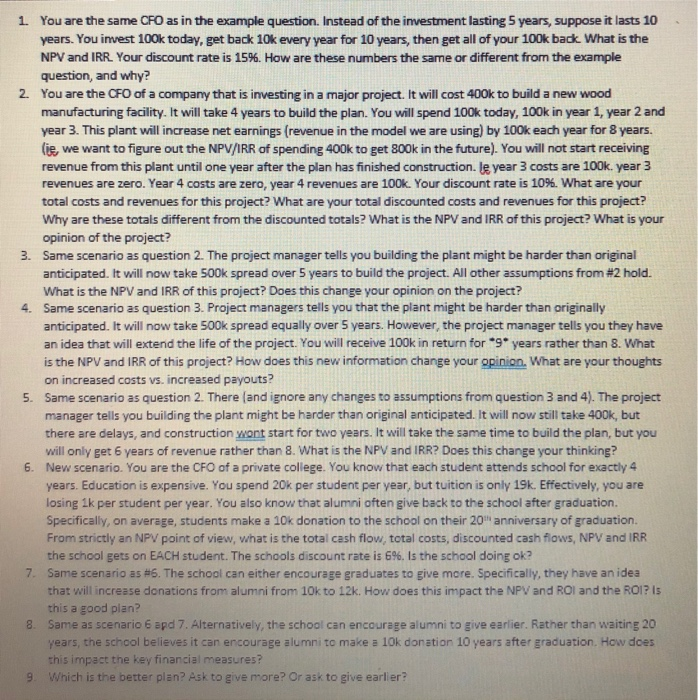

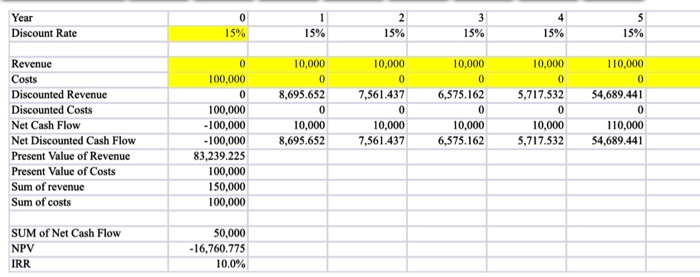

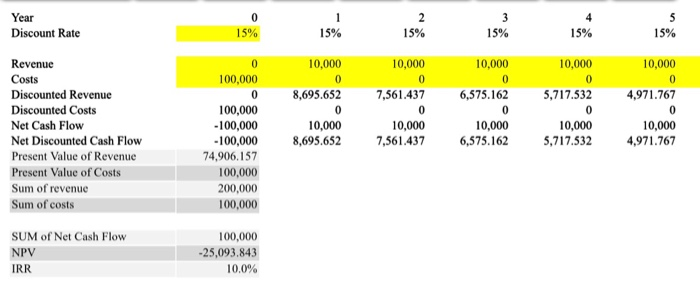

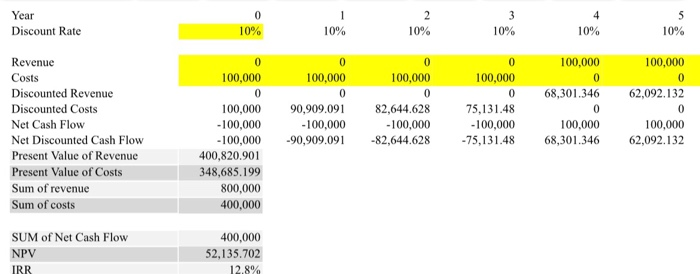

1 You are the same CFO as in the example question. Instead of the investment lasting 5 years, suppose it lasts 10 years. You invest 100k today, get back 10k every year for 10 years, then get all of your 100k back What is the NPV and IRR. Your discount rate is 15%. How are these numbers the same or different from the example question, and why? 2. You are the CFO of a company that is investing in a major project. It will cost 400k to build a new wood manufacturing facility. It will take 4 years to build the plan. You will spend 100k today, 100k in year 1, year 2 and year 3. This plant will increase net earnings (revenue in the model we are using) by 100k each year for 8 years. lie, we want to figure out the NPV/IRR of spending 400k to get 800k in the future). You will not start receiving revenue from this plant until one year after the plan has finished construction. le year 3 costs are 100k. year 3 revenues are zero. Year 4 costs are zero, year 4 revenues are 100k. Your discount rate is 10%. What are your total costs and revenues for this project? What are your total discounted costs and revenues for this project? Why are these totals different from the discounted totals? What is the NPV and IRR of this project? What is your opinion of the project? 3. Same scenario as question 2. The project manager tells you building the plant might be harder than original anticipated. It will now take 500k spread over 5 years to build the project. All other assumptions from #2 hold. What is the NPV and IRR of this project? Does this change your opinion on the project? 4. Same scenario as question 3. Project managers tells you that the plant might be harder than originally anticipated. It will now take 500k spread equally over 5 years. However, the project manager tells you they have an idea that will extend the life of the project. You will receive 100k in return for 9 years rather than 8. What is the NPV and IRR of this project? How does this new information change your opinion. What are your thoughts on increased costs vs. increased payouts? 5. Same scenario as question 2. There (and ignore any changes to assumptions from question 3 and 4). The project manager tells you building the plant might be harder than original anticipated. It will now still take 400k, but there are delays, and construction wont start for two years. It will take the same time to build the plan, but you will only get 6 years of revenue rather than 8. What is the NPV and IRR? Does this change your thinking? 