Question

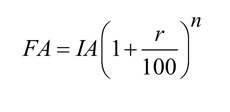

1. You have $5,000 which you plan on investing and low and behold someone tells you that you can earn 14% annual interest on your

1. You have $5,000 which you plan on investing and low and behold someone tells you that you can earn 14% annual interest on your $5,000. Assuming this is true, how much would it grow to in 10 years? Note, if you could get 14% return either the inflation rate is really high or it may be too good to be true.

2. You have $5,000 which you need to double in the next 10 years. What would the rate of interest be so that your $5,000 nest egg will double in 10 years?

3. You have a goal of having $5,000 for a down payment on a car in four years. You know that you can get a CD paying 4% annually for four years. How much will you need now in order to have your $5,000 in four years?

4. Your gross annual salary is $45,000. Your boss is going to give a $2,000 a year raise for this year and also for the next 2 years.

a. What is the percentage increase in your salary for the first year?

b. Suppose you invest just the first year raise amount of $2,000 and you get a 10% annual return on it. How much will it have grown to in 20 years?

c. Suppose you invest $2,000 for the second year raise, and you get a 10% annual return on it. How much will it have grown to in 19 years?

d. Suppose you invest $2,000 for the third year raise, and you get a 10% annual return on it. How much will it have grown to in 18 years?

e. Suppose you invest your $2,000 first year raise every year for twenty years, and you get a 10% annual return on it. How much will it have grown to in 20 years? (Use the ordinary annuity formula.)

5. You want to buy a new car and need $5,000, but you have only $3,000. You are willing to wait 3 years. What percent return on your $3,000 would you need so that your $3,000 would grow to $5,000 in 3 years?

6. Your annual living expenses are $25,000. Assuming that your spending habits dont change over the next 20 years, and the inflation rate would be 4% per year for that 20 year period, what will be your living expenses 20 years from now? The purpose of this problem is to help you appreciate how large an effect inflation can have over a long period of time, even at a low rate of 4%,. This is compounding working against you for sure yes?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started