Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. You want to build a CRR binomial model to value options on Moderna (MRNA). The current stock price of MRNA is 310.20. Assume

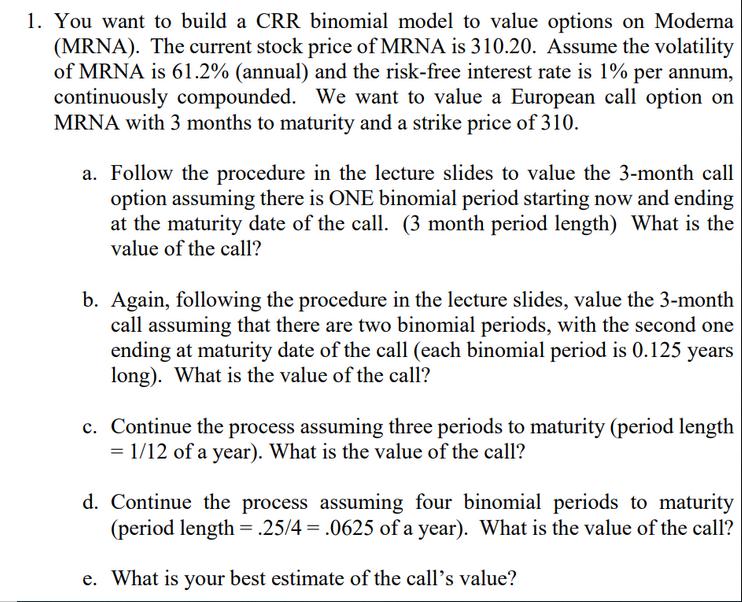

1. You want to build a CRR binomial model to value options on Moderna (MRNA). The current stock price of MRNA is 310.20. Assume the volatility of MRNA is 61.2% (annual) and the risk-free interest rate is 1% per annum, continuously compounded. We want to value a European call option on MRNA with 3 months to maturity and a strike price of 310. a. Follow the procedure in the lecture slides to value the 3-month call option assuming there is ONE binomial period starting now and ending at the maturity date of the call. (3 month period length) What is the value of the call? b. Again, following the procedure in the lecture slides, value the 3-month call assuming that there are two binomial periods, with the second one ending at maturity date of the call (each binomial period is 0.125 years long). What is the value of the call? c. Continue the process assuming three periods to maturity (period length = 1/12 of a year). What is the value of the call? d. Continue the process assuming four binomial periods to maturity (period length = .25/4 = .0625 of a year). What is the value of the call? e. What is your best estimate of the call's value?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Valuing a European Call Option on MRNA using CRR Model We can value the European call option on MRNA using the CoxRossRubinstein CRR binomial model wi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started