Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Zachary Fox does not make any voluntary deductions that impact eamings subject to federal income tax withholding or FICA taxes. He has authorized

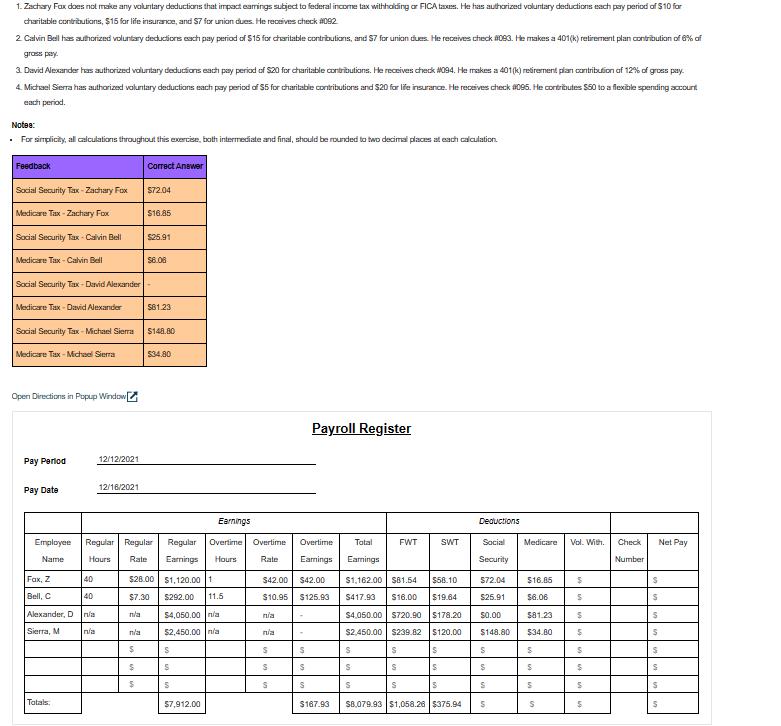

1. Zachary Fox does not make any voluntary deductions that impact eamings subject to federal income tax withholding or FICA taxes. He has authorized voluntary deductions each pay period of $10 for charitable contributions, $15 for life insurance, and $7 for union dues. He receives check #092 2. Calvin Bell has authorized voluntary deductions each pay period of $15 for charitable contributions, and $7 for union dues. He receives check #093. He makes a 401(k) retirement plan contribution of 6% of gross pay. 3. David Alexander has authorized voluntary deductions each pay period of $20 for charitable contributions. He receives check #094. He makes a 401(k) retirement plan contribution of 12% of gross pay. 4. Michael Sierra has authorized voluntary deductions each pay period of $5 for charitable contributions and $20 for life insurance. He receives check #095. He contributes $50 to a flexible spending account each period. Notes: . For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. Feedback Social Security Tax-Zachary Fox Medicare Tax-Zachary Fox Social Security Tax - Calvin Bell Medicare Tax- Calvin Bell Social Security Tax-David Alexander Medicare Tax David Alexander Social Security Tax-Michael Sierra Medicare Tax - Michael Sierra Open Directions in Popup Window Pay Period Pay Date Employee Name Fax, Z Bell, C 40 40 Alexander, D n/a Sierra, M Totals 12/12/2021 n/a 12/18/2021 Correct Answer n/a $72.04 $ $ $ $16.85 $25.91 $6.08 581.23 Regular Regular Hours Rate $148.80 534.80 Regular Overtime Overtime Earnings Hours Rate $28.00 $1,120.00 1 $7.30 $292.00 11.5 n/a $4,050.00 n/a $2,450.00 n/a S $ S Earnings 57,912.00 n/a nia S S S Payroll Register Overtime Total Earnings Earnings $ $ S $42.00 $42.00 $1,162.00 $81.54 $58.10 $10.95 $125.93 $417.93 $16.00 $19.64 $25.91 $4,050.00 $720.90 $178.20 $0.00 $2,450.00 $239.82 $120.00 $148.80 $ S S S FWT S $ S SWT S $167.93 $8,079.93 $1,058.26 $375.94 S Deductions Social Medicare Security $72.04 $16.85 $6.06 $81.23 $34.80 S $ S S S S S S Vol. With. $ S $ $ $ $ S $ Check Number Net Pay $ S $ S $ S $ S

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Here are the calculations for payroll taxes Zachary Fox Gross Pay 53480 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started