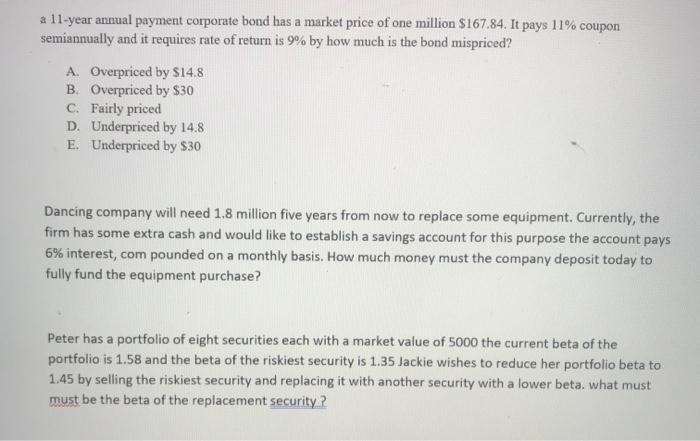

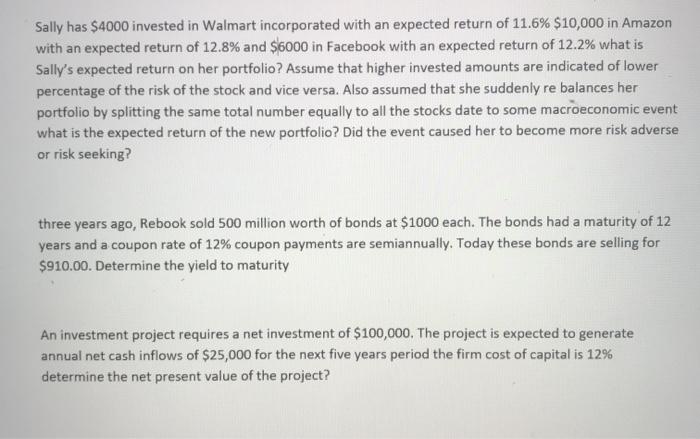

1 year al corporate bodo price of 51674 115 mally and it is often by how much the band wiced? A Orepied by $141 B Od by 50 Curly end Driedy Erdby 50 Dancing company will need 2 million five years from now to replace some equipment Currently, the trm has some extra cash and would like to estisha saing account for this purpose the account pay interest, compounded on a monthly basis. How much money must the company deposit today to tudy hand the current purchase Peter has a portfolio of securities each with a market value of the current bet of the porto 15 and the bets of the security is 1.5 Jacke wishes to reduce her portfolio bette 145 tysing the security and replacing with another security with a lower bets what must not be the best of the replacement Nancy company common stock is currenting for $20 persecurity analysts at Jonathan Lic had the following probition to the price of anoreturn on any stack from bow that Wyspected to pay any divents during the com a determine the properties on stock Sally has $4000 invested in Walmart incorporated with an expected return of 12.6% $10,000 in Amazon with an expected return of 12.8% and 6000 in Facebook with an expected return of 12.25 what is Sally's expected retum on her portfolio? Assume that higher invested amounts are indicated of lower percentage of the risk of the stock and vice versa. Also assumed that she suddenly re batances her portfolio by splitting the same total number equally to all the stocks date to some macroeconomic event what is the expected return of the new portfolio? Did the event cared her to become more risk adverse or risk seeking? three years ago, Rebook sold 500 million worth of bonds at $1000 each. The bonds had a maturity of 12 years and a coupon rate of 126 coupon payments are semiannually. Today these bonds are selling for $310.00. Determine the yield to maturity An investment project requires a net investment of $100,000. The project is expected to generate annual net cash inflows of $25,000 for the next five years period the firm cost of capital is 12% determine the net present value of the project? a 11-year annual payment corporate bond has a market price of one million $167.84. It pays 11% coupon semiannually and it requires rate of return is 9% by how much is the bond mispriced? A. Overpriced by $14.8 B. Overpriced by $30 C. Fairly priced D. Underpriced by 14.8 E. Underpriced by $30 Dancing company will need 1.8 million five years from now to replace some equipment. Currently, the firm has some extra cash and would like to establish a savings account for this purpose the account pays 6% interest, com pounded on a monthly basis. How much money must the company deposit today to fully fund the equipment purchase? Peter has a portfolio of eight securities each with a market value of 5000 the current beta of the portfolio is 1.58 and the beta of the riskiest security is 1.35 Jackie wishes to reduce her portfolio beta to 1.45 by selling the riskiest security and replacing it with another security with a lower beta. what must must be the beta of the replacement security? Sally has $4000 invested in Walmart incorporated with an expected return of 11.6% $10,000 in Amazon with an expected return of 12.8% and $6000 in Facebook with an expected return of 12.2% what is Sally's expected return on her portfolio? Assume that higher invested amounts are indicated of lower percentage of the risk of the stock and vice versa. Also assumed that she suddenly re balances her portfolio by splitting the same total number equally to all the stocks date to some macroeconomic event what is the expected return of the new portfolio? Did the event caused her to become more risk adverse or risk seeking? three years ago, Rebook sold 500 million worth of bonds at $1000 each. The bonds had a maturity of 12 years and a coupon rate of 12% coupon payments are semiannually. Today these bonds are selling for $910.00. Determine the yield to maturity An investment project requires a net investment of $100,000. The project is expected to generate annual net cash inflows of $25,000 for the next five years period the firm cost of capital is 12% determine the net present value of the project