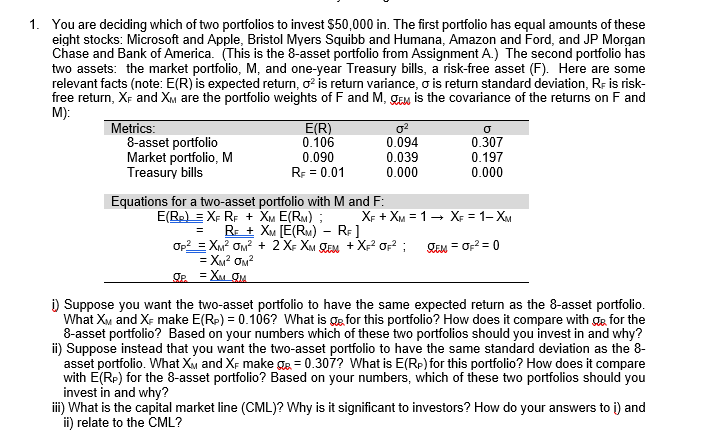

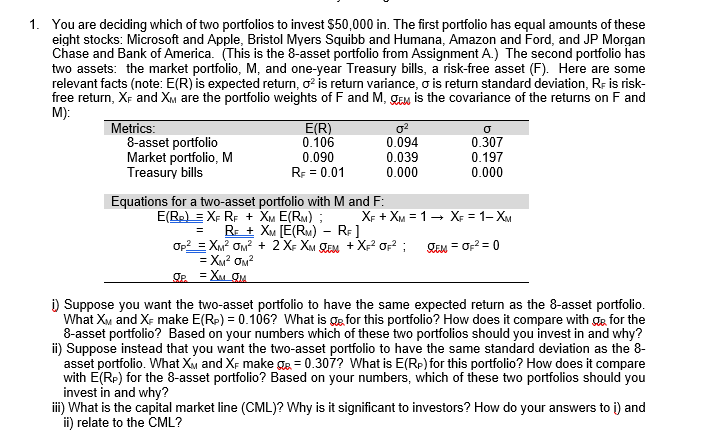

1. You are deciding which of two portfolios to invest $50,000 in. The first portfolio has equal amounts of these eight stocks: Microsoft and Apple, Bristol Myers Squibb and Humana, Amazon and Ford, and JP Morgan Chase and Bank of America. (This is the 8-asset portfolio from Assignment A.) The second portfolio has two assets: the market portfolio, M, and one-year Treasury bills, a risk-free asset (F). Here are some relevant facts (note: E(R) is expected return, o2 is return variance, o is return standard deviation, RF is risk- free return, XF and X are the portfolio weights of F and M, Dam is the covariance of the returns on F and M): Metrics: E(R) o 8-asset portfolio 0.106 0.094 0.307 Market portfolio, M 0.090 0.039 0.197 Treasury bills Rp = 0.01 0.000 0.000 Equations for a two-asset portfolio with M and F: E(Rp) : XF RF + XE(RM); X + X = 14 XE = 1-XM RE + XM [E(RM) - RF] Op2 = XM2 M2 + 2 X XM DEM +X-2 0f ; STEM OF2 = 0 = XM2 OM OP = XM OM = 1) Suppose you want the two-asset portfolio to have the same expected return as the 8-asset portfolio. What XM and X make E(R) = 0.106? What is de for this portfolio? How does it compare with da for the 8-asset portfolio? Based on your numbers which of these two portfolios should you invest in and why? ii) Suppose instead that you want the two-asset portfolio to have the same standard deviation as the 8- asset portfolio. What Xu and XF make de = 0.307? What is E(Rp) for this portfolio? How does it compare with E(Rp) for the 8-asset portfolio? Based on your numbers, which of these two portfolios should you invest in and why? ii) What is the capital market line (CML)? Why is it significant to investors? How do your answers to i) and ii) relate to the CML? 1. You are deciding which of two portfolios to invest $50,000 in. The first portfolio has equal amounts of these eight stocks: Microsoft and Apple, Bristol Myers Squibb and Humana, Amazon and Ford, and JP Morgan Chase and Bank of America. (This is the 8-asset portfolio from Assignment A.) The second portfolio has two assets: the market portfolio, M, and one-year Treasury bills, a risk-free asset (F). Here are some relevant facts (note: E(R) is expected return, o2 is return variance, o is return standard deviation, RF is risk- free return, XF and X are the portfolio weights of F and M, Dam is the covariance of the returns on F and M): Metrics: E(R) o 8-asset portfolio 0.106 0.094 0.307 Market portfolio, M 0.090 0.039 0.197 Treasury bills Rp = 0.01 0.000 0.000 Equations for a two-asset portfolio with M and F: E(Rp) : XF RF + XE(RM); X + X = 14 XE = 1-XM RE + XM [E(RM) - RF] Op2 = XM2 M2 + 2 X XM DEM +X-2 0f ; STEM OF2 = 0 = XM2 OM OP = XM OM = 1) Suppose you want the two-asset portfolio to have the same expected return as the 8-asset portfolio. What XM and X make E(R) = 0.106? What is de for this portfolio? How does it compare with da for the 8-asset portfolio? Based on your numbers which of these two portfolios should you invest in and why? ii) Suppose instead that you want the two-asset portfolio to have the same standard deviation as the 8- asset portfolio. What Xu and XF make de = 0.307? What is E(Rp) for this portfolio? How does it compare with E(Rp) for the 8-asset portfolio? Based on your numbers, which of these two portfolios should you invest in and why? ii) What is the capital market line (CML)? Why is it significant to investors? How do your answers to i) and ii) relate to the CML