Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) You have done extensive analysis on the risk and returns of two companies (Firm A and Firm B). Your analysis has determined that there

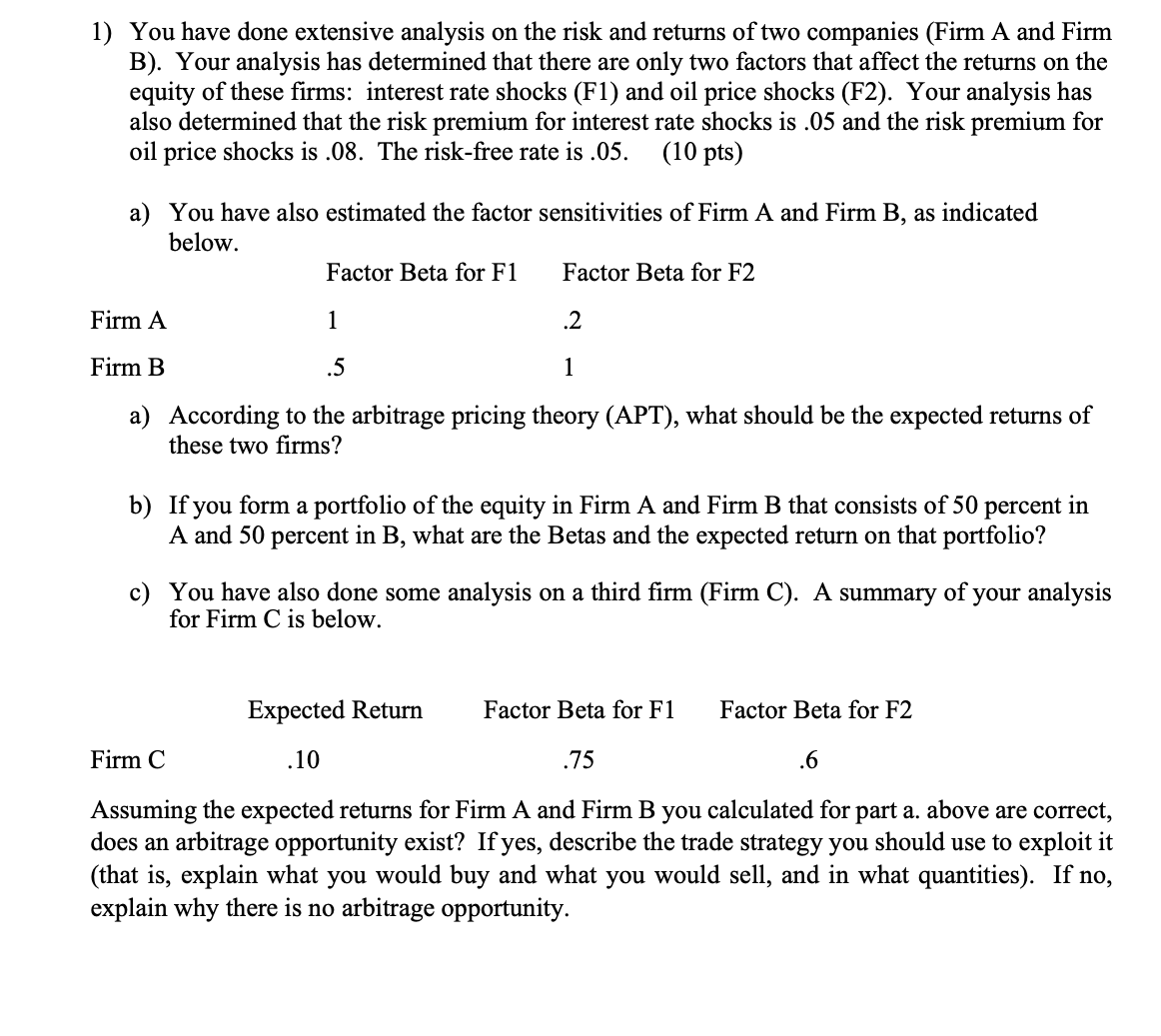

1) You have done extensive analysis on the risk and returns of two companies (Firm A and Firm B). Your analysis has determined that there are only two factors that affect the returns on the equity of these firms: interest rate shocks (F1) and oil price shocks (F2). Your analysis has also determined that the risk premium for interest rate shocks is .05 and the risk premium for oil price shocks is .08 . The risk-free rate is .05 . (10 pts) a) You have also estimated the factor sensitivities of Firm A and Firm B, as indicated below. a) According to the arbitrage pricing theory (APT), what should be the expected returns of these two firms? b) If you form a portfolio of the equity in Firm A and Firm B that consists of 50 percent in A and 50 percent in B, what are the Betas and the expected return on that portfolio? c) You have also done some analysis on a third firm (Firm C). A summary of your analysis for Firm C is below. Assuming the expected returns for Firm A and Firm B you calculated for part a. above are correct, does an arbitrage opportunity exist? If yes, describe the trade strategy you should use to exploit it (that is, explain what you would buy and what you would sell, and in what quantities). If no, explain why there is no arbitrage opportunity

1) You have done extensive analysis on the risk and returns of two companies (Firm A and Firm B). Your analysis has determined that there are only two factors that affect the returns on the equity of these firms: interest rate shocks (F1) and oil price shocks (F2). Your analysis has also determined that the risk premium for interest rate shocks is .05 and the risk premium for oil price shocks is .08 . The risk-free rate is .05 . (10 pts) a) You have also estimated the factor sensitivities of Firm A and Firm B, as indicated below. a) According to the arbitrage pricing theory (APT), what should be the expected returns of these two firms? b) If you form a portfolio of the equity in Firm A and Firm B that consists of 50 percent in A and 50 percent in B, what are the Betas and the expected return on that portfolio? c) You have also done some analysis on a third firm (Firm C). A summary of your analysis for Firm C is below. Assuming the expected returns for Firm A and Firm B you calculated for part a. above are correct, does an arbitrage opportunity exist? If yes, describe the trade strategy you should use to exploit it (that is, explain what you would buy and what you would sell, and in what quantities). If no, explain why there is no arbitrage opportunity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started