Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. You need to have $300 saved up in 3 periods. You want to create a savings plan to set aside a fixed amount each

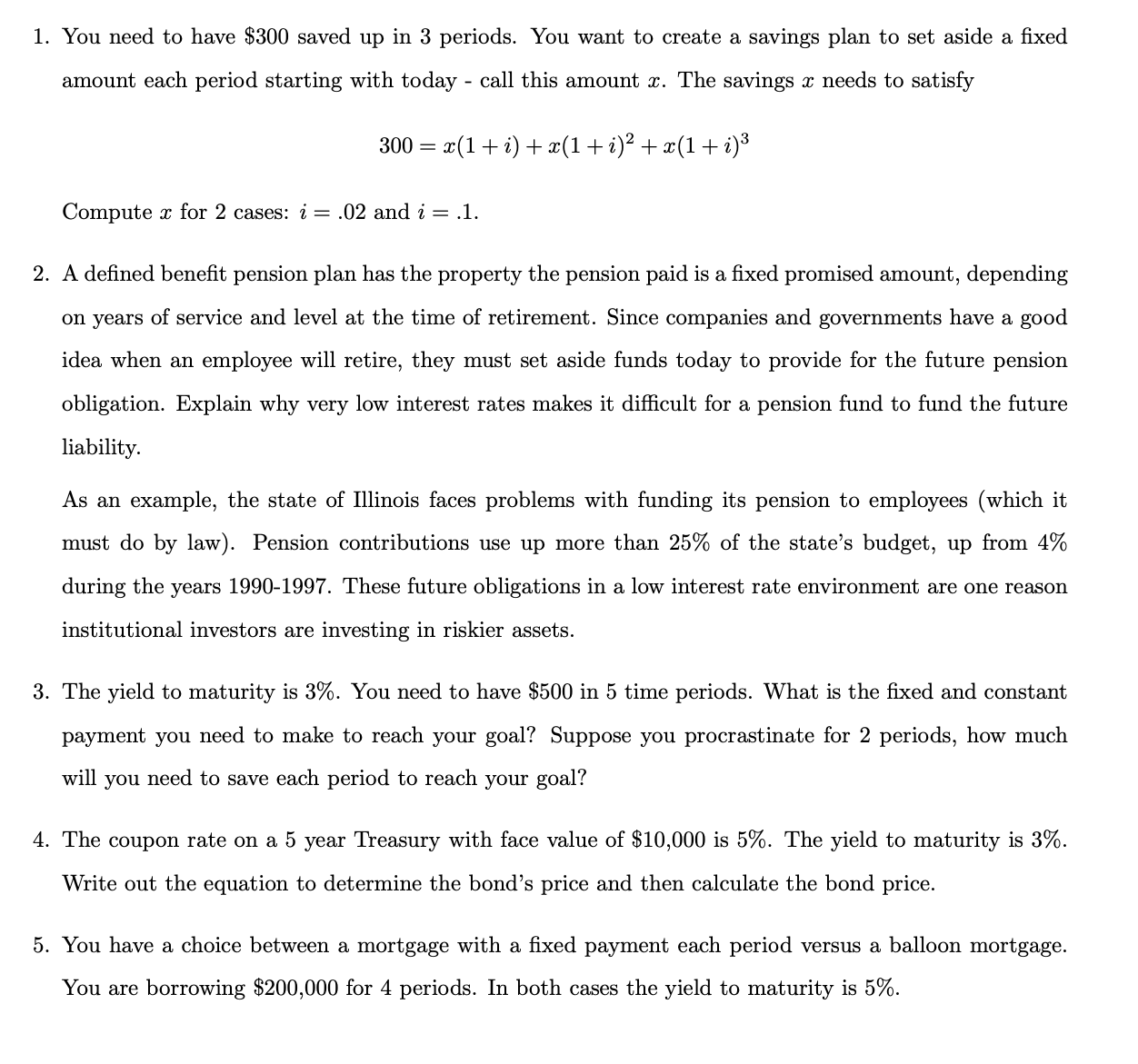

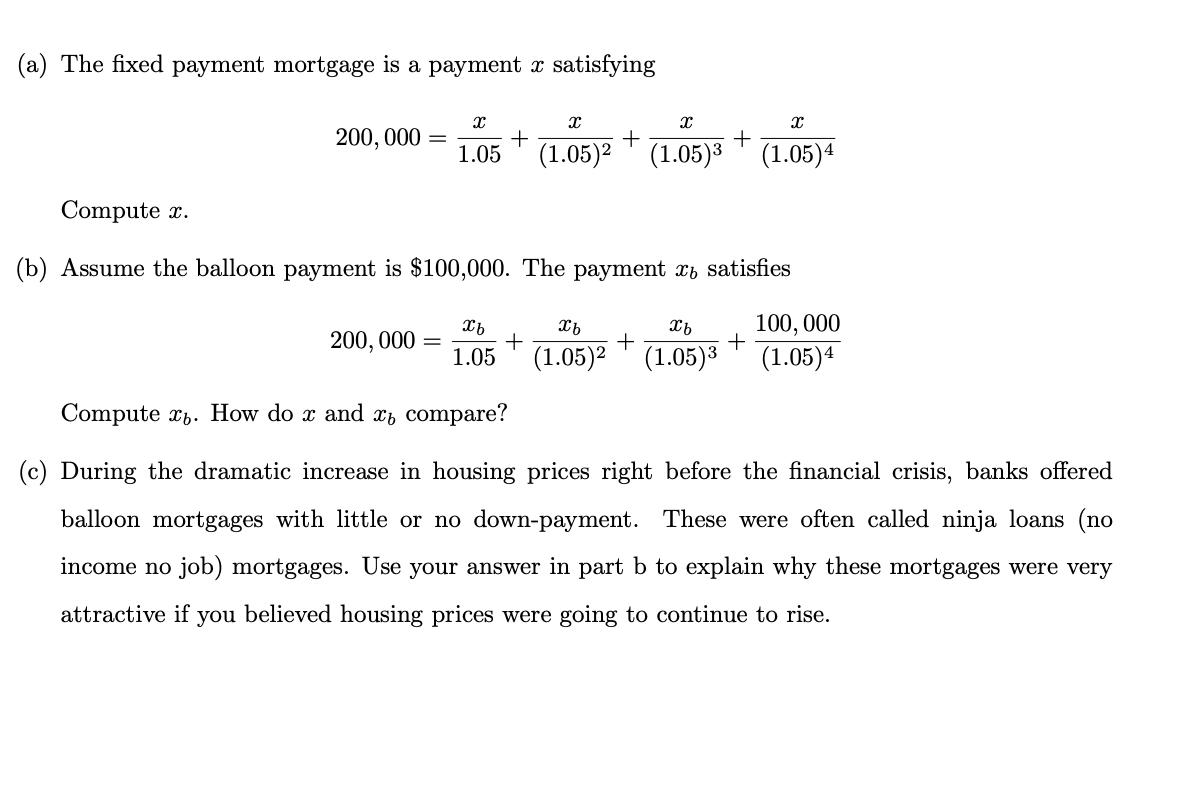

1. You need to have $300 saved up in 3 periods. You want to create a savings plan to set aside a fixed amount each period starting with today - call this amount x. The savings x needs to satisfy 300=x(1+i)+x(1+i)2+x(1+i)3 Compute x for 2 cases: i=.02 and i=.1. 2. A defined benefit pension plan has the property the pension paid is a fixed promised amount, depending on years of service and level at the time of retirement. Since companies and governments have a good idea when an employee will retire, they must set aside funds today to provide for the future pension obligation. Explain why very low interest rates makes it difficult for a pension fund to fund the future liability. As an example, the state of Illinois faces problems with funding its pension to employees (which it must do by law). Pension contributions use up more than 25% of the state's budget, up from 4% during the years 1990-1997. These future obligations in a low interest rate environment are one reason institutional investors are investing in riskier assets. 3. The yield to maturity is 3%. You need to have $500 in 5 time periods. What is the fixed and constant payment you need to make to reach your goal? Suppose you procrastinate for 2 periods, how much will you need to save each period to reach your goal? 4. The coupon rate on a 5 year Treasury with face value of $10,000 is 5%. The yield to maturity is 3%. Write out the equation to determine the bond's price and then calculate the bond price. 5. You have a choice between a mortgage with a fixed payment each period versus a balloon mortgage. You are borrowing $200,000 for 4 periods. In both cases the yield to maturity is 5%. (a) The fixed payment mortgage is a payment x satisfying 200,000=1.05x+(1.05)2x+(1.05)3x+(1.05)4x Compute x. (b) Assume the balloon payment is $100,000. The payment xb satisfies 200,000=1.05xb+(1.05)2xb+(1.05)3xb+(1.05)4100,000 Compute xb. How do x and xb compare? (c) During the dramatic increase in housing prices right before the financial crisis, banks offered balloon mortgages with little or no down-payment. These were often called ninja loans (no income no job) mortgages. Use your answer in part b to explain why these mortgages were very attractive if you believed housing prices were going to continue to rise

