Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. You bought one gold future contract at Rs. 542.65 per 10g. What would be your profit (loss) at maturity if the gold spot price

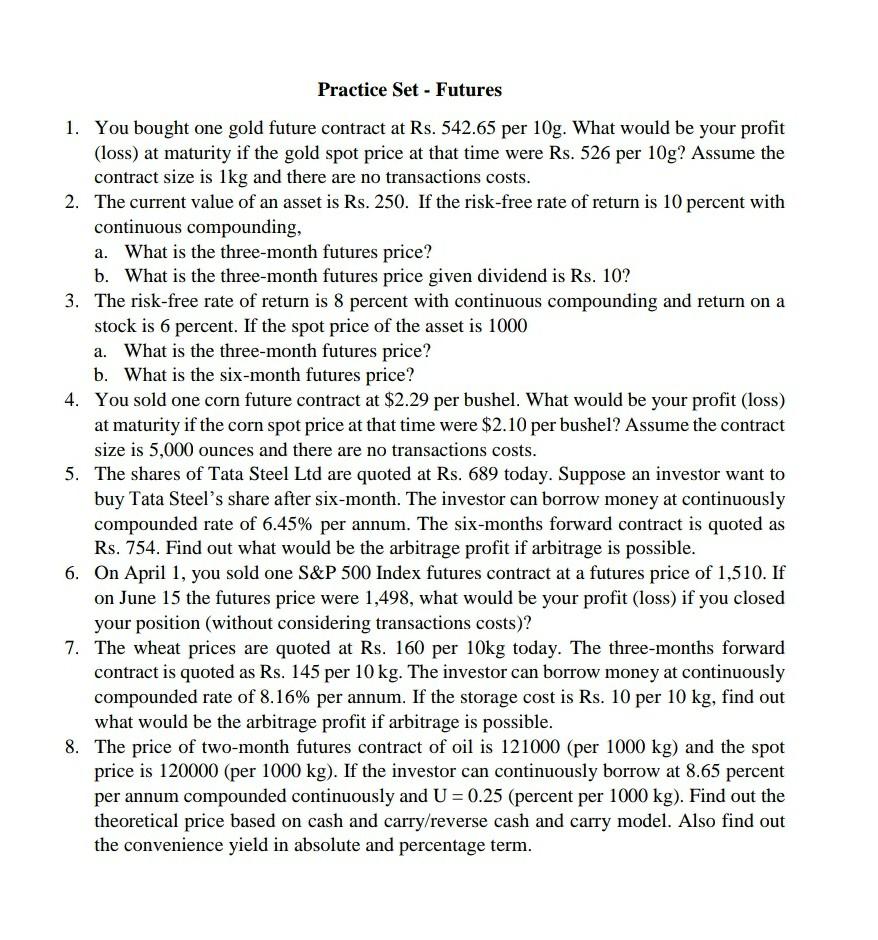

1. You bought one gold future contract at Rs. 542.65 per 10g. What would be your profit (loss) at maturity if the gold spot price at that time were Rs. 526 per 10g ? Assume the contract size is 1kg and there are no transactions costs. 2. The current value of an asset is Rs. 250. If the risk-free rate of return is 10 percent with continuous compounding, a. What is the three-month futures price? b. What is the three-month futures price given dividend is Rs. 10? 3. The risk-free rate of return is 8 percent with continuous compounding and return on a stock is 6 percent. If the spot price of the asset is 1000 a. What is the three-month futures price? b. What is the six-month futures price? 4. You sold one corn future contract at $2.29 per bushel. What would be your profit (loss) at maturity if the corn spot price at that time were $2.10 per bushel? Assume the contract size is 5,000 ounces and there are no transactions costs. 5. The shares of Tata Steel Ltd are quoted at Rs. 689 today. Suppose an investor want to buy Tata Steel's share after six-month. The investor can borrow money at continuously compounded rate of 6.45% per annum. The six-months forward contract is quoted as Rs. 754. Find out what would be the arbitrage profit if arbitrage is possible. 6. On April 1, you sold one S\&P 500 Index futures contract at a futures price of 1,510. If on June 15 the futures price were 1,498, what would be your profit (loss) if you closed your position (without considering transactions costs)? 7. The wheat prices are quoted at Rs. 160 per 10kg today. The three-months forward contract is quoted as Rs. 145 per 10kg. The investor can borrow money at continuously compounded rate of 8.16% per annum. If the storage cost is Rs. 10 per 10kg, find out what would be the arbitrage profit if arbitrage is possible. 8. The price of two-month futures contract of oil is 121000 (per 1000kg ) and the spot price is 120000 (per 1000kg ). If the investor can continuously borrow at 8.65 percent per annum compounded continuously and U=0.25 (percent per 1000kg ). Find out the theoretical price based on cash and carry/reverse cash and carry model. Also find out the convenience yield in absolute and percentage term

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started