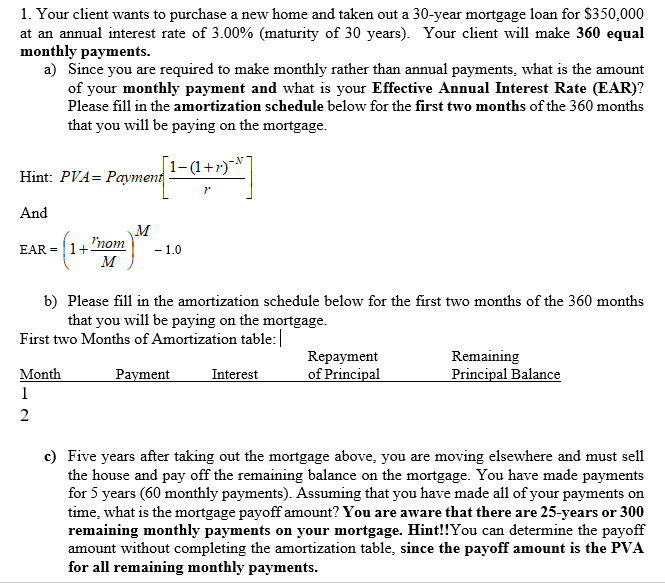

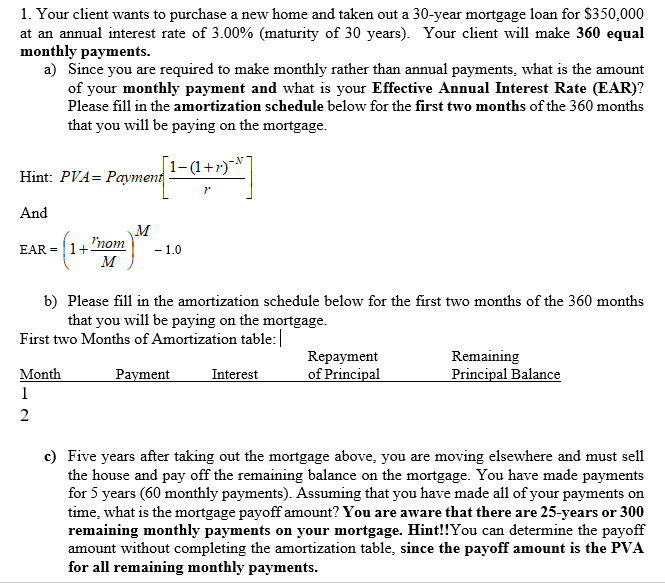

1. Your client wants to purchase a new home and taken out a 30-year mortgage loan for $350,000 at an annual interest rate of 3.00% (maturity of 30 years). Your client will make 360 equal monthly payments. a) Since you are required to make monthly rather than annual payments, what is the amount of your monthly payment and what is your Effective Annual Interest Rate (EAR)? Please fill in the amortization schedule below for the first two months of the 360 months that you will be paying on the mortgage. 1-(1+r)^ Hint: PVA= Payment 7" And M M EAR = 1+ inom M - 1.0 b) Please fill in the amortization schedule below for the first two months of the 360 months that you will be paying on the mortgage. First two Months of Amortization table:|| Repayment Remaining Month Payment Interest of Principal Principal Balance 1 2 c) Five years after taking out the mortgage above, you are moving elsewhere and must sell the house and pay off the remaining balance on the mortgage. You have made payments for 5 years (60 monthly payments). Assuming that you have made all of your payments on time, what is the mortgage payoff amount? You are aware that there are 25-years or 300 remaining monthly payments on your mortgage. Hint!!You can determine the payoff amount without completing the amortization table, since the payoff amount is the PVA for all remaining monthly payments. 1. Your client wants to purchase a new home and taken out a 30-year mortgage loan for $350,000 at an annual interest rate of 3.00% (maturity of 30 years). Your client will make 360 equal monthly payments. a) Since you are required to make monthly rather than annual payments, what is the amount of your monthly payment and what is your Effective Annual Interest Rate (EAR)? Please fill in the amortization schedule below for the first two months of the 360 months that you will be paying on the mortgage. 1-(1+r)^ Hint: PVA= Payment 7" And M M EAR = 1+ inom M - 1.0 b) Please fill in the amortization schedule below for the first two months of the 360 months that you will be paying on the mortgage. First two Months of Amortization table:|| Repayment Remaining Month Payment Interest of Principal Principal Balance 1 2 c) Five years after taking out the mortgage above, you are moving elsewhere and must sell the house and pay off the remaining balance on the mortgage. You have made payments for 5 years (60 monthly payments). Assuming that you have made all of your payments on time, what is the mortgage payoff amount? You are aware that there are 25-years or 300 remaining monthly payments on your mortgage. Hint!!You can determine the payoff amount without completing the amortization table, since the payoff amount is the PVA for all remaining monthly payments