1. You need to have $300 saved up in 3 periods. You want to create a savings plan to set aside a fixed amount each period starting with today - call this amount x. The savings x needs to satisfy 300=x(1+i)+x(1+i)2+x(1+i)3 Compute x for 2 cases: i=.02 and i=.1. 2. A defined benefit pension plan has the property the pension paid is a fixed promised amount, depending on years of service and level at the time of retirement. Since companies and governments have a good idea when an employee will retire, they must set aside funds today to provide for the future pension obligation. Explain why very low interest rates makes it difficult for a pension fund to fund the future liability. As an example, the state of Illinois faces problems with funding its pension to employees (which it must do by law). Pension contributions use up more than 25% of the state's budget, up from 4% during the years 1990-1997. These future obligations in a low interest rate environment are one reason institutional investors are investing in riskier assets. 3. The yield to maturity is 3%. You need to have $500 in 5 time periods. What is the fixed and constant payment you need to make to reach your goal? Suppose you procrastinate for 2 periods, how much will you need to save each period to reach your goal? 4. The coupon rate on a 5 year Treasury with face value of $10,000 is 5%. The yield to maturity is 3%. Write out the equation to determine the bond's price and then calculate the bond price. 5. You have a choice between a mortgage with a fixed payment each period versus a balloon mortgage. You are borrowing $200,000 for 4 periods. In both cases the yield to maturity is 5%. (a) The fixed payment mortgage is a payment x satisfying 200,000=1.05x+(1.05)2x+(1.05)3x+(1.05)4x Compute x. (b) Assume the balloon payment is $100,000. The payment xb satisfies 200,000=1.05xb+(1.05)2xb+(1.05)3xb+(1.05)4100,000 Compute xb. How do x and xb compare? (c) During the dramatic increase in housing prices right before the financial crisis, banks offered balloon mortgages with little or no down-payment. These were often called ninja loans (no income no job) mortgages. Use your answer in part b to explain why these mortgages were very attractive if you believed housing prices were going to continue to rise Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started