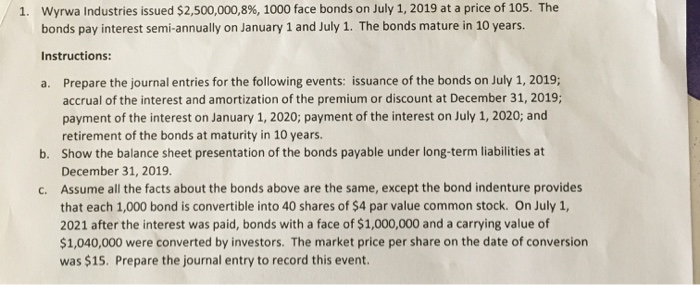

1. Wyrwa Industries issued $2,500,000,8%, 1000 face bonds on July 1, 2019 at a price of 105. The bonds pay interest semi-annually on January 1 and July 1. The bonds mature in 10 years. Instructions: a. Prepare the journal entries for the following events: issuance of the bonds on July 1, 2019; accrual of the interest and amortization of the premium or discount at December 31, 2019; payment of the interest on January 1, 2020; payment of the interest on July 1, 2020; and retirement of the bonds at maturity in 10 years. b. Show the balance sheet presentation of the bonds payable under long-term liabilities at December 31, 2019. Assume all the facts about the bonds above are the same, except the bond indenture provides that each 1,000 bond is convertible into 40 shares of $4 par value common stock. On July 1, 2021 after the interest was paid, bonds with a face of $1,000,000 and a carrying value of $1,040,000 were converted by investors. The market price per share on the date of conversion was $15. Prepare the journal entry to record this event. 1. Wyrwa Industries issued $2,500,000,8%, 1000 face bonds on July 1, 2019 at a price of 105. The bonds pay interest semi-annually on January 1 and July 1. The bonds mature in 10 years. Instructions: a. Prepare the journal entries for the following events: issuance of the bonds on July 1, 2019; accrual of the interest and amortization of the premium or discount at December 31, 2019; payment of the interest on January 1, 2020; payment of the interest on July 1, 2020; and retirement of the bonds at maturity in 10 years. b. Show the balance sheet presentation of the bonds payable under long-term liabilities at December 31, 2019. Assume all the facts about the bonds above are the same, except the bond indenture provides that each 1,000 bond is convertible into 40 shares of $4 par value common stock. On July 1, 2021 after the interest was paid, bonds with a face of $1,000,000 and a carrying value of $1,040,000 were converted by investors. The market price per share on the date of conversion was $15. Prepare the journal entry to record this event