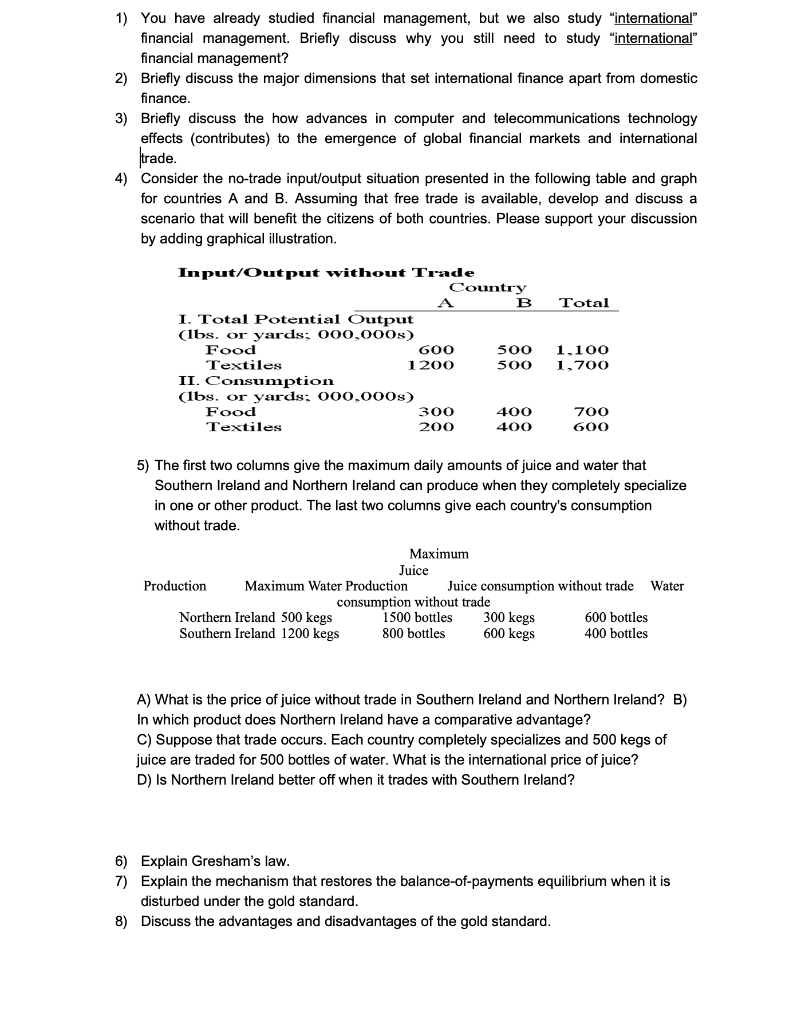

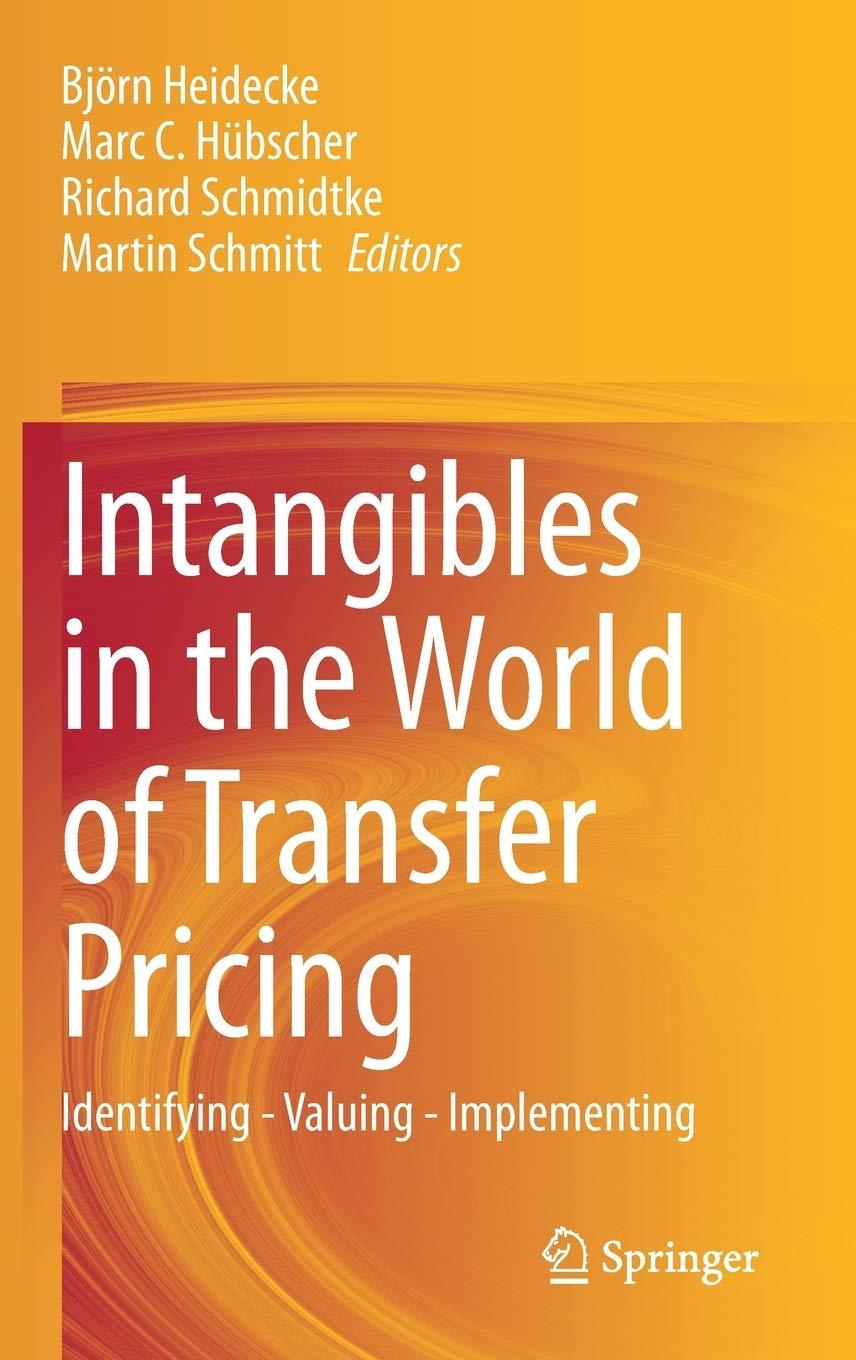

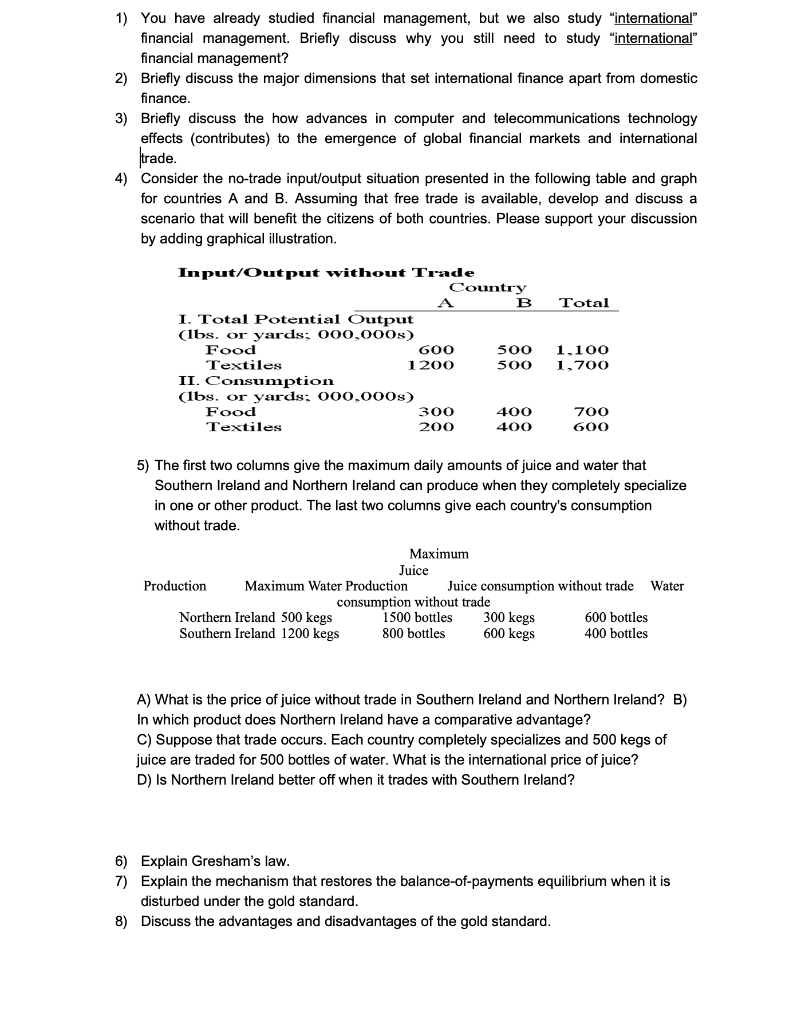

1) You have already studied financial management, but we also study "international financial management. Briefly discuss why you still need to study international" financial management? 2) Briefly discuss the major dimensions that set international finance apart from domestic finance. 3) Briefly discuss the how advances in computer and telecommunications technology effects (contributes) to the emergence of global financial markets and international trade. 4) Consider the no-trade input/output situation presented in the following table and graph for countries A and B. Assuming that free trade is available, develop and discuss a scenario that will benefit the citizens of both countries. Please support your discussion by adding graphical illustration. Total Input/Output without Trade Country A B I. Total Potential Output (lbs. or yards; 000,000s) Food 600 500 Textiles 