Question

1. You are the audit senior of White & Co and are planning the audit of Redsmith Co for the year ended 30 September 2010.

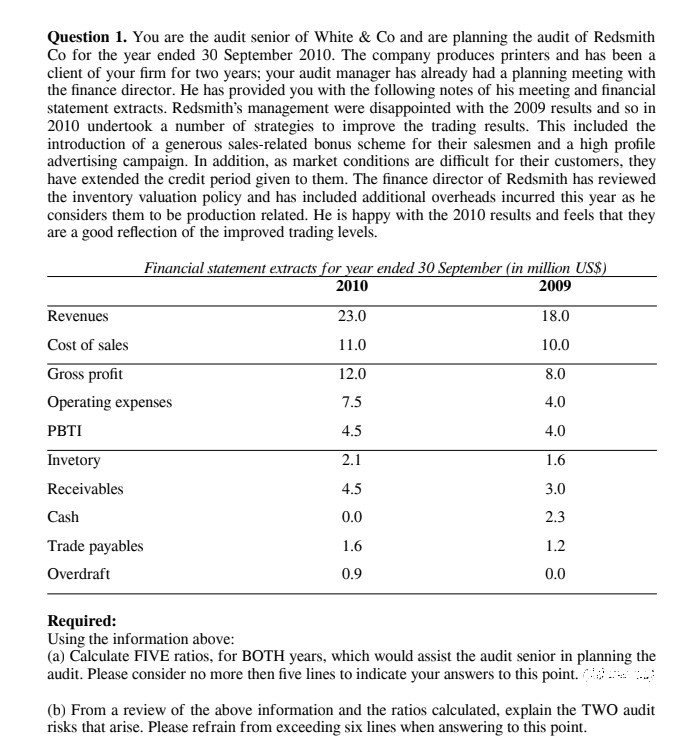

1. You are the audit senior of White & Co and are planning the audit of Redsmith Co for the year ended 30 September 2010. The company produces printers and has been a client of your firm for two years; your audit manager has already had a planning meeting with the finance director. He has provided you with the following notes of his meeting and financial statement extracts. Redsmiths management were disappointed with the 2009 results and so in 2010 undertook a number of strategies to improve the trading results. This included the introduction of a generous sales-related bonus scheme for their salesmen and a high profile advertising campaign. In addition, as market conditions are difficult for their customers, they have extended the credit period given to them. The finance director of Redsmith has reviewed the inventory valuation policy and has included additional overheads incurred this year as he considers them to be production related. He is happy with the 2010 results and feels that they are a good reflection of the improved trading levels. Financial statement extracts for year ended 30 September (in million US$) 2010 2009 Revenues 23.0 18.0 Cost of sales 11.0 10.0 Gross profit 12.0 8.0 Operating expenses 7.5 4.0 PBTI 4.5 4.0 Invetory 2.1 1.6 Receivables 4.5 3.0 Cash 0.0 2.3 Trade payables 1.6 1.2 Overdraft 0.9 0.0 Required: Using the information above: (a) Calculate FIVE ratios, for BOTH years, which would assist the audit senior in planning the audit. Please consider no more then five lines to indicate your answers to this point. (b) From a review of the above information and the ratios calculated, explain the TWO audit risks that arise. Please refrain from exceeding six lines when answering to this point.

Question 1. You are the audit senior of White & Co and are planning the audit of Redsmith Co for the year ended 30 September 2010. The company produces printers and has been a client of your firm for two years; your audit manager has already had a planning meeting with the finance director. He has provided you with the following notes of his meeting and financial statement extracts. Redsmith's management were disappointed with the 2009 results and so in 2010 undertook a number of strategies to improve the trading results. This included the introduction of a generous sales-related bonus scheme for their salesmen and a high profile advertising campaign. In addition, as market conditions are difficult for their customers, they have extended the credit period given to them. The finance director of Redsmith has reviewed the inventory valuation policy and has included additional overheads incurred this year as he considers them to be production related. He is happy with the 2010 results and feels that they are a good reflection of the improved trading levels. Financial statement extracts for year ended 30 September (in million US$) 2010 2009 Revenues 23.0 18.0 Cost of sales 11.0 10.0 Gross profit 12.0 8.0 Operating expenses 7.5 4.0 PBTI 4.0 Invetory 1.6 Receivables 4.5 3.0 Cash 2.3 Trade payables 1.6 1.2 Overdraft 0.9 0.0 4.5 2.1 0.0 Required: Using the information above: (a) Calculate FIVE ratios, for BOTH years, which would assist the audit senior in planning the audit. Please consider no more then five lines to indicate your answers to this point. (b) From a review of the above information and the ratios calculated, explain the TWO audit risks that arise. Please refrain from exceeding six lines when answering to this point

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started