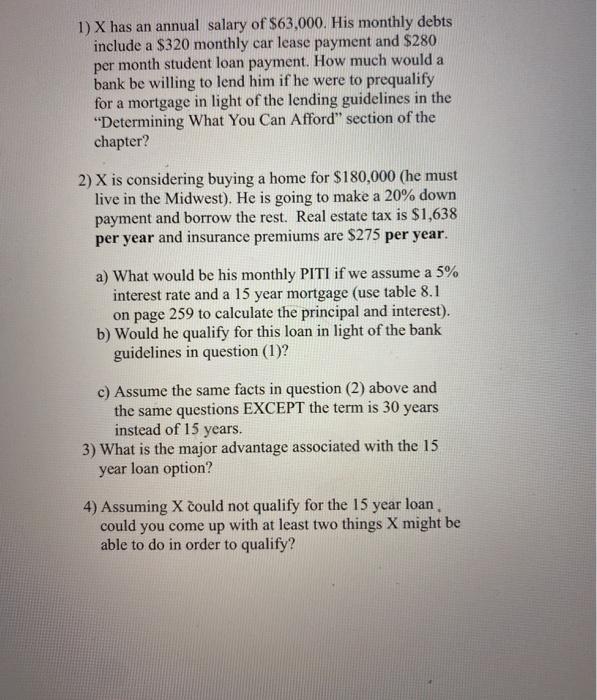

1) X has an annual salary of $63,000. His monthly debts include a $320 monthly car lease payment and $280 per month student loan payment. How much would a bank be willing to lend him if he were to prequalify for a mortgage in light of the lending guidelines in the "Determining What You Can Afford" section of the chapter? 2) X is considering buying a home for $180,000 (he must live in the Midwest). He is going to make a 20% down payment and borrow the rest. Real estate tax is $1,638 per year and insurance premiums are $275 per year. a) What would be his monthly PITI if we assume a 5% interest rate and a 15 year mortgage (use table 8.1 on page 259 to calculate the principal and interest). b) Would he qualify for this loan in light of the bank guidelines in question (1)? c) Assume the same facts in question (2) above and the same questions EXCEPT the term is 30 years instead of 15 years. 3) What is the major advantage associated with the 15 year loan option? 4) Assuming X could not qualify for the 15 year loan could you come up with at least two things X might be able to do in order to qualify? 1) X has an annual salary of $63,000. His monthly debts include a $320 monthly car lease payment and $280 per month student loan payment. How much would a bank be willing to lend him if he were to prequalify for a mortgage in light of the lending guidelines in the "Determining What You Can Afford" section of the chapter? 2) X is considering buying a home for $180,000 (he must live in the Midwest). He is going to make a 20% down payment and borrow the rest. Real estate tax is $1,638 per year and insurance premiums are $275 per year. a) What would be his monthly PITI if we assume a 5% interest rate and a 15 year mortgage (use table 8.1 on page 259 to calculate the principal and interest). b) Would he qualify for this loan in light of the bank guidelines in question (1)? c) Assume the same facts in question (2) above and the same questions EXCEPT the term is 30 years instead of 15 years. 3) What is the major advantage associated with the 15 year loan option? 4) Assuming X could not qualify for the 15 year loan could you come up with at least two things X might be able to do in order to qualify