1200 500 II. Consumption (lbs. or yards: 000,000s) Food 300 400 Textiles 200 400 1,100 1,700 700 600 5) The first two columns give the maximum daily amounts of juice and water that Southern Ireland and Northern Ireland can produce when they completely specialize in one or other product. The last two columns give each country's consumption without trade. Maximum Juice Production Maximum Water Production Juice consumption without trade Water consumption without trade Northern Ireland 500 kegs 1500 bottles 300 kegs 600 bottles Southern Ireland 1200 kegs 800 bottles 600 kegs 400 bottles A) What is the price of juice without trade in Southern Ireland and Northern Ireland? B) In which product does Northern Ireland have a comparative advantage? C) Suppose that trade occurs. Each country completely specializes and 500 kegs of juice are traded for 500 bottles of water. What is the international price of juice? D) Is Northern Ireland better off when it trades with Southern Ireland? 6) Explain Gresham's law. 7) Explain the mechanism that restores the balance-of-payments equilibrium when it is disturbed under the gold standard. 8) Discuss the advantages and disadvantages of the gold standard. 9) Comment on the proposition that the Bretton Woods system was programmed to an eventual demise. 10) There are arguments for and against the alternative exchange rate regimes. A) List the advantages of the flexible exchange rate regime. B) Criticize the flexible exchange rate regime from the viewpoint of the proponents of the fixed exchange rate regime. C) Rebut the above criticism from the viewpoint of the proponents of the flexible exchange rate regime. 11) Once capital markets are integrated, it is difficult for a country to maintain a fixed exchange rate. Explain why this may be so. 12) Assess the possibility for the euro to become another global currency rivaling the U.S. dollar. If the euro really becomes a global currency, what impact will it have on the U.S. dollar and the world economy