1. Your parents will retire in 18 years. They currently have $390,000 saved, and they think they will need $2,200,000 at retirement. What annual interest rate must they earn to reach their goal, assuming they don't save any additional funds? Round your answer to two decimal places.

2. You have $17,361.54 in a brokerage account, and you plan to deposit an additional $5,000 at the end of every future year until your account totals $220,000. You expect to earn 14% annually on the account. How many years will it take to reach your goal? Round your answer to the nearest whole number.

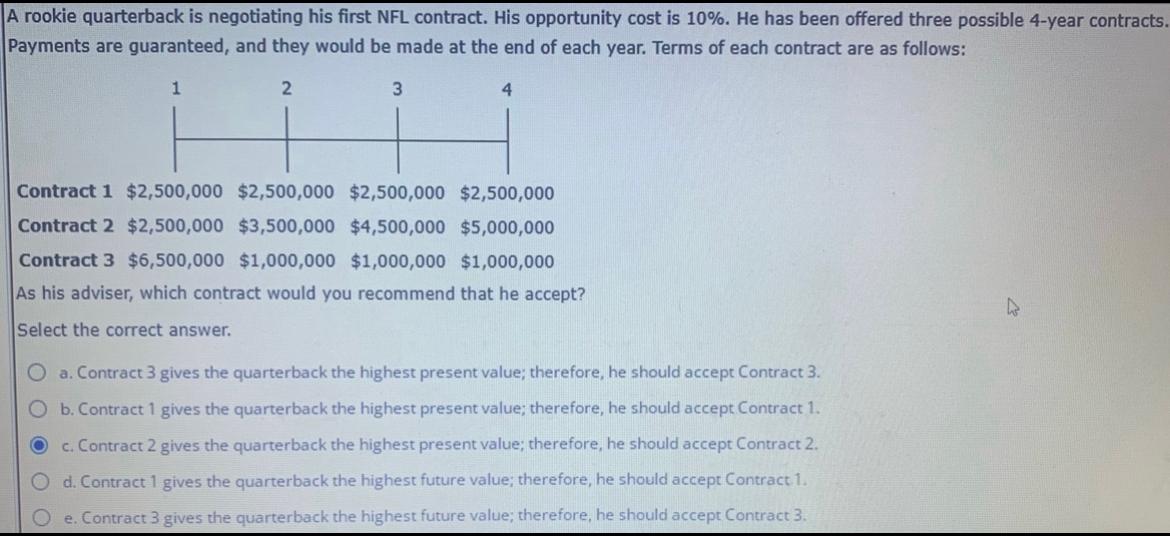

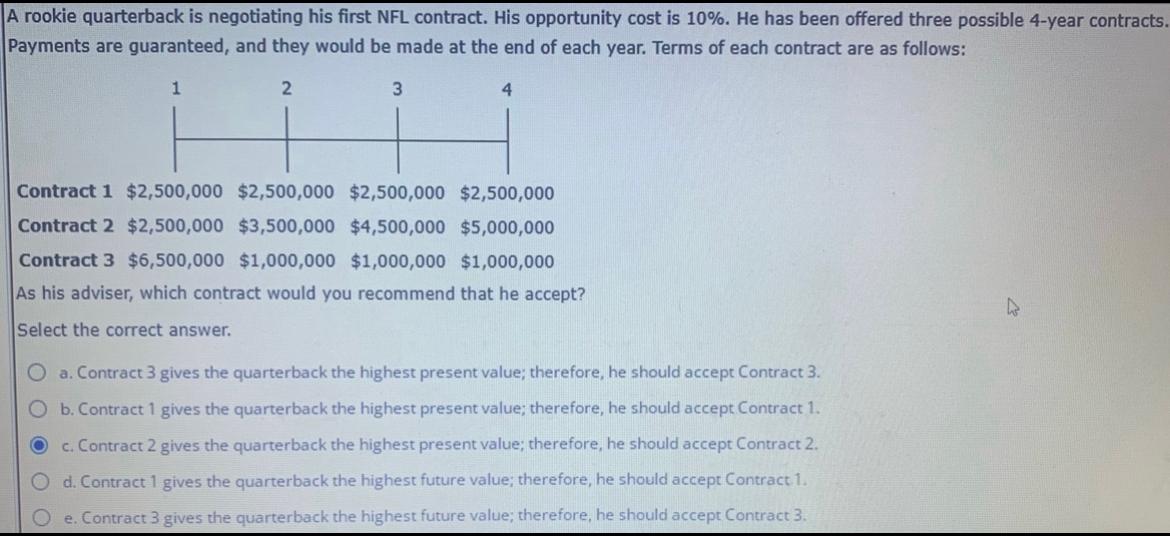

Your client is 20 years old. She wants to begin saving for retirement, with the first payment to come one year from now. She can save $4,000 per year, and you advise her to invest it in the stock market, which you expect to provide an average return of 9% in the future. a. If she follows your advice, how much money will she have at 65? Do not round intermediate calculations. Round your answer to the nearest cent. b. How much will she have at 70? Do not round intermediate calculations. Round your answer to the nearest cent. $ c. She expects to live for 20 years if she retires at 65 and for 15 years if she retires at 70. If her investments continue to earn the same rate, how much will she be able to withdraw at the end of each year after retirement at each retirement age? Do not round intermediate calculations. Round your answers to the nearest cent. Annual withdrawals if she retires at 65: $ Annual withdrawals if she retires at 70: $ A rookie quarterback is negotiating his first NFL contract. His opportunity cost is 10%. He has been offered three possible 4-year contracts. Payments are guaranteed, and they would be made at the end of each year. Terms of each contract are as follows: 1 2 3 Contract 1 $2,500,000 $2,500,000 $2,500,000 $2,500,000 Contract 2 $2,500,000 $3,500,000 $4,500,000 $5,000,000 Contract 3 $6,500,000 $1,000,000 $1,000,000 $1,000,000 As his adviser, which contract would you recommend that he accept? Select the correct answer. O a. Contract 3 gives the quarterback the highest present value; therefore, he should accept Contract 3. b. Contract 1 gives the quarterback the highest present value; therefore, he should accept Contract 1. c. Contract 2 gives the quarterback the highest present value; therefore, he should accept Contract 2 d. Contract 1 gives the quarterback the highest future value; therefore, he should accept Contract 1. O e. Contract 3 gives the quarterback the highest future value; therefore, he should accept Contract 3