Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. You need to select a Corporate Bond that is a Good Faith and Credit Instrument. This corporate bond should: a. Not be a

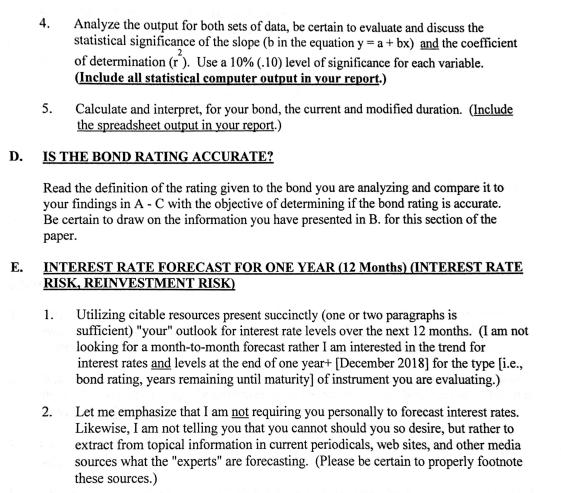

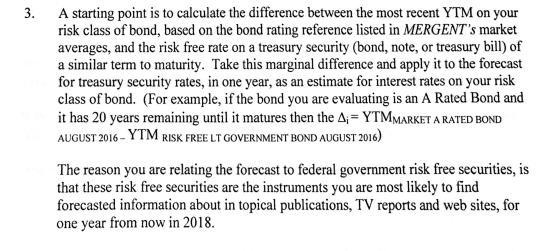

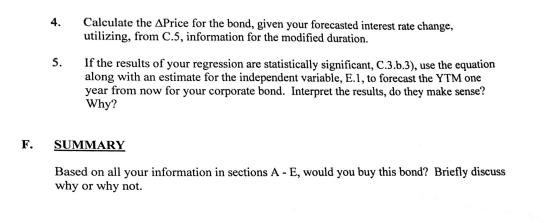

1. You need to select a Corporate Bond that is a Good Faith and Credit Instrument. This corporate bond should: a. Not be a Senior bond b. No pledge of any assets to back the bond you select c. No foreign corporate bonds (thus, no need to evaluate foreign exchange risk) d. The designation of the corporate bond being a Debenture or Note is the best indicator that you are selecting the correct type of bond. 2. Not all firms have issued Corporate Bonds - If you are interested in a particular firm, but it has no Corporate Bonds outstanding, select another company in the same industry that does have a corporate bond outstanding. Your evaluation of this alternative firm and the industry can be of use in later assignments. 3. It is probably best to select an S&P 500 firm, but this is not required. Lots of these firms will have multiple bonds outstanding that will qualify for this assignment. 4. The bond that you select must have at least a two year maturity remaining, thus at least 24 months are remaining in its life. 5. The bond that you select should have been issued at least 5 years ago (2013), although there is some flexibility here for your selection. 6. The bond rating is important in the evaluation process for this assignment but you can select either an Investment Grade or a Speculative Grade (Junk Bond) bond. A. B. GENERAL BOND AND INVESTOR INFORMATION What I'm looking for Briefly discuss the general characteristics of the bond touching on: 1. 1. a. b. 2. A brief discussion of why you selected this bond to analyze, emphasizing how your investment objectives and/or your business interests have resulted in this selection. EVALUATION OF THE CORPORATE BOND'S UNSYSTEMATIC RISK Corporation's Ability to Repay Principal - This entails the identification or calculation of key financial ratios for both their current financial data and historical values. a. b. Finacial and nowmrative. C. A brief description of the company that issued the bond. A brief description of the bond issue; such as the original life of the bond, life remaining, coupon rate, if the bond is callable, current rating, current yield, etc. Identify these key ratios based on our text and lecture. (NOTE: These can be selected, in certain instances it might be necessary to calculate the financial ratio based on financial data provided in financial statements in the database, from the Standard & Poor's - Net Advantage and MORNINGSTAR in the ALADIN databases, you might find the company reports in Value Line useful, this is also in the ALADIN databases..) (Note: You might also find useful the key financial statements and financial ratios that are available on the Internet at Yahoo's web site, http://finance.yahoo.com/) Compare these results to industry standards available from published sources or preferably compare to the industry leader (sales/revenue) [or number two (sales/revenue) in the industry if you are analyzing the industry leader] based on financial ratios from the ALADIN databases, et. al. In addition, include an evaluation of the company's ratios, from B.1.a, over time, what is commonly referred to as trend analysis. C. 3. 1. 2. 2. Credit Position of the Company Discuss the debt-paying experience of the company. (Use the information about this company's current and historic bond ratings.) Has the company ever defaulted? What is the character of the issuing corporation? a. Corporation's Ability to Pay Interest - Same procedure as in 1 above. Note: As per our class discussion, Standard & Poor's Bond Guide, (both hard copy and in their database) provides information about an interest coverage ratio, and calculates this value over several years. b. C. EVALUATION OF THE CORPORATE BOND'S INVESTMENT RETURN AND SYSTEMATIC RISK Determine the Yield-To-Maturity (YTM) based on quarterly periods (March, June, September, December) for the past nineteen periods. (March 2013 through September 2017). [If September 2017 is not available, use data through June 2017.] Look-up Bond Yield Averages for the corresponding nineteen quarterly periods (available in either Standard & Poor's Bond Guide or MERGENT's Bond Record as per handout example) by the same bond rating classification. (Note: These publications are in the Marymount University Ballston Library.) 