Question

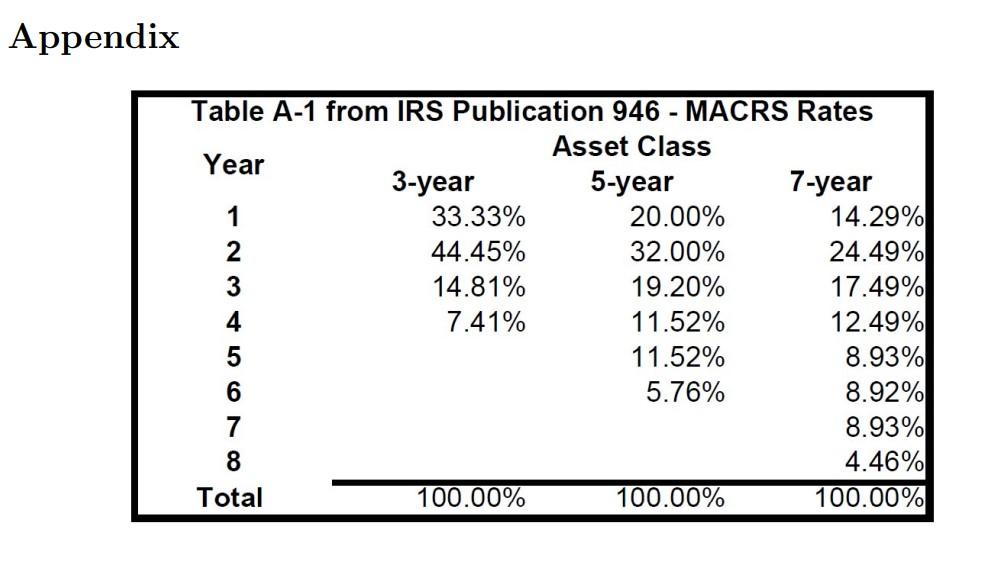

1. Your firm is considering the purchase of a new inventory management system, which is anticipated to cost $1,150,000. The system will be depreciated using

1. Your firm is considering the purchase of a new inventory management system, which is anticipated to cost $1,150,000. The system will be depreciated using the five year MACRS depreciation method (see the appendix). It is anticipated that the system will have a salvage value of $125,000 at the end of that time. You are expected to reduce inventory handling costs by $410,000 before taxes each year, and you will reduce working capital by $133,000 (one-time reduction) due to the increased inventory efficiencies. Assuming a marginal tax rate of 40% and a discount rate (risk-adjusted cost of capital) of 16%, should you purchase the new system? Assume that changes in working capital at the beginning of the project will reverse at the time of sale. Be sure to calculate the NPV, IRR, MIRR, payback, discounted payback, and BCR.

2. Your firm is evaluating a new robotic lathe for machining custom materials that will cost $495,000 to purchase, modify, and install. It is considered to be a four year project, and it falls into the five-year MACRS classification (see the appendix). The project is expected to produce an annual cost reduction of $185,000. The anticipated salvage value of the machine at the end of the four year project is $50,000. Because this machine is unlike all of the other equipment used by your firm, implementing this project will require an additional initial investment of $12,000 in spare parts, with an additional $5,000 of maintenance expenses in each following year. Assume that the original investment in working capital will be recaptured at the end of the projects life. Assuming a marginal tax rate of 40% and a discount rate (risk-adjusted cost of capital) of 16%, should you purchase the new system? Be sure to calculate the NPV, IRR, MIRR, payback, discounted payback, and BCR.

3. After studying the possible alternatives, management has requested that you perform an analysis of an investment opportunity. The investment opportunity entails investing in a new electricity generator to replace the old one currently in use. The new machine costs $40 million, is expected to have a four-year life, and is expected to save the company $7.25 million in reduced energy costs per year due to its higher efficiency and electricity output (relative to the old machine). The new machine will also require a $1 million increase in net working capital. Assume that the investment in working capital will be recaptured at the end of the new machines life. The old generator, which is anticipated to have an additional four years of life remaining, has a current book value of $10 million, and a market value of $12 million. Assume that neither project has any salvage value at the end of year four, and that the marginal tax rate is 35%. If the discount rate (risk-adjusted cost of capital) is 9%, should you purchase the new system? Be sure to calculate the NPV, IRR, MIRR, payback, discounted payback, and BCR. Utilize straight-line depreciation for both machines.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started