Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. You are a loan officer. An owner approaches your lending institution for a $1,000,000 mortgage loan. The parcel is vacant, with commercial zoning

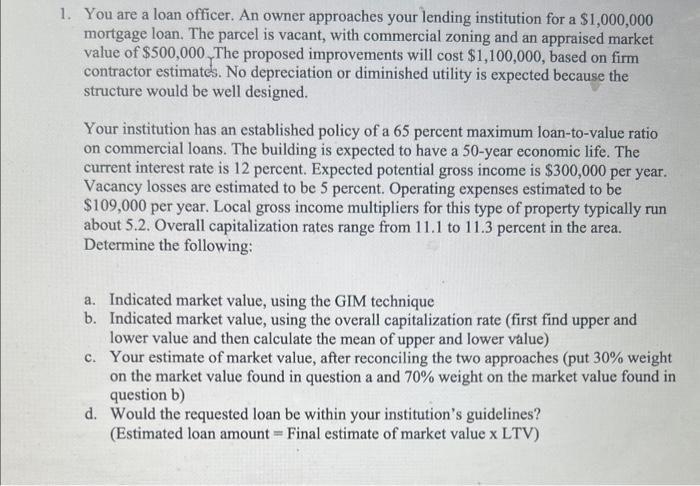

1. You are a loan officer. An owner approaches your lending institution for a $1,000,000 mortgage loan. The parcel is vacant, with commercial zoning and an appraised market value of $500,000 The proposed improvements will cost $1,100,000, based on firm contractor estimates. No depreciation or diminished utility is expected because the structure would be well designed. Your institution has an established policy of a 65 percent maximum loan-to-value ratio on commercial loans. The building is expected to have a 50-year economic life. The current interest rate is 12 percent. Expected potential gross income is $300,000 per year. Vacancy losses are estimated to be 5 percent. Operating expenses estimated to be $109,000 per year. Local gross income multipliers for this type of property typically run about 5.2. Overall capitalization rates range from 11.1 to 11.3 percent in the area. Determine the following: a. Indicated market value, using the GIM technique b. Indicated market value, using the overall capitalization rate (first find upper and lower value and then calculate the mean of upper and lower value) c. Your estimate of market value, after reconciling the two approaches (put 30% weight on the market value found in question a and 70% weight on the market value found in question b) d. Would the requested loan be within your institution's guidelines? (Estimated loan amount = Final estimate of market value x LTV)

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Indicated market value using the GIM technique Potential gross income 300000 Vacancy and credit lo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started