3. Utilizing EXCEL, (this is also available at our Computer Lab) complete the following statistical analysis: (Note: The best and most succinct discussion on using and interpreting EXCEL is the statistics text STATISTICS for BUSINESS and ECONOMICS, authored by Anderson, Sweeney, Williams, 2012, SOUTH- WESTERN CENGAGE Learning. ISBN 13: 978-0-538-48165-6; this has been updated to a more recent edition.) Enter the two sets of data. Evaluate your data by using EXCEL to compute: a. b. 1) 2) 3) REGRESSION ANALYSIS DESCRIPTIVE STATISTICS SCATTERPLOTS Note: Make certain that the regression coefficients (a and b in the equation y = a + bx) in C.3.b.2) and C.3.b.3) are equal, frequently errors are made in these EXCEL applications which result in switching the dependent variable and independent variable. 4. E. 5. Analyze the output for both sets of data, be certain to evaluate and discuss the statistical significance of the slope (b in the equation y = a +bx) and the coefficient of determination (r). Use a 10 % (.10 ) level of significance for each variable. (Include all statistical computer output in your report.) D. IS THE BOND RATING ACCURATE? Read the definition of the rating given to the bond you are analyzing and compare it to your findings in A - C with the objective of determining if the bond rating is accurate. Be certain to draw on the information you have presented in B. for this section of the paper. Calculate and interpret, for your bond, the current and modified duration. (Include the spreadsheet output in your report.) INTEREST RATE FORECAST FOR ONE YEAR (12 Months) (INTEREST RATE RISK, REINVESTMENT RISK) 2. 1. Utilizing citable resources present succinctly (one or two paragraphs is sufficient) "your" outlook for interest rate levels over the next 12 months. (I am not looking for a month-to-month forecast rather I am interested in the trend for interest rates and levels at the end of one year+ [December 2018] for the type [i.e., bond rating, years remaining until maturity] of instrument you are evaluating.) Let me emphasize that I am not requiring you personally to forecast interest rates. Likewise, I am not telling you that you cannot should you so desire, but rather to extract from topical information in current periodicals, web sites, and other media sources what the "experts" are forecasting. (Please be certain to properly footnote these sources.) 3. A starting point is to calculate the difference between the most recent YTM on your risk class of bond, based on the bond rating reference listed in MERGENT's market averages, and the risk free rate on a treasury security (bond, note, or treasury bill) of a similar term to maturity. Take this marginal difference and apply it to the forecast for treasury security rates, in one year, as an estimate for interest rates on your risk class of bond. (For example, if the bond you are evaluating is an A Rated Bond and it has 20 years remaining until it matures then the AYTMMARKET A RATED BOND AUGUST 2016 - YTM RISK FREE LT GOVERNMENT BOND AUGUST 2016) The reason you are relating the forecast to federal government risk free securities, is that these risk free securities are the instruments you are most likely to find forecasted information about in topical publications, TV reports and web sites, for one year from now in 2018. F. 4. 5. Calculate the APrice for the bond, given your forecasted interest rate change, utilizing, from C.5, information for the modified duration. If the results of your regression are statistically significant, C.3.b.3), use the equation along with an estimate for the independent variable, E.1, to forecast the YTM one year from now for your corporate bond. Interpret the results, do they make sense? Why? SUMMARY Based on all your information in sections A - E, would you buy this bond? Briefly discuss why or why not.

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Here is a draft response addressing the queries related to evaluating a corporate bond using the Yahoo Finance URL content A GENERAL BOND AND INVESTOR ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started