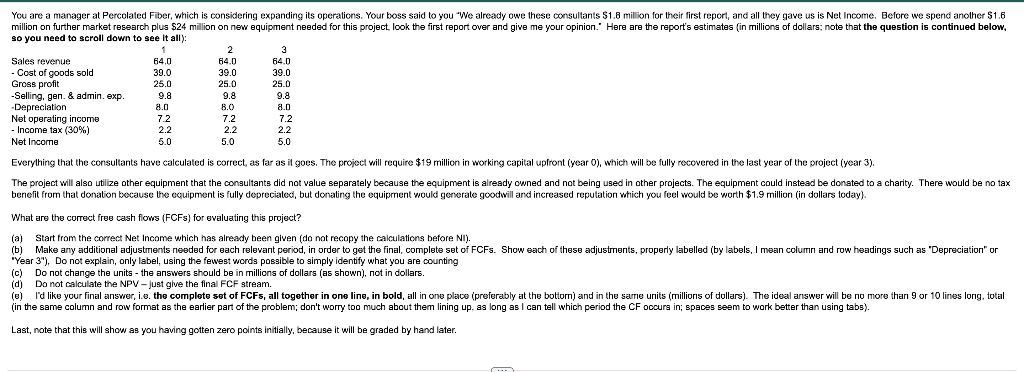

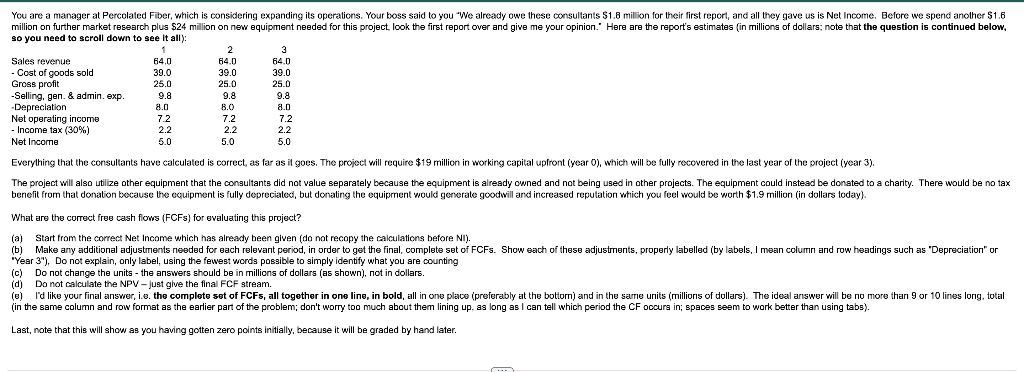

1 You are a manager at Percolated Fiber, which is considering expanding its operations. Your boss said to you "We already owe these consultants $1.8 million for their first report, and all they gave us is Net Income. Before we spend another $1.6 million on further market research plus $24 million on new equipment needed for this project look the first report over and give me your opinion. Here are the report's estimates (in millions of dollars: note that the question is continued below, so you need to scroll down to see it all) 2 3 Sales revenue 64.0 64.0 64.0 - Cost of goods sold 39.0 39.0 39.0 Gross profit 25.0 25.0 25.0 -Selling, gen. & admin. exp. 9.8 9.8 9.8 -Depreciation 8.0 8.0 8.0 Net operating income 7.2 7.2 7.2 - Income tax (30%) 2.2 2.2 2.2 Net Income 5.0 5.0 5.0 Everything that the consultants have calculated is correct, as far as it goes. The project will require $19 million in working capital upfront (year o), which will be fully recovered in the last year of the project (year 3). The project will also utilize other equipment that the consultants did not value separately because the equipment is already owned and not being used in other projects. The equipment could instead be donated to a charity. There would be no tax benefit from that donation because the equipment is fully depreciated, but donating the equipment would generale goodwill and increased reputation which you feel would be worth $1.9 million (in dollars today). What are the correct free cash flows (FCFS) for evaluating this project? (a) Start from the correct Net Income which has already been given (do not recopy the calculations before NI). (b) Make any additional adjustments needed for each relevant period, in order to get the final, complete set of FCFs. Show each of these adjustments, properly labelled (by labels, I mean column and row headings such as 'Depreciation or 'Year 3"), Do not explain, only label, using the fewest words possible to simply identify what you are counting (c) Do not change the units - the answers should be in millions of dollars (as shown), not in dollars. (d) Do not calculate the NPV - Just give the final FCF stream. le) I'd like your final answer, i.e. the complete set of FCFs, all together in one line, in bold, all in one place (preferably at the bottor) and in the same units (millions of dollars). The ideal answer will be no more than 9 or 10 lines long, total (in the same column and row format as the earlier part of the problem; don't worry too much about them lining up, as long as I can tell which period the CF occurs in; spaces seem to work better than using tabs). Last, note that this will show as you having gotten zero points initially, because it will be graded by hand later