Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. You're now holding a $10,000 bond that matures in 2030. The bond comes with 12% coupons and just cost you $12,700.... a. Confirm

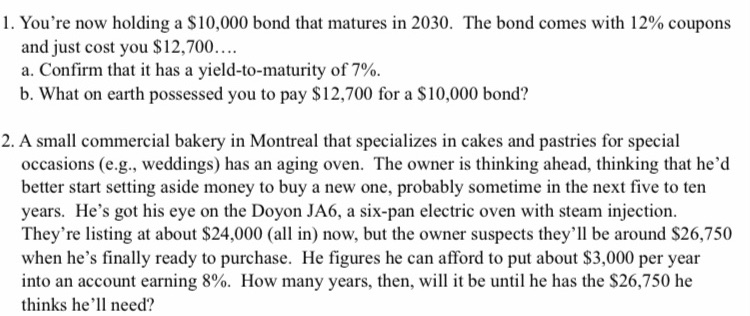

1. You're now holding a $10,000 bond that matures in 2030. The bond comes with 12% coupons and just cost you $12,700.... a. Confirm that it has a yield-to-maturity of 7%. b. What on earth possessed you to pay $12,700 for a $10,000 bond? 2. A small commercial bakery in Montreal that specializes in cakes and pastries for special occasions (e.g., weddings) has an aging oven. The owner is thinking ahead, thinking that he'd better start setting aside money to buy a new one, probably sometime in the next five to ten years. He's got his eye on the Doyon JA6, a six-pan electric oven with steam injection. They're listing at about $24,000 (all in) now, but the owner suspects they'll be around $26,750 when he's finally ready to purchase. He figures he can afford to put about $3,000 per year into an account earning 8%. How many years, then, will it be until he has the $26,750 he thinks he'll need?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To confirm whether the bond has a yieldtomaturity YTM of 7 we need to calculate the present value of the bonds future cash flows and compare it to t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started