Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. You are 25 now. You have got your first job and you want to plan for your retirement. You plan to work until

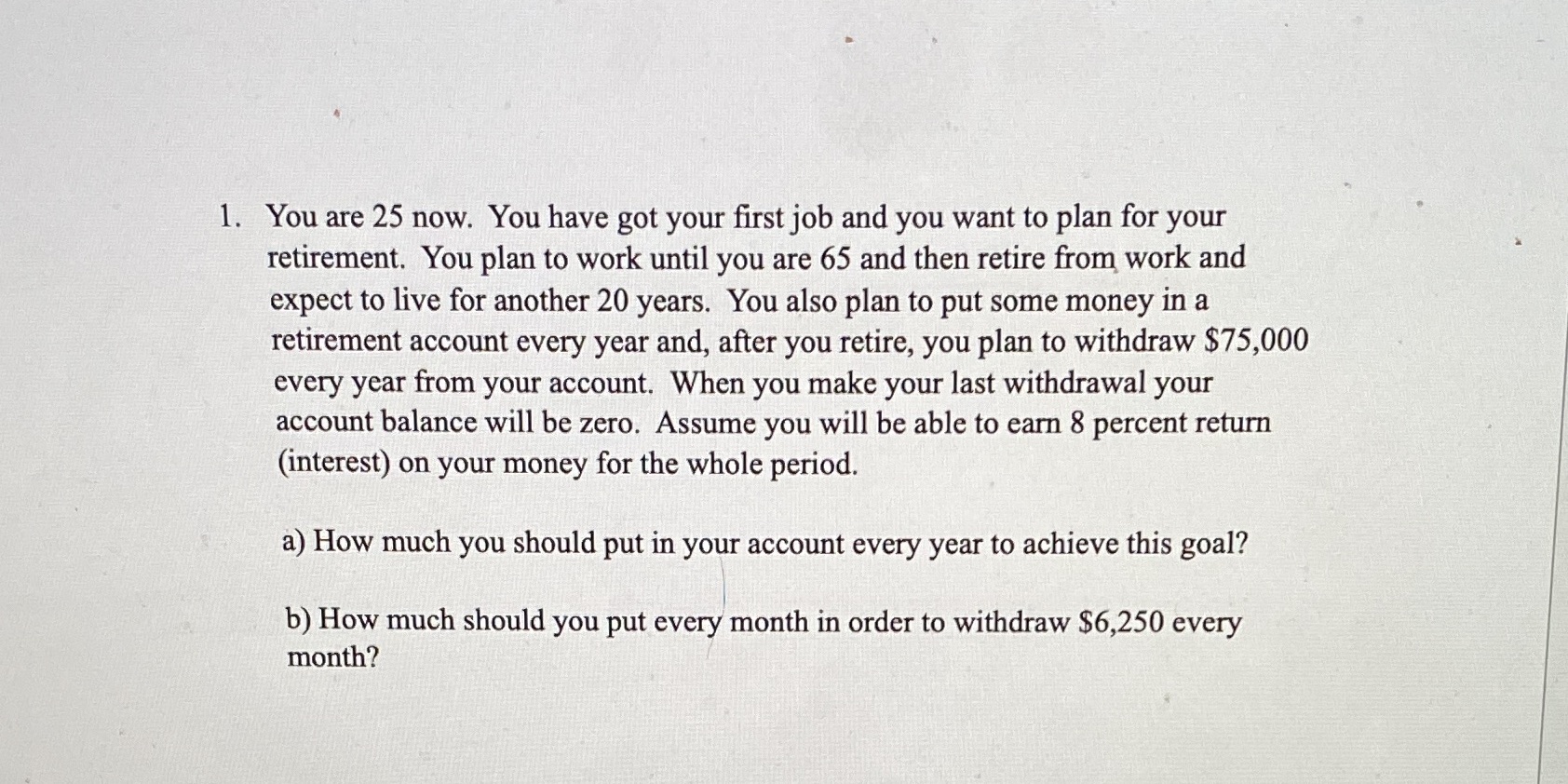

1. You are 25 now. You have got your first job and you want to plan for your retirement. You plan to work until you are 65 and then retire from work and expect to live for another 20 years. You also plan to put some money in a retirement account every year and, after you retire, you plan to withdraw $75,000 every year from your account. When you make your last withdrawal your account balance will be zero. Assume you will be able to earn 8 percent return (interest) on your money for the whole period. a) How much you should put in your account every year to achieve this goal? b) How much should you put every month in order to withdraw $6,250 every month?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the amount you should put in your retirement account every year to achieve your goal we can use the concept of an annuity The future va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started