Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. You observe that six month T-bills trade at 6.0% in Italy and 8.0% in Greece. As well, annual inflation expectations are 4% in

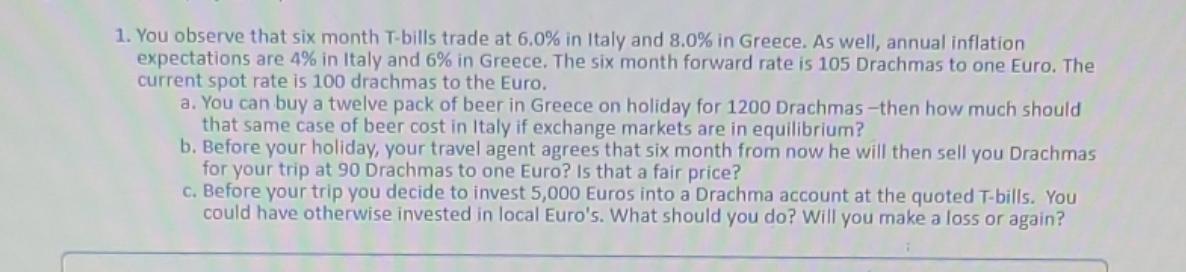

1. You observe that six month T-bills trade at 6.0% in Italy and 8.0% in Greece. As well, annual inflation expectations are 4% in Italy and 6% in Greece. The six month forward rate is 105 Drachmas to one Euro. The current spot rate is 100 drachmas to the Euro. a. You can buy a twelve pack of beer in Greece on holiday for 1200 Drachmas-then how much should that same case of beer cost in Italy if exchange markets are in equilibrium? b. Before your holiday, your travel agent agrees that six month from now he will then sell you Drachmas for your trip at 90 Drachmas to one Euro? Is that a fair price? c. Before your trip you decide to invest 5,000 Euros into a Drachma account at the quoted T-bills. You could have otherwise invested in local Euro's. What should you do? Will you make a loss or again?

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a To compare prices of the beer in Italy and Greece we need to adjust for the exchange rate and the inflation differential between the two co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started