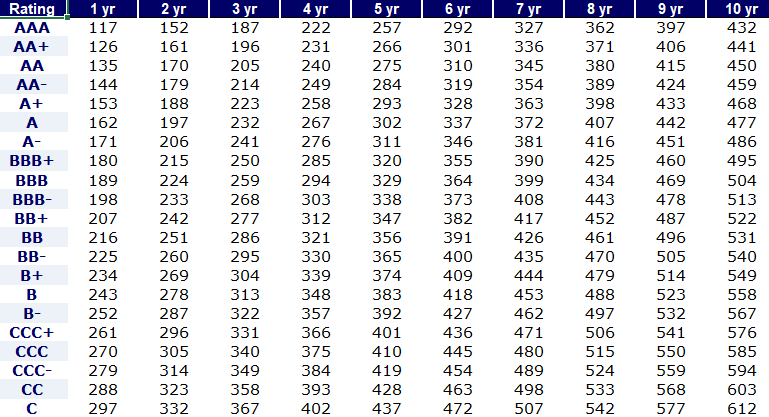

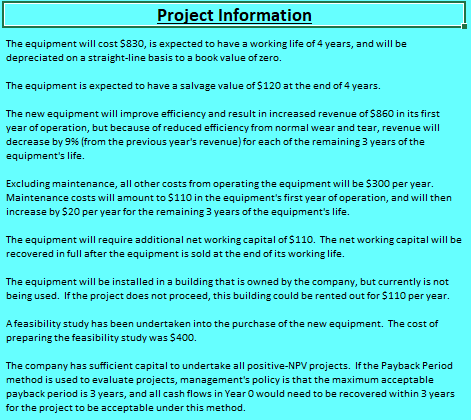

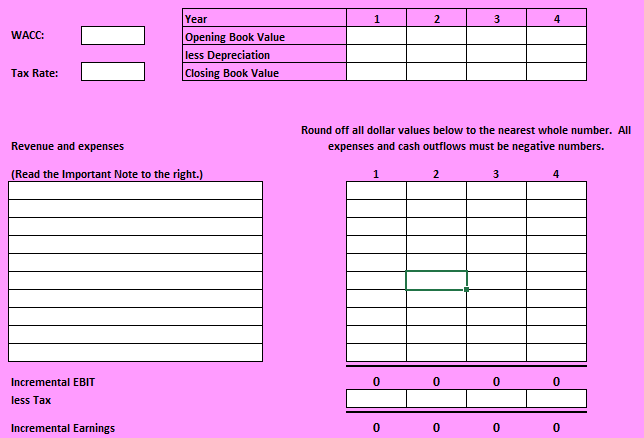

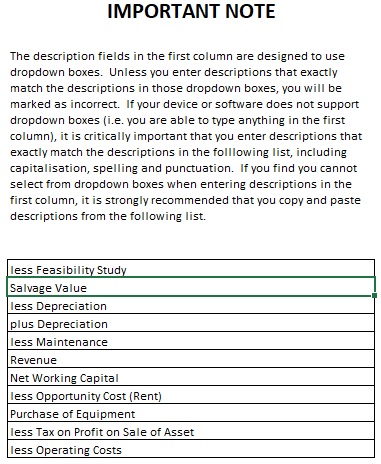

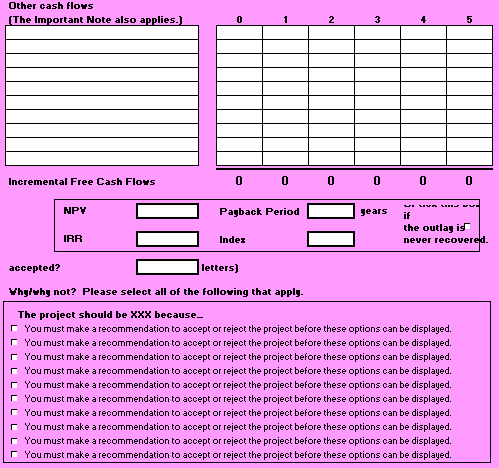

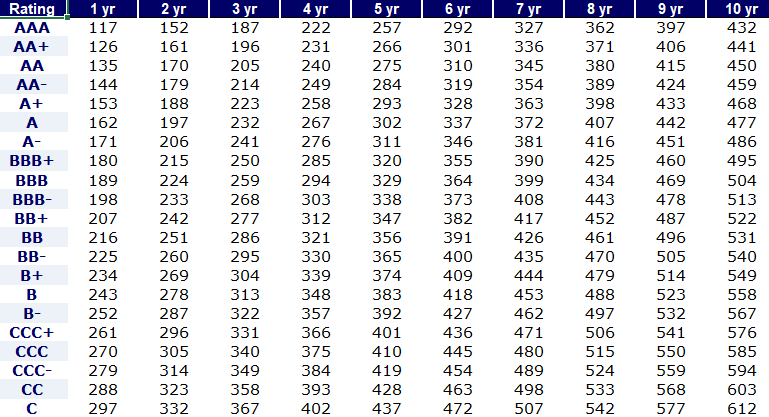

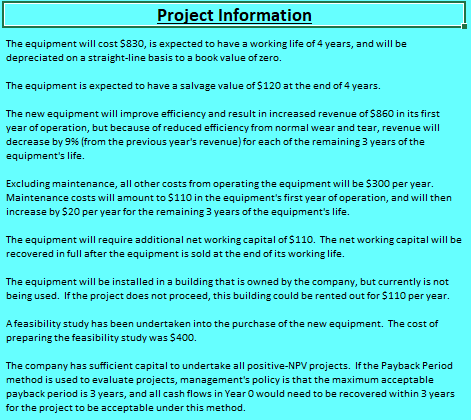

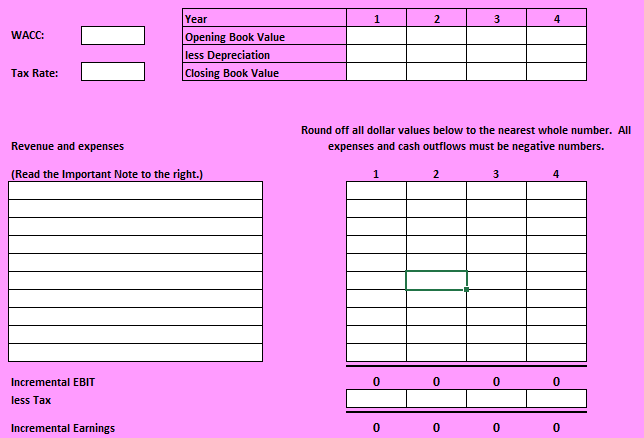

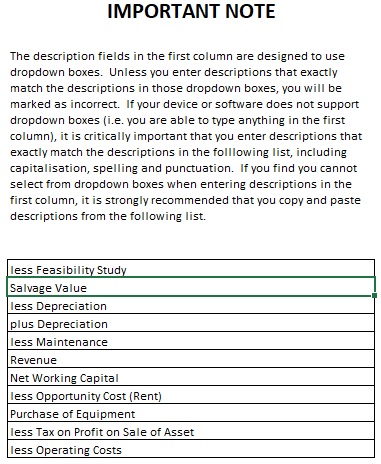

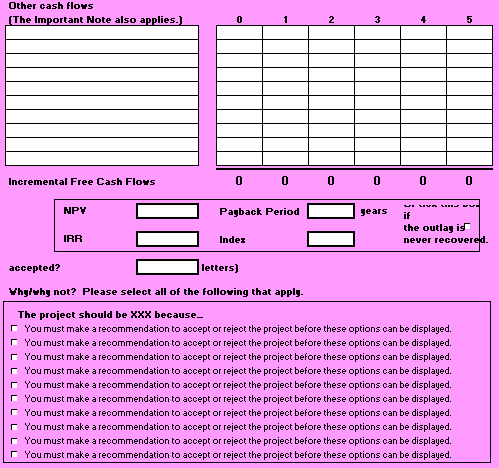

1 yr 4 6 yr 7 yr 8 10 yr Rating AA+ AA- A+ A - BBB+ BBB- BB+ BB- + B - CCC+ CCC- 117 126 135 144 153 162 171 180 189 198 207 216 225 234 243 252 261 270 279 288 297 2 yr 152 161 170 179 188 197 206 215 224 233 242 251 260 269 278 287 296 305 314 323 332 187 196 205 214 223 232 241 250 259 268 277 286 295 304 313 322 331 340 349 358 367 222 231 240 249 258 267 276 285 294 303 312 321 330 339 348 357 366 375 384 393 402 5 yr 257 266 275 284 293 302 311 320 329 338 347 356 365 374 383 392 401 410 419 428 437 292 301 310 319 328 337 346 355 364 373 382 391 400 409 418 427 436 445 454 463 472 327 336 345 354 363 372 381 390 399 408 417 426 435 444 453 462 471 480 489 498 507 362 371 380 389 398 407 416 425 434 443 452 461 470 479 488 497 506 515 524 533 542 9 yr 397 406 415 424 433 442 451 460 469 478 487 496 505 514 523 532 541 550 559 568 577 432 441 450 459 468 477 486 495 504 513 522 531 540 549 558 567 576 585 594 603 612 Project Information The equipment will cost $830, is expected to have a working life of 4 years, and will be depreciated on a straight-line basis to a book value of zero. The equipment is expected to have a salvage value of $120 at the end of 4 years. The new equipment will improve efficiency and result in increased revenue of $860 in its first year of operation, but because of reduced efficiency from normal wear and tear, revenue will decrease by 9% (from the previous year's revenue) for each