Question

1. You have recently graduated and the list below describes your financial situation: You have been working for a year with a gross monthly salary

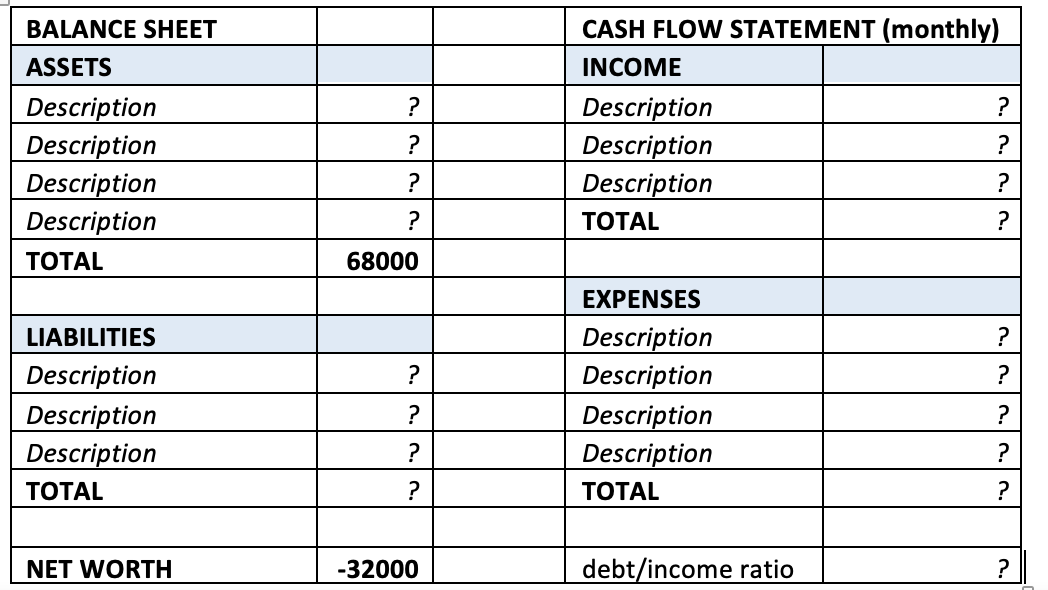

1. You have recently graduated and the list below describes your financial situation: You have been working for a year with a gross monthly salary of $6,500. In addition, your employer has a generous pension fund and you already have accumulated $12,500 in your 401k. The income it generates does not affect your taxes, unless you liquidate it, and you are free to do so. You are sharing a two-bedroom apartment with your friend, and you each pay $1,400 a month in rent. Last year you purchased a brand new car for $20,000 as a necessity to commute to work. You still have a $16,000 balance on your 5-year auto loan at a 4% rate, and your monthly payment is $400. In a year, the car has depreciated already to a blue book value of $13,000. You recently took a well-deserved but expensive vacation: your credit card balance is $4,000 with monthly minimum payments of $100. The cards interest rate is 15%. You have $80,000 in student loan balance to be paid off in 20 years at 4% interest rate. Your monthly payment is $600. You do not keep much in your checking and savings accounts, as they pay virtually no interest rate and your current balance in those accounts is $2,500. You do have an eTrade account where you actively buy and sell stocks. You have done very well in the past two years and you have reported your gains in your income taxes. You averaged $600 a year in dividend income and you averaged $9,000 a year in short-term capital gains. The amount invested now totals $40,000.

Complete the Balance Sheet and the Cash Flow statements below:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started