Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) You need to construct the table of the Butterfly and the pay-off diagram. 2) You need to calculate the call value based on the

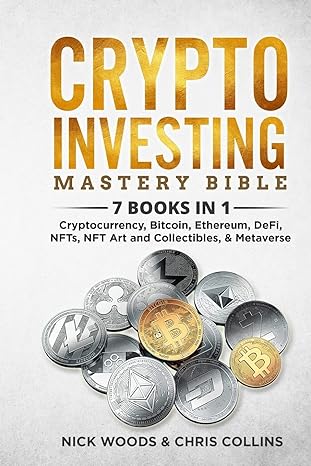

1) You need to construct the table of the Butterfly and the pay-off diagram.

1) You need to construct the table of the Butterfly and the pay-off diagram.

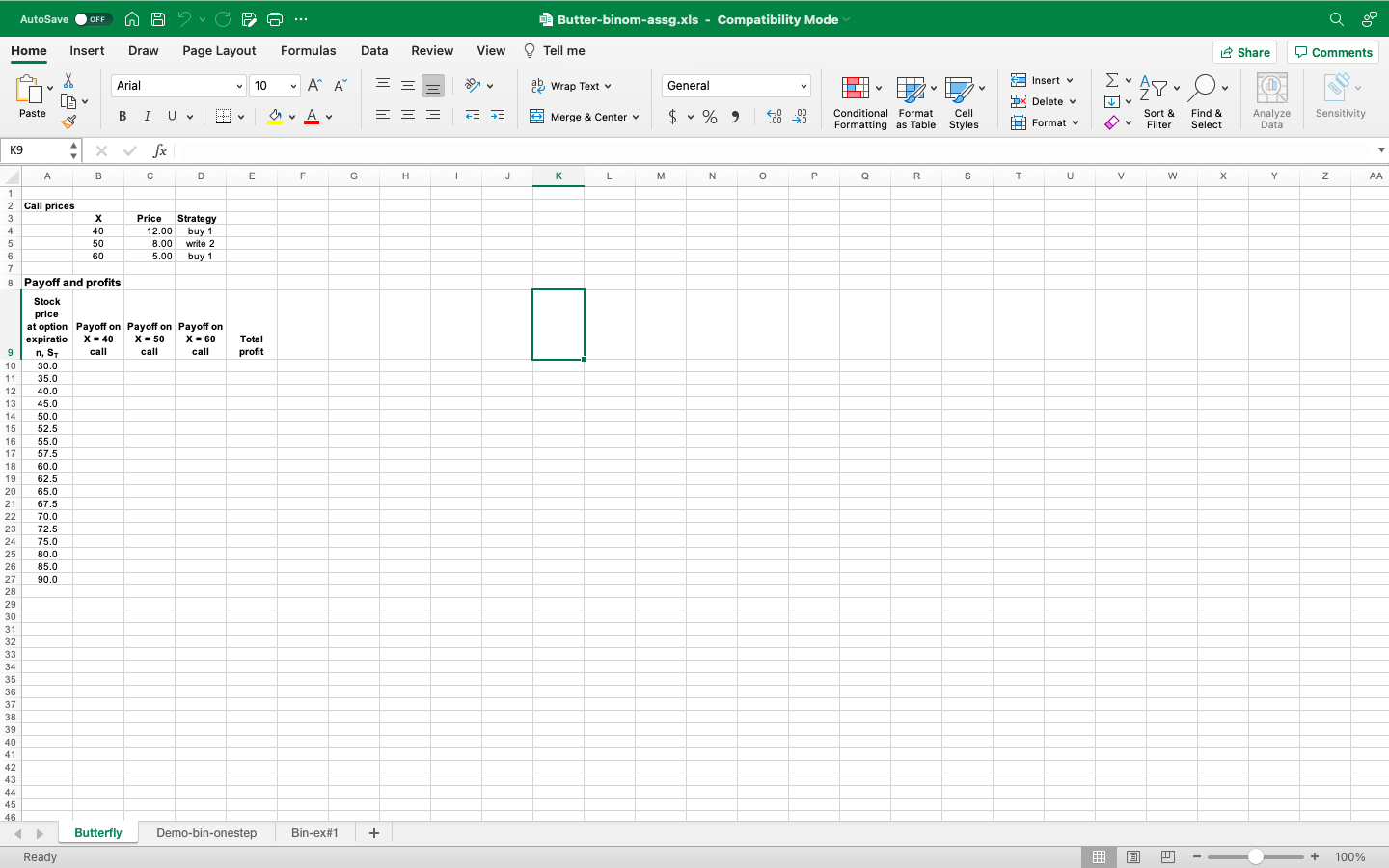

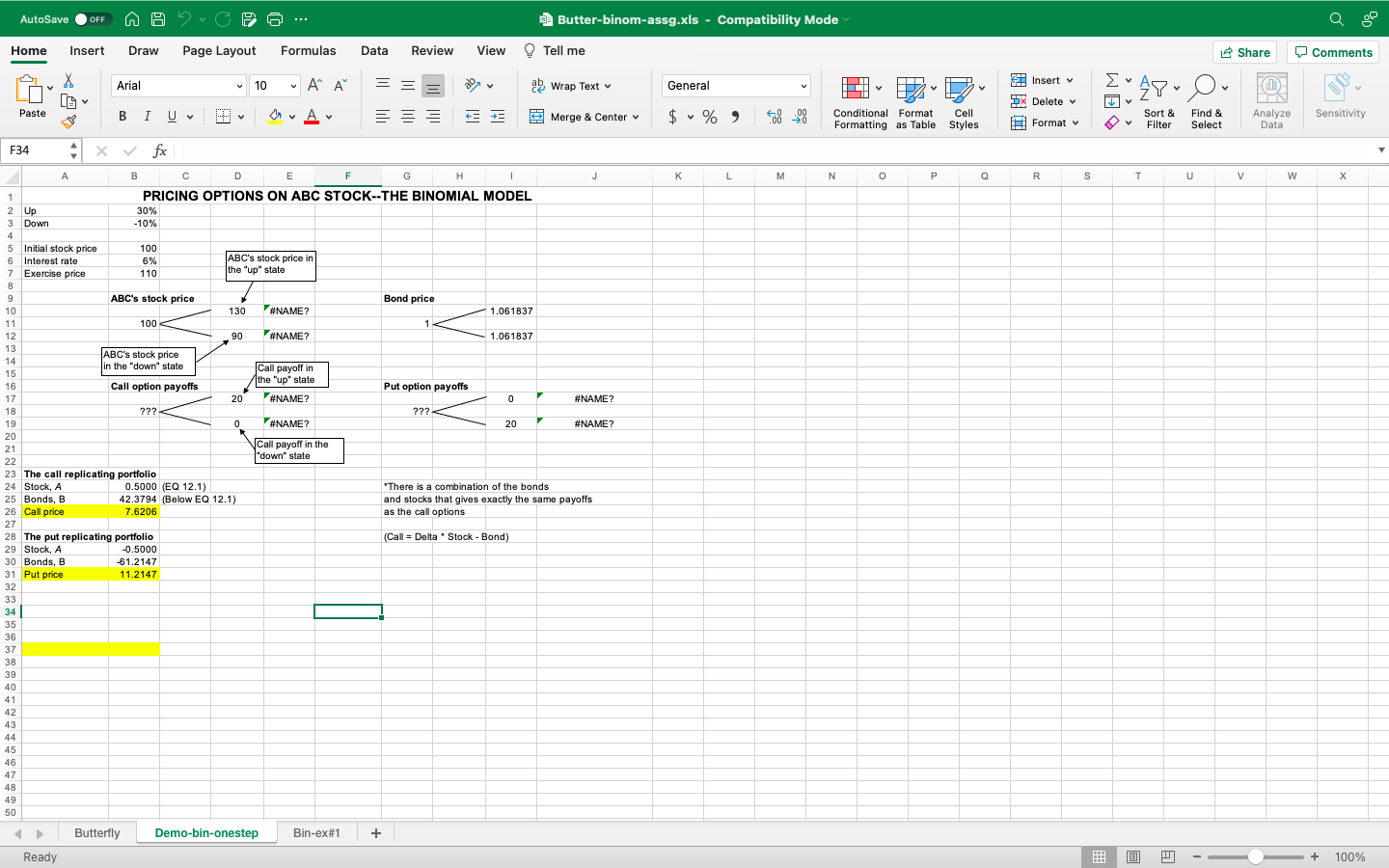

2) You need to calculate the call value based on the information in the Bin-Ex#1 as demonstrated in Demo-bin-one step worksheet.

