10)

11)

12)

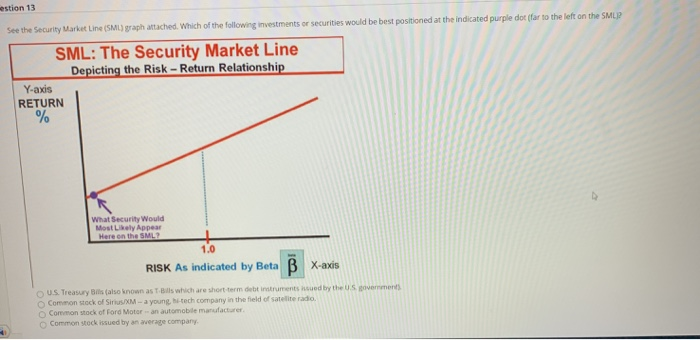

13)

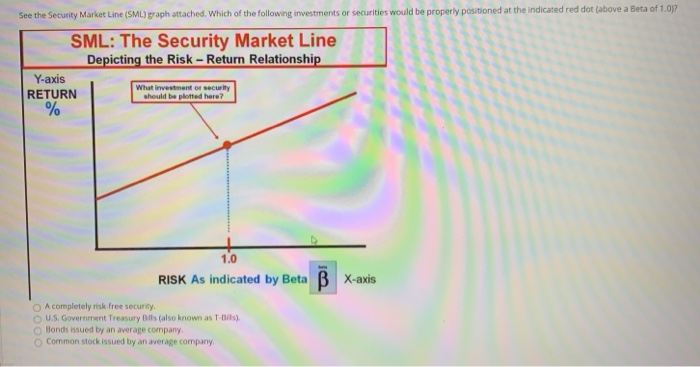

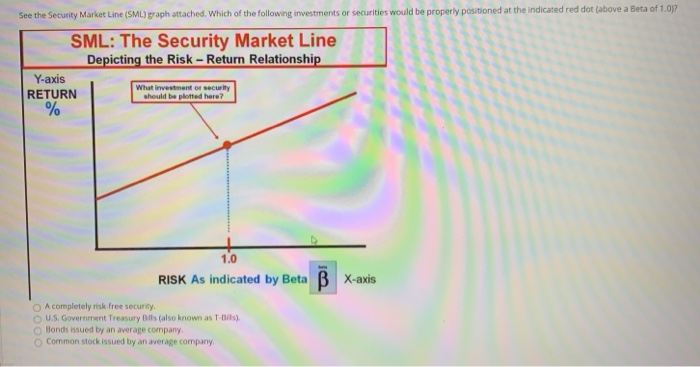

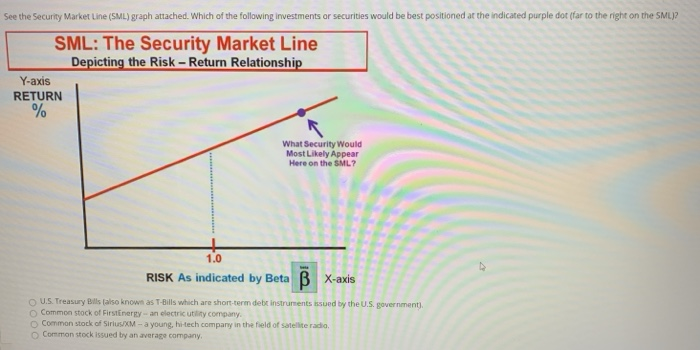

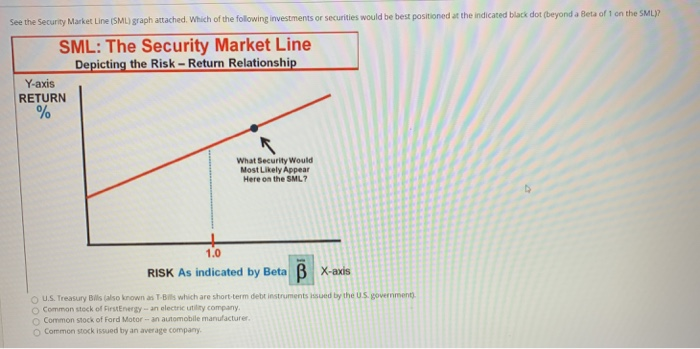

