Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Zahner Corporation manufactures housewares products that are sold through a network of external agents. The agents are paid a commission of 20% of revenues.

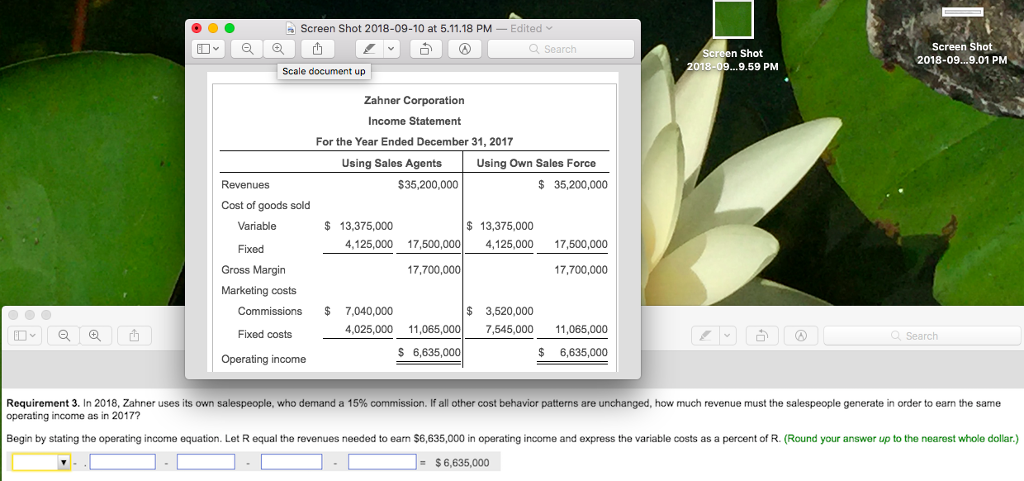

1. Zahner Corporation manufactures housewares products that are sold through a network of external agents. The agents are paid a commission of 20% of revenues. Zahner is considering replacing the sales agents with its own salespeople, who would be paid a commission of 10% of revenues and total salaries of $3,520,000. The income statement for the year ending December 31, 2017, under the two scenarios is shown here.

Screen Shot 2018-09-10 at 5.11.18 PM -Edited Screen Shot 2018-09...9.01 PM Q Search Shot 8-09 .9.59 PM Scale document up Zahner Corporation Income Statement For the Year Ended December 31, 2017 Using Salos Agents Using Own Sales Force Revenues 35,200,000 $ 35,200,000 Cost of goods sold Variable 13,375,000 13,375,000 4,125,000 17,500,0004,125,000 17,500,000 Fixed Gross Margin Marketing costs 17,700,000 17,700,000 Commissions 7,040,000 $ 3,520,000 Fixed costs 4,025,000 11,065,0007,545,000 11,065,000 Q Search S 6,635,000 $ 6,635,000 Operating income Requirement 3. In 2018, Zahner uses its own salespeople, who demand a 15% commission. If all other cost behavior patterns are unchanged, how much revenue must the salespeople generate in order to earn the same operating income as in 2017? Begin by stating the operating income equation. Let R equal the revenues needed to earn $6,635,000 in operating income and express the variable costs as a percent of R.(Round your answer up to the nearest whole dollar.) $6,635,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started