6. New scenario. You are the CFO of a private college. You know that each student attends school for exactly 4 years. Education is expensive. You spend 20k per student per year, but tuition is only 19k. Effectively, you are losing 1k per student per year. You also know that alumni often give back to the school after graduation. Specifically, on average, students make a 10k donation to the school on their 20 anniversary of graduation From strictly an NPV point of view, what is the total cash flow, total costs, discounted cash flows, NPV and IRR the school gets on EACH student. The schools discount rate is 6%. Is the school doing ok? Same scenario as #6. The school can either encourage graduates to give more. Specifically, they have an idea that will increase donations from alumni from 10K to 12k. How does this impact the NPV and ROI and the ROI? Is this a good plan? 8. Same as scenario 6 apd 7. Alternatively, the school can encourage alumni to give earlier. Rather than waiting 20 years, the school believes it can encourage alumni to make a 10k donation 10 years after graduation. How does this impact the key financial measures? 9. Which is the better plan? Ask to give more? Or ask to give earlier? Year Discount Rate 5 15% 15% 15% 15% 15% 15% 10,000 10,000 10,000 10,000 110,000 100,000 0 7,561.437 6,575.162 5,717.532 54,689.441 Revenue Costs Discounted Revenue Discounted Costs Net Cash Flow Net Discounted Cash Flow Present Value of Revenue Present Value of Costs Sum of revenue Sum of costs 8,695.652 0 10,000 8,695.652 10,000 7,561.437 10,000 6,575.162 10,000 5,717.532 110,000 54,689.441 100,000 -100,000 - 100,000 83,239.225 100,000 150,000 100,000 SUM of Net Cash Flow NPV IRR 50,000 -16,760.775 10.0% Year Discount Rate 15% 15% 10,000 10,000 10,000 10,000 10,000 100,000 0 7,561.437 6,575.162 5,717.532 4,971.767 Revenue Costs Discounted Revenue Discounted Costs Net Cash Flow Net Discounted Cash Flow Present Value of Revenue Present Value of Costs Sum of revenue Sum of costs 8,695.652 0 10,000 8,695.652 10,000 7,561.437 10,000 6,575.162 10,000 5,717.532 10,000 4,971.767 100,000 -100,000 -100,000 74.906.157 100,000 200,000 100,000 SUM of Net Cash Flow NPV IRR 100,000 -25,093.843 10.0% Year Discount Rate 0 10% 10% 10% 10% 10% 10% 100,000 100,000 0 100,000 100,000 100,000 100,000 62,092.132 Revenue Costs Discounted Revenue Discounted Costs Net Cash Flow Net Discounted Cash Flow Present Value of Revenue Present Value of Costs Sum of revenue Sum of costs 90,909.091 -100,000 -90,909.091 82,644.628 -100,000 -82,644.628 75,131.48 -100,000 -75,131.48 68,301.346 0 100,000 68,301.346 100,000 62,092.132 100,000 -100,000 - 100,000 400,820.901 348,685.199 800,000 400,000 SUM of Net Cash Flow NPV IRR 400,000 52,135.702 12.8%