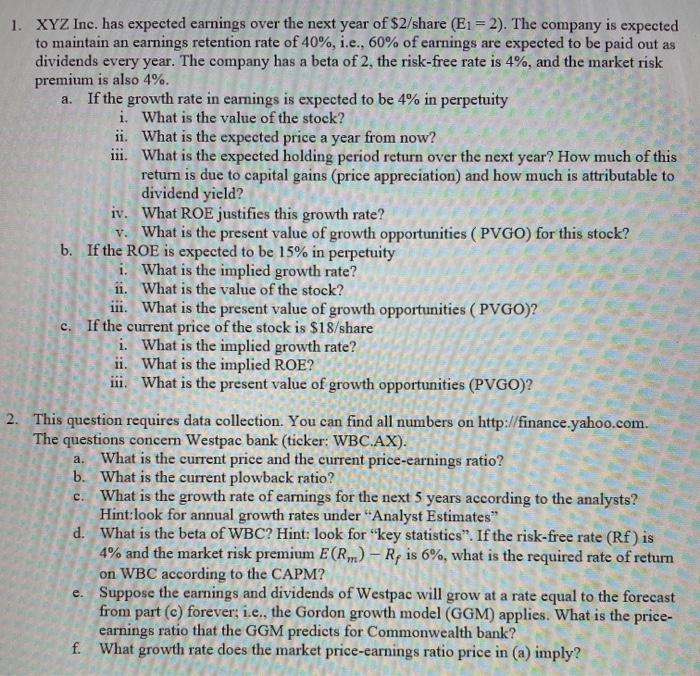

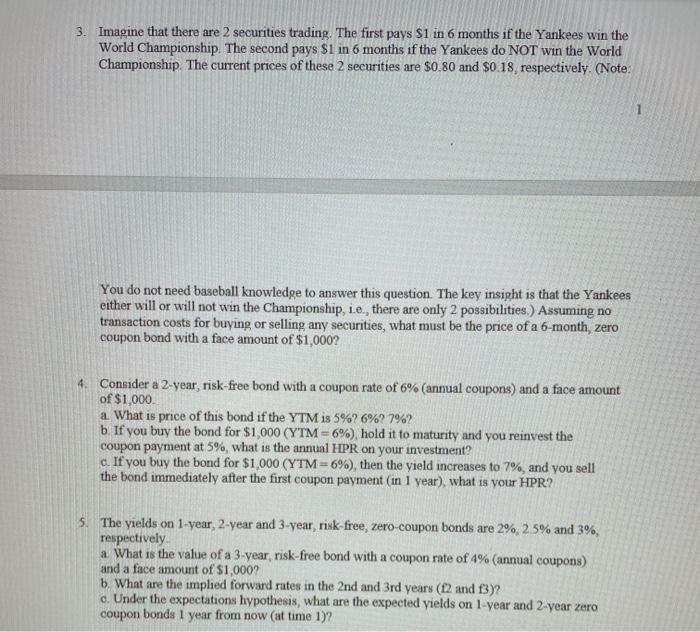

1. XYZ Inc. has expected earnings over the next year of $2/share (E1 = 2). The company is expected to maintain an earnings retention rate of 40%, i.e., 60% of earnings are expected to be paid out as dividends every year. The company has a beta of 2, the risk-free rate is 4%, and the market risk premium is also 4%. a. If the growth rate in earnings is expected to be 4% in perpetuity i. What is the value of the stock? ii. What is the expected price a year from now? iii. What is the expected holding period return over the next year? How much of this return is due to capital gains (price appreciation) and how much is attributable to dividend yield? iv. What ROE justifies this growth rate? v. What is the present value of growth opportunities (PVGO) for this stock? b. If the ROE is expected to be 15% in perpetuity i. What is the implied growth rate? ii. What is the value of the stock? iii. What is the present value of growth opportunities (PVGO)? c. If the current price of the stock is $18/share i. What is the implied growth rate? ii. What is the implied ROE? iii. What is the present value of growth opportunities (PVGO)? 2. This question requires data collection. You can find all numbers on http://finance.yahoo.com. The questions concern Westpac bank (ticker: WBC.AX). What is the current price and the current price-earnings ratio? b. What is the current plowback ratio? c. What is the growth rate of earnings for the next 5 years according to the analysts? Hint:look for annual growth rates under "Analyst Estimates" d. What is the beta of WBC? Hint: look for "key statistics". If the risk-free rate (Rf) is 4% and the market risk premium E(Rm) - Ry is 6%, what is the required rate of return on WBC according to the CAPM? e. Suppose the earnings and dividends of Westpac will grow at a rate equal to the forecast from part (c) forever: i.e., the Gordon growth model (GGM) applies. What is the price- earnings ratio that the GGM predicts for Commonwealth bank? f What growth rate does the market price-earnings ratio price in (a) imply? 3. Imagine that there are 2 securities trading. The first pays $1 in 6 months if the Yankees win the World Championship. The second pays $1 in 6 months if the Yankees do NOT win the World Championship. The current prices of these 2 securities are $0.80 and $0.18, respectively. (Note: You do not need baseball knowledge to answer this question. The key insight is that the Yankees either will or will not win the Championship, i.e. there are only 2 possibilities. Assuming no transaction costs for buying or selling any securities, what must be the price of a 6-month, zero coupon bond with a face amount of $1,000? 4. Consider a 2-year, risk-free bond with a coupon rate of 6% (annual coupons) and a face amount of $1,000 a What is price of this bond if the YTM is 5%? 6%? 7%? b. If you buy the bond for $1,000 (YTM = 6%), hold it to maturity and you reinvest the coupon payment at 5%, what is the annual HPR on your investment? c. If you buy the bond for $1,000 (YTM -6%), then the yield increases to 7%, and you sell the bond immediately after the first coupon payment (in 1 year), what is your HPR? 5. The yields on 1-year, 2-year and 3-year risk-free, zero-coupon bonds are 2% 2.5% and 3%, respectively a. What is the value of a 3 year, risk-free bond with a coupon rate of 4% (annual coupons) and a face amount of $1,000? b. What are the implied forward rates in the 2nd and 3rd years (12 and 13)? c. Under the expectations hypothesis, what are the expected yields on 1-year and 2-year zero coupon bonds 1 year from now (at time 1)