Question

1. You are planning to invest Rs.25 lakhs for 6 months and link it to the returns on a sectoral index. You are also

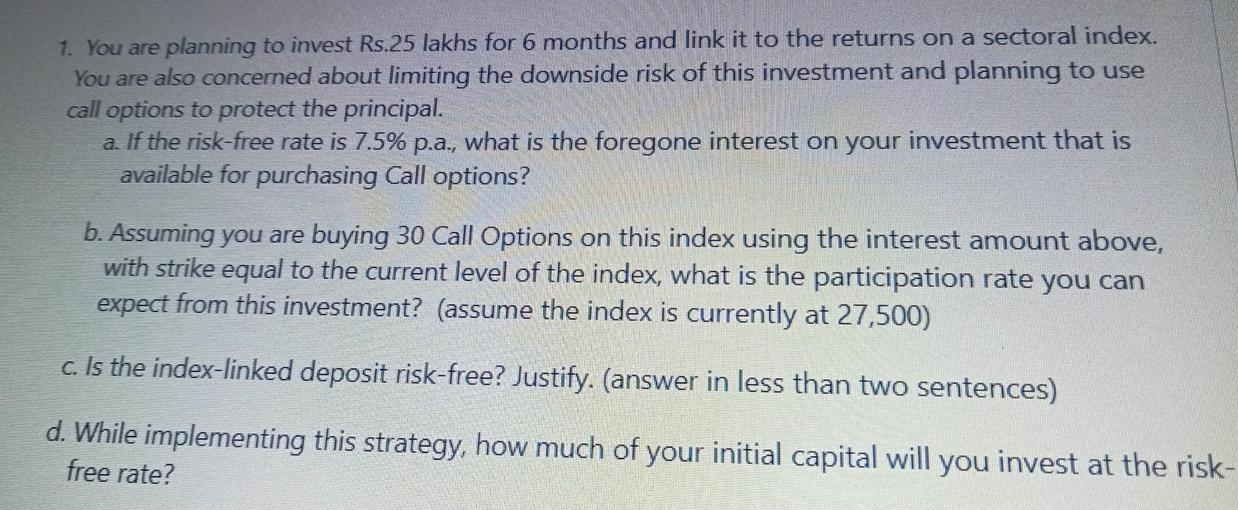

1. You are planning to invest Rs.25 lakhs for 6 months and link it to the returns on a sectoral index. You are also concerned about limiting the downside risk of this investment and planning to use call options to protect the principal. a. If the risk-free rate is 7.5% p.a., what is the foregone interest on your investment that is available for purchasing Call options? b. Assuming you are buying 30 Call Options on this index using the interest amount above, with strike equal to the current level of the index, what is the participation rate you can expect from this investment? (assume the index is currently at 27,500) c. Is the index-linked deposit risk-free? Justify. (answer in less than two sentences) d. While implementing this strategy, how much of your initial capital will you invest at the risk- free rate?

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Practical Business Statistics

Authors: Andrew Siegel

6th Edition

0123852080, 978-0123852083

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App