of the remaining 3 years of the equipment's life. Excluding maintenance, all other costs from operating the equipment will be $300 per year. Maintenance costs will amount to $110 in the equipment's first year of operation, and will then increase by $20 per year for the remaining 3 years of the equipment's life. The equipment will require additional networking capital of $110. The networking capital will be recovered in full after the equipment is sold at the end of its working life. The equipment will be installed in a building that is owned by the company, but currently is not being used. If the project does not proceed, this building could be rented out for $110 per year. A feasibility study has been undertaken into the purchase of the new equipment. The cost of preparing the feasibility study was $400. The company has sufficient capital to undertake all positive-NPV projects. If the Payback Period method is used to evaluate projects, management's policy is that the maximum acceptable payback period is 3 years, and all cash flows in Year Owould need to be recovered within 3 years for the project to be acceptable under this method. 1 2 3 4 WACC: Year Opening Book Value less Depreciation Closing Book Value Tax Rate: Revenue and expenses Round off all dollar values below to the nearest whole number. All expenses and cash outflows must be negative numbers. (Read the important Note to the right.) 1 2 3 0 0 0 Incremental EBIT less Tax Incremental Earnings 0 0 O 0 IMPORTANT NOTE The description fields in the first column are designed to use dropdown boxes. Unless you enter descriptions that exactly match the descriptions in those dropdown boxes, you will be marked as incorrect. If your device or software does not support dropdown boxes (i.e. you are able to type anything in the first column), it is critically important that you enter descriptions that exactly match the descriptions in the folllowing list, including capitalisation, spelling and punctuation. If you find you cannot select from dropdown boxes when entering descriptions in the first column, it is strongly recommended that you copy and paste descriptions from the following list. less Feasibility Study Salvage Value less Depreciation plus Depreciation less Maintenance Revenue Net Working Capital less Opportunity Cost (Rent) Purchase of Equipment less Tax on Profit on Sale of Asset less Operating costs Other cash floys (The Important Note also applies.) 0 2 3 5 Incremental Free Cash Flors 0 0 0 0 0 0 NPY Payback Period gears V. VA VUL if the outlay is never recovered. IRR Index accepted? letters) Vhy/vhy not? Please select all of the following that apply. The project should be XXX because- You must make a recommendation to accept or reject the project before these options can be displayed. You must make a recommendation to accept or reject the project before these options can be displayed. You must make a recommendation to accept or reject the project before these options can be displayed. You must make a recommendation to accept or reject the project before these options can be displayed. You must make a recommendation to accept or reject the project before these options can be displayed. You must make a recommendation to accept or reject the project before these options can be displayed. You must make a recommendation to accept or reject the project before these options can be displayed. You must make a recommendation to accept or reject the project before these options can be displayed. You must make a recommendation to accept or reject the project before these options can be displayed. You must make a recommendation to accept or reject the project before these options can be displayed