AutoSave OFF A 9 buc Butter-binom-assg.xls - Compatibility Mode Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments X Arial V 10 . = = ab Wrap Text Insert v General WE 48- 0 DX Delete v Paste I U B a. Av A * Merge & Center .00 00 0 $ % ) Conditional Format Cell Formatting as Table Styles Sensitivity Format Find & Select Sort & Filter Analyze Data K9 4 x fx F G H 1 J K L M N 0 P Q R s s T T U v w Y Z AA A B C D D E 1 1 2 Call prices 3 Price Strategy 4 40 12.00 buy 1 5 50 8.00 write 2 6 60 5.00 buy 1 7 8 Payoff and profits Stock price at option Payoff on Payoff on Payoff on expiratio X = 40 X = 50 X = 60 Total 9 n, S. call call call profit 10 30.0 11 35.0 12 40.0 13 45.0 14 50.0 15 52.5 16 55.0 17 57.5 18 60.0 19 62.5 20 65.0 21 67.5 22 70.0 23 72.5 24 75.0 25 80.0 26 85.0 27 90.0 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 Butterfly Demo-bin-onestep Bin-ex#1 + Ready @ a + 100% AutoSave OFF A 9 buc Butter-binom-assg.xls - Compatibility Mode Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments Arial V 10 . A = = ab Wrap Text Insert v X LO General WE 47 DX Delete v Paste B I I U A V Merge & Center & $ % ) .00 00 0 V Sensitivity Conditional Format Cell Formatting as Table Styles Format Find & Select Sort & Filter Analyze Data F34 4 x fx K L M N o Q R S s T U V V w A B DE F F G H 1 J 1 PRICING OPTIONS ON ABC STOCK-THE BINOMIAL MODEL 2 Up 30% 3 3 Down -10% 4 5 Initial stock price 100 6 Interest rate 6% ABC's stock price in 7 Exercise price 110 the "up" state 8 9 ABC's stock price Bond price 10 130 #NAME? 1.061837 11 100 1 12 90 #NAME? 1.061837 13 ABC's stock price 14 in the "down" state Call payoff in 15 16 Call option payoffs the 'up" state Put option payoffs 17 20 #NAME? 0 #NAME? 18 ??? ??? 19 0 #NAME? 20 #NAME? 20 Call payoff in the 21 "down" state 22 23 The call replicating portfolio 24 Stock, A 0.5000 (EQ 12.1) "There is a combination of the bonds 25 Bonds, B 42.3794 (Below EQ 12.1) and stocks that gives exactly the same payoffs 26 Call price 7.6206 as the call options 27 28 The put replicating portfolio (Call= Delta Stock - Bond) 29 Stock, A -0.5000 30 Bonds, B -61.2147 31 Put price 11.2147 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 Butterfly Demo-bin-onestep Bin-ex #1 + Ready @ a + 100% AutoSave OFF A 9 buc Butter-binom-assg.xls - Compatibility Mode Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments Arial V 10 . = = ab Wrap Text Insert v General X LO * WE AY ov DX Delete v Paste B I U A === Merge & Center $ % ) .00 00 0 Conditional Format Cell Formatting as Table Styles Sensitivity Format Find & Select Sort & Filter Analyze Data F32 4 x fx A B D E F G H 1 J K L M N 0 P Q R s s U v w Y Z AA 1 2 3 e Consider the one step Model: The stock price goes up by 15% or decreases by 8% The one-period interest is 8%. Consider a European call with X=$28 for the stock of $26. What is the call price? What is the put price? 