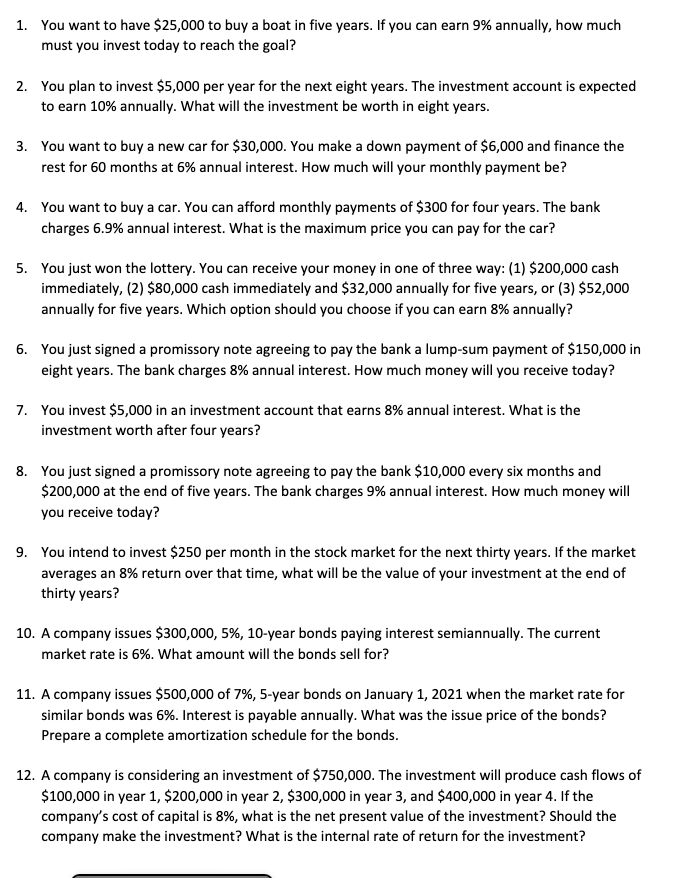

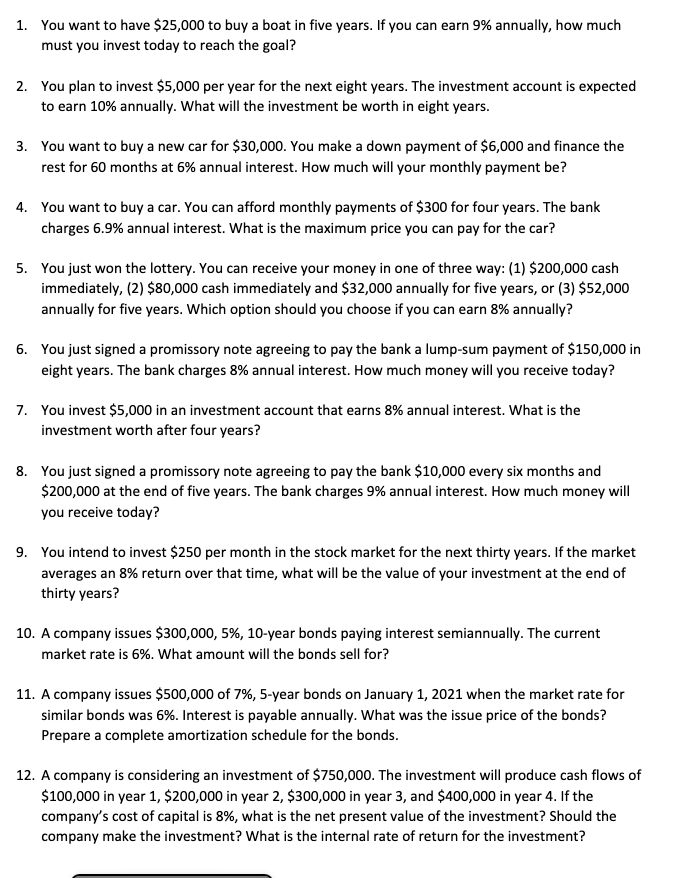

1. You want to have $25,000 to buy a boat in five years. If you can earn 9% annually, how much must you invest today to reach the goal? 2. You plan to invest $5,000 per year for the next eight years. The investment account is expected to earn 10% annually. What will the investment be worth in eight years. 3. You want to buy a new car for $30,000. You make a down payment of $6,000 and finance the rest for 60 months at 6% annual interest. How much will your monthly payment be? 4. You want to buy a car. You can afford monthly payments of $300 for four years. The bank charges 6.9% annual interest. What is the maximum price you can pay for the car? 5. You just won the lottery. You can receive your money in one of three way: (1) $200,000 cash immediately, (2) $80,000 cash immediately and $32,000 annually for five years, or (3) $52,000 annually for five years. Which option should you choose if you can earn 8% annually? 6. You just signed a promissory note agreeing to pay the bank a lump-sum payment of $150,000 in eight years. The bank charges 8% annual interest. How much money will you receive today? 7. You invest $5,000 in an investment account that earns 8% annual interest. What is the investment worth after four years? 8. You just signed a promissory note agreeing to pay the bank $10,000 every six months and $200,000 at the end of five years. The bank charges 9% annual interest. How much money will you receive today? 9. You intend to invest $250 per month in the stock market for the next thirty years. If the market averages an 8% return over that time, what will be the value of your investment at the end of thirty years? 10. A company issues $300,000, 5%, 10-year bonds paying interest semiannually. The current market rate is 6%. What amount will the bonds sell for? 11. A company issues $500,000 of 7%, 5-year bonds on January 1, 2021 when the market rate for similar bonds was 6%. Interest is payable annually. What was the issue price of the bonds? Prepare a complete amortization schedule for the bonds. 12. A company is considering an investment of $750,000. The investment will produce cash flows of $100,000 in year 1, $200,000 in year 2, $300,000 in year 3, and $400,000 in year 4. If the company's cost of capital is 8%, what is the net present value of the investment? Should the company make the investment? What is the internal rate of return for the investment