimated EPS Estimated dividend payout ratio = 80% BDT4.50 (a) Calculate the firm's ROE and sustainable growth rate. (b) Calculate the P/E multiple and estimated share price of the company. PART: B [Answer any ONE] [5 marks] 8. Assume that you are an analyst for the Bangladesh Pharmaceuticals industry. Consider the following information that you propose to use to obtain an estimate of year 2024 EPS for the Industry: Year 2023 Personal consumption expenditures BDT6,800 billion Personal consumption expenditures growth Industry Sales per share Industry Operating profit margin Industry Depreciation/Fixed Assets Industry Fixed asset turnover Interest rate Industry Total asset turnover Industry Debt/Total assets Industry Tax rate Estimated Year 2024 2.5% BDT525 15% 8.25% 3 7% 1.2 45% 25% 39.75 3.77 544 You are required to calculate the industry EPS for the year 2024 9. Generic drugs are the equivalents of brand-name drugs, typically sold under their generic chemical names at prices below those of their brand-name equivalents. Generic drugs may be manufactured and marketed only if relevant patents on their brand-name equivalents have expired, been challenged or invalidated, or otherwise validly circumvented. Future generic industry growth can be attributed to both a large number of branded drugs losing patent protection in the coming years and a strengthened desire by healthcare payers to increase generic drug utilization. The generic industry has seen rapid growth since the mid-1980's. Accompanying this growth has been a growing desire within the industry to challenge the legality of branded drug patents in court, often enabling patents to be overturned years ahead of schedule. Also attributing to the rapid generic growth id the appeal of Healthcare payers, such as large employers like GM and pharmacy benefit managers (PBMs) like Medco Health Systems, to increasingly direct their clients to buy more and more generics. The Going Public Transaction Glazer Drug Co. is the fourth largest generic drug company in the world, with annual sales of over $3 billion. It trails only Norvatis AG, Teva Pharmaceutical, and Mylan Labs in sales and profits. Its home office is in St. Louis, with its laboratories and sales outlets in the U.S. and 30 foreign countries, with the largest foreign operations in Great Britain and Australia. Its generic brand labels cover medication for heart disease, diabetes, acute infections, and many other ailments. In the fall of 2012, the company decided to go public. Its investment banker was Aaron, Barkley, and Company. Glazer Drug Co.'s most recent 12 month earnings were $150 million with one hundred million shares, providing an EPS figure of $1.50. After conducting a careful analysis of the generic drug industry, the investment banker decided a P/E of 25 would be appropriate, giving the stock a value of $37.50. Allowing for the underwriting speed, the net to the corporation and selling stockholders was $36.68. The out-of- pocket underwriting expense was $2 million on the 20 million chares that were to be sold to the public. Ten million of the 20 million shares in the IPO were new corporate shares and the remaining 10 million were shares currently owned by Larry Glazer, one of the founders of the company. The 10 million shares sold by Glazer represented 85 percent of his holdings. On the day of the offering, the stock price shot up from $37.50 to $51.10 a share, and by January 1, 2013, the stock had reached a price of $61.75. Since no specific events involving the company had taken place, it appeared that the stock market had a favorable impression of the firm. Required: (a) What was the percent underwriting speed? (b) Subsequent to the issue, by what amount would earnings per share be diluted? (c) What are the net proceeds to the corporation from the issue? (d) What rate of return would the corporation need to earn on the net proceeds to avoid dilution? Note: because of the relatively high P/E of 25, the answer is less than 5 percent. However, the P/E does not figure directly into the calculation. (e) Using the original earnings per share of $1.50, what would the P/E ratio be based on the stock price of $61.75 on January 1, 2013? (f) Should Mr. Glazer be happy about the pricing of the stock by the investment banker and the movement of the stock.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started