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 D Butterfly Demo-bin-onestep Bin-ex#1 + Ready @ T TUU70 AutoSave OFF A 9 buc Butter-binom-assg.xls - Compatibility Mode Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments X Arial V 10 . = = ab Wrap Text Insert v General WE 48- 0 DX Delete v Paste I U B a. Av A * Merge & Center .00 00 0 $ % ) Conditional Format Cell Formatting as Table Styles Sensitivity Format Find & Select Sort & Filter Analyze Data K9 4 x fx F G H 1 J K L M N 0 P Q R s s T T U v w Y Z AA A B C D D E 1 1 2 Call prices 3 Price Strategy 4 40 12.00 buy 1 5 50 8.00 write 2 6 60 5.00 buy 1 7 8 Payoff and profits Stock price at option Payoff on Payoff on Payoff on expiratio X = 40 X = 50 X = 60 Total 9 n, S. call call call profit 10 30.0 11 35.0 12 40.0 13 45.0 14 50.0 15 52.5 16 55.0 17 57.5 18 60.0 19 62.5 20 65.0 21 67.5 22 70.0 23 72.5 24 75.0 25 80.0 26 85.0 27 90.0 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 Butterfly Demo-bin-onestep Bin-ex#1 + Ready @ a + 100% AutoSave OFF A 9 buc Butter-binom-assg.xls - Compatibility Mode Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments Arial V 10 . A = = ab Wrap Text Insert v X LO General WE 47 DX Delete v Paste B I I U A V Merge & Center & $ % ) .00 00 0 V Sensitivity Conditional Format Cell Formatting as Table Styles Format Find & Select Sort & Filter Analyze Data F34 4 x fx K L M N o Q R S s T U V V w A B DE F F G H 1 J 1 PRICING OPTIONS ON ABC STOCK-THE BINOMIAL MODEL 2 Up 30% 3 3 Down -10% 4 5 Initial stock price 100 6 Interest rate 6% ABC's stock price in 7 Exercise price 110 the "up" state 8 9 ABC's stock price Bond price 10 130 #NAME? 1.061837 11 100 1 12 90 #NAME? 1.061837 13 ABC's stock price 14 in the "down" state Call payoff in 15 16 Call option payoffs the 'up" state Put option payoffs 17 20 #NAME? 0 #NAME? 18 ??? ??? 19 0 #NAME? 20 #NAME? 20 Call payoff in the 21 "down" state 22 23 The call replicating portfolio 24 Stock, A 0.5000 (EQ 12.1) "There is a combination of the bonds 25 Bonds, B 42.3794 (Below EQ 12.1) and stocks that gives exactly the same payoffs 26 Call price 7.6206 as the call options 27 28 The put replicating portfolio (Call= Delta Stock - Bond) 29 Stock, A -0.5000 30 Bonds, B -61.2147 31 Put price 11.2147 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 Butterfly Demo-bin-onestep Bin-ex #1 + Ready @ a + 100% AutoSave OFF A 9 buc Butter-binom-assg.xls - Compatibility Mode Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments Arial V 10 . = = ab Wrap Text Insert v General X LO * WE AY ov DX Delete v Paste B I U A === Merge & Center $ % ) .00 00 0 Conditional Format Cell Formatting as Table Styles Sensitivity Format Find & Select Sort & Filter Analyze Data F32 4 x fx A B D E F G H 1 J K L M N 0 P Q R s s U v w Y Z AA 1 2 3 e Consider the one step Model: The stock price goes up by 15% or decreases by 8% The one-period interest is 8%. Consider a European call with X=$28 for the stock of $26. What is the call price? What is the put price? 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 D Butterfly Demo-bin-onestep Bin-ex#1 + Ready @ T TUU70Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started