Answered step by step

Verified Expert Solution

Question

1 Approved Answer

XY is a pharmaceutical company with the head-quarter in the United States. However, its cash flow depends only on sales in Japan. It receives

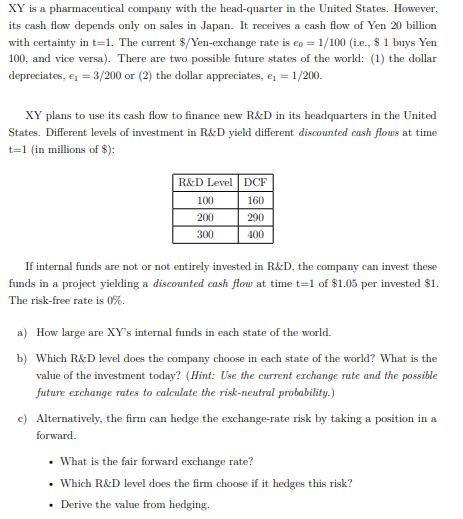

XY is a pharmaceutical company with the head-quarter in the United States. However, its cash flow depends only on sales in Japan. It receives a cash flow of Yen 20 billion with certainty in t=1. The current $/Yen-exchange rate is co= 1/100 (ie., $ 1 buys Yen 100, and vice versa). There are two possible future states of the world: (1) the dollar depreciates, = 3/200 or (2) the dollar appreciates, e = 1/200. XY plans to use its cash flow to finance new R&D in its headquarters in the United States. Different levels of investment in R&D yield different discounted cash flows at time t-1 (in millions of $): R&D Level DCF 160 100 200 300 290 400 If internal funds are not or not entirely invested in R&D, the company can invest these funds in a project yielding a discounted cash flow at time t=1 of $1.05 per invested $1. The risk-free rate is 0%. a) How large are XY's internal funds in each state of the world. b) Which R&D level does the company choose in each state of the world? What is the value of the investment today? (Hint: Use the current exchange rate and the possible future exchange rates to calculate the risk-neutral probability.) c) Alternatively, the firm can hedge the exchange-rate risk by taking a position in a forward. What is the fair forward exchange rate? Which R&D level does the firm choose if it hedges this risk? Derive the value from hedging.

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Okay lets solve this stepbystep a XYs internal funds in each state of the world State 1 dollar de...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started