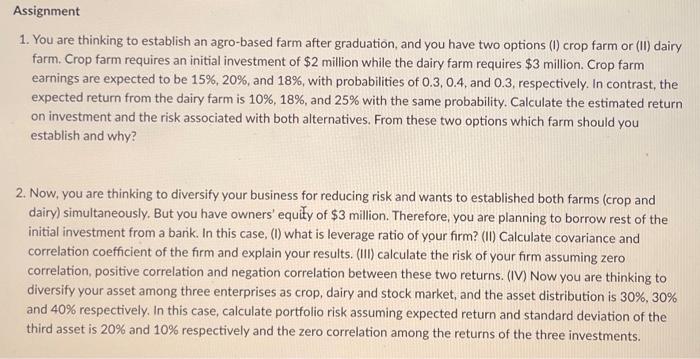

1. You are thinking to establish an agro-based farm after graduation, and you have two options (I) crop farm or (II) dairy farm. Crop farm requires an initial investment of $2 million while the dairy farm requires $3 million. Crop farm earnings are expected to be 15%,20%, and 18%, with probabilities of 0.3,0.4, and 0.3 , respectively. In contrast, the expected return from the dairy farm is 10%,18%, and 25% with the same probability. Calculate the estimated return on investment and the risk associated with both alternatives. From these two options which farm should you establish and why? 2. Now, you are thinking to diversify your business for reducing risk and wants to established both farms (crop and dairy) simultaneously. But you have owners' equity of $3 million. Therefore, you are planning to borrow rest of the initial investment from a barik. In this case, (I) what is leverage ratio of your firm? (II) Calculate covariance and correlation coefficient of the firm and explain your results. (III) calculate the risk of your firm assuming zero correlation, positive correlation and negation correlation between these two returns. (IV) Now you are thinking to diversify your asset among three enterprises as crop, dairy and stock market, and the asset distribution is 30%,30% and 40% respectively. In this case, calculate portfolio risk assuming expected return and standard deviation of the third asset is 20% and 10% respectively and the zero correlation among the returns of the three investments. 1. You are thinking to establish an agro-based farm after graduation, and you have two options (I) crop farm or (II) dairy farm. Crop farm requires an initial investment of $2 million while the dairy farm requires $3 million. Crop farm earnings are expected to be 15%,20%, and 18%, with probabilities of 0.3,0.4, and 0.3 , respectively. In contrast, the expected return from the dairy farm is 10%,18%, and 25% with the same probability. Calculate the estimated return on investment and the risk associated with both alternatives. From these two options which farm should you establish and why? 2. Now, you are thinking to diversify your business for reducing risk and wants to established both farms (crop and dairy) simultaneously. But you have owners' equity of $3 million. Therefore, you are planning to borrow rest of the initial investment from a barik. In this case, (I) what is leverage ratio of your firm? (II) Calculate covariance and correlation coefficient of the firm and explain your results. (III) calculate the risk of your firm assuming zero correlation, positive correlation and negation correlation between these two returns. (IV) Now you are thinking to diversify your asset among three enterprises as crop, dairy and stock market, and the asset distribution is 30%,30% and 40% respectively. In this case, calculate portfolio risk assuming expected return and standard deviation of the third asset is 20% and 10% respectively and the zero correlation among the returns of the three investments