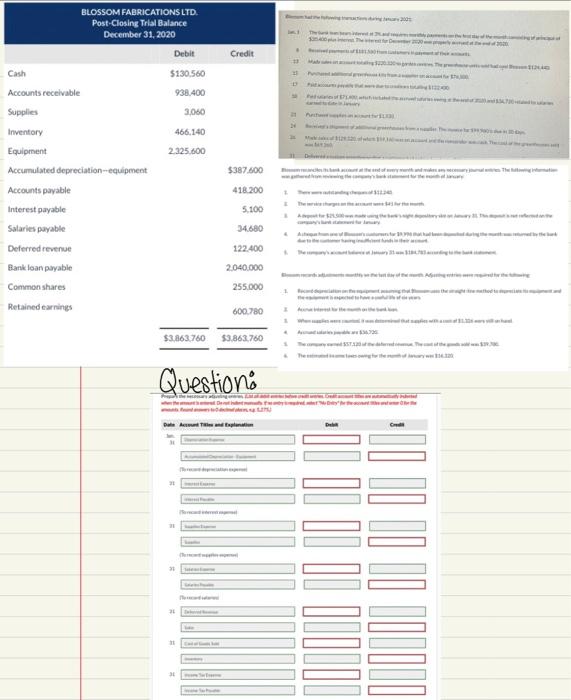

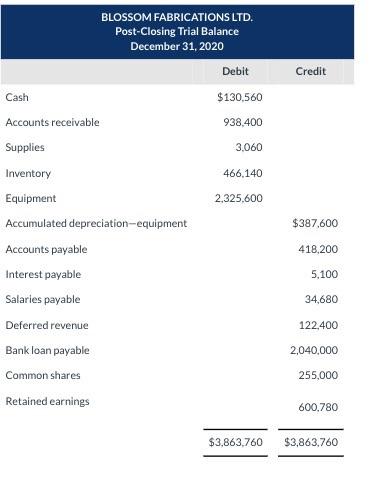

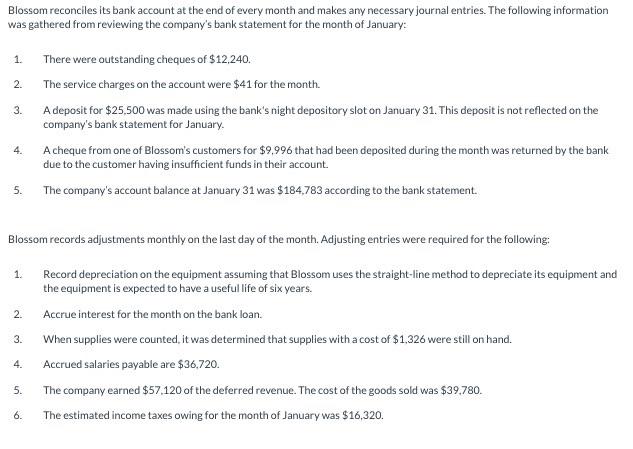

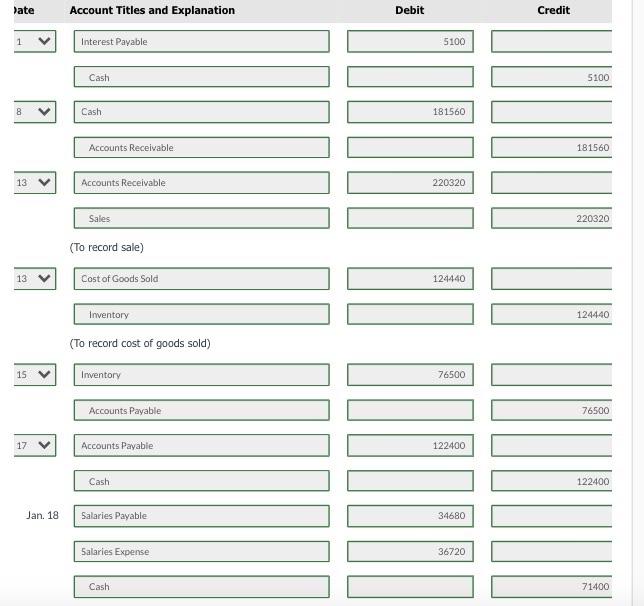

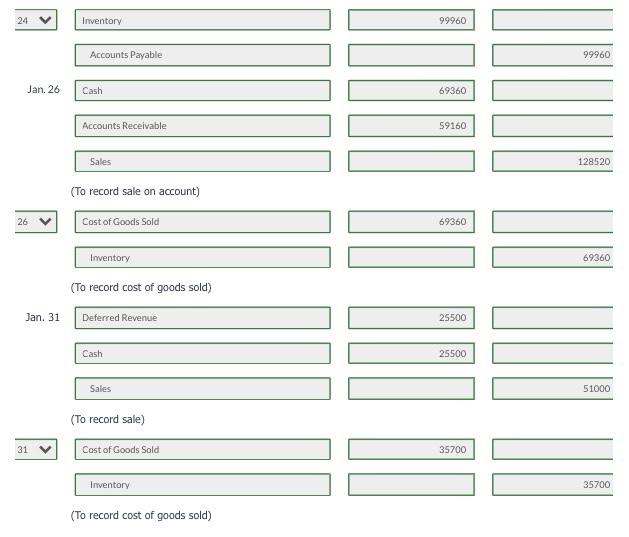

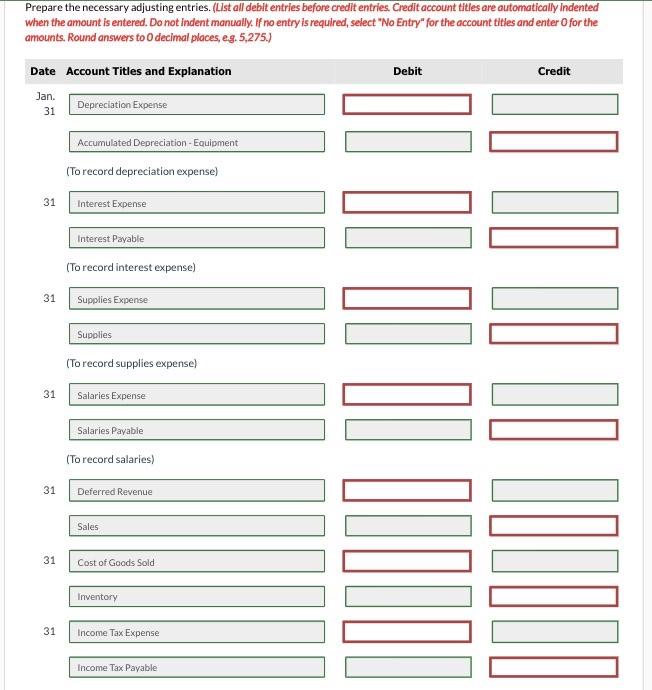

1. Yuestionio BLOSSOMFABRICATIONSLTD. Post-Closing Trial Balance December 31, 2020 Blossom reconciles its bank account at the end of every month and makes any necessary journal entries. The following information was gathered from reviewing the company's bank statement for the month of January: 1. There were outstanding cheques of $12,240. 2. The service charges on the account were $41 for the month. 3. A deposit for $25,500 was made using the bank's night depository slot on January 31 . This deposit is not reflected on the company's bank statement for January. 4. A cheque from one of Blossom's customers for $9,996 that had been deposited during the month was returned by the bank due to the customer having insufficient funds in their account. 5. The company's account balance at January 31 was $184,783 according to the bank statement. Blossom records adjustments monthly on the last day of the month. Adjusting entries were required for the following: 1. Record depreciation on the equipment assuming that Blossom uses the straight-line method to depreciate its equipment and the equipment is expected to have a useful life of six years. 2. Accrue interest for the month on the bank loan. 3. When supplies were counted, it was determined that supplies with a cost of $1,326 were still on hand. 4. Accrued salaries payable are $36,720. 5. The company earned $57,120 of the deferred revenue. The cost of the goods soid was $39,780. 6. The estimated income taxes owing for the month of January was $16,320. late Account Titles and Explanation Debit Credit 1 Interest Payable \begin{tabular}{|l|} \hline \\ \hline \end{tabular} 8V Cash \begin{tabular}{|r|} \hline 181560 \\ \hline \end{tabular} Accounts Receivable. 5100 13 Accounts Receivable 220320 181560220320 (To record sale) Cost of Goods Sold \begin{tabular}{|l|} \hline 124440 \\ \hline \end{tabular} Imventory (To record cost of goods sold) 15V Inventory \begin{tabular}{|r|} \hline 76500 \\ \hline \end{tabular} Accounts Payable 124440 Jan. 18 Accounts Payable 122400 76500 Cash 122400 Salaries Payable \begin{tabular}{|l|} \hline 34680 \\ \hline \end{tabular} Salaries Expense 36720 Cash Inventory \begin{tabular}{|r|} \hline 99960 \\ \hline \end{tabular} Accounts Payable Jan. 26 Cash 69360 Accounts Receivable 59160 Sales (To record sale on account) Cost of Goods Sold 69360 Inventory (To record cost of goods sold) Jan. 31 Deferred Revenue 25500 Cash 25500 Sales (To record sale) 31 Cost of Goods Sold \begin{tabular}{|l|} \hline 35700 \\ \hline \end{tabular} Inventory (To record cost of goods sold) Prepare the necessary adjusting entries. (List all debit entries before credit entries. Credit account titles are outomatically indented when the amount is antered. Do not indent manuallu. If no entrvis rearilred. colert "No Fintru" for the arcount fitles and anter 0 for the