Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer in excel, as part a, b, c, d sume you are a budget analyst, and the town is considering an investment in a

Please answer in excel, as part a, b, c, d

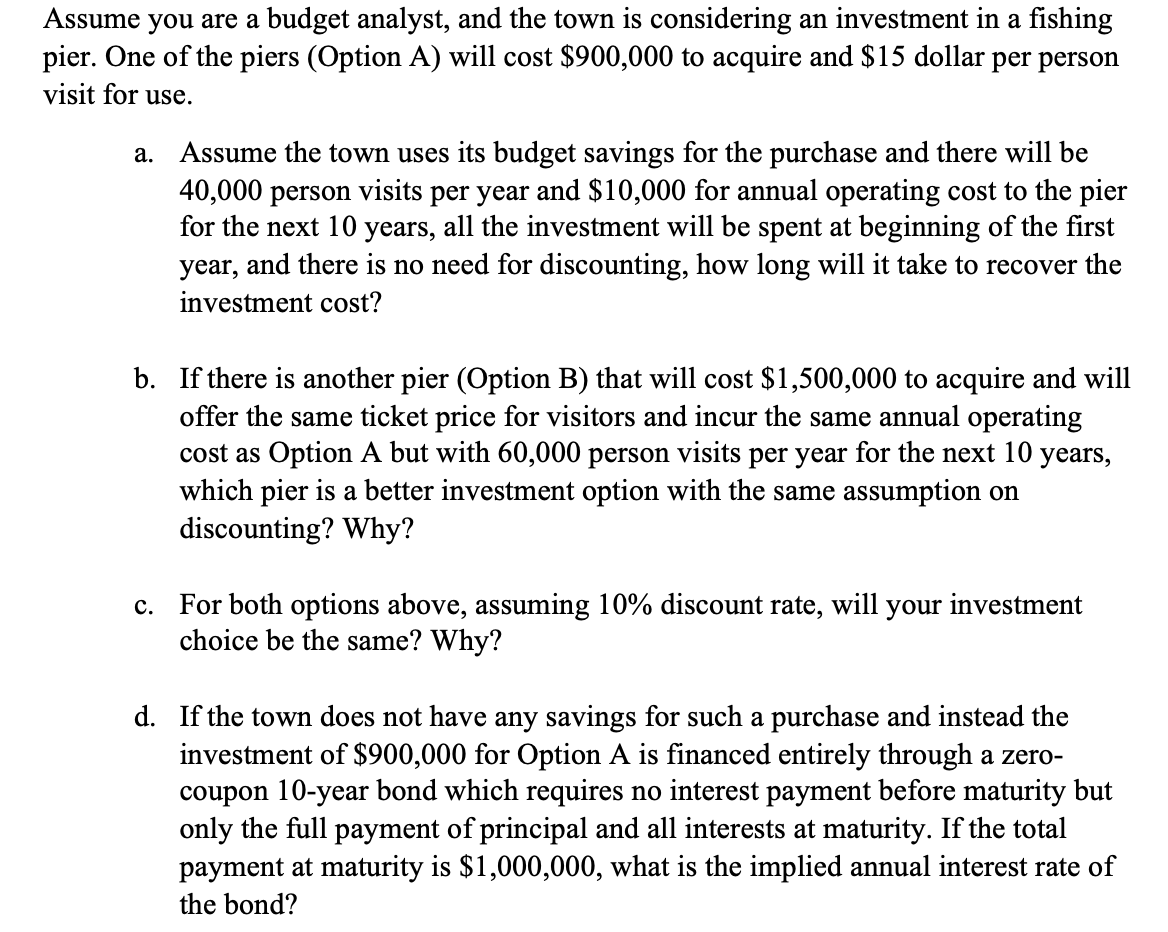

sume you are a budget analyst, and the town is considering an investment in a fishing r. One of the piers (Option A) will cost $900,000 to acquire and $15 dollar per person it for use. a. Assume the town uses its budget savings for the purchase and there will be 40,000 person visits per year and $10,000 for annual operating cost to the pier for the next 10 years, all the investment will be spent at beginning of the first year, and there is no need for discounting, how long will it take to recover the investment cost? b. If there is another pier (Option B) that will cost $1,500,000 to acquire and will offer the same ticket price for visitors and incur the same annual operating cost as Option A but with 60,000 person visits per year for the next 10 years, which pier is a better investment option with the same assumption on discounting? Why? c. For both options above, assuming 10% discount rate, will your investment choice be the same? Why? d. If the town does not have any savings for such a purchase and instead the investment of $900,000 for Option A is financed entirely through a zerocoupon 10-year bond which requires no interest payment before maturity but only the full payment of principal and all interests at maturity. If the total payment at maturity is $1,000,000, what is the implied annual interest rate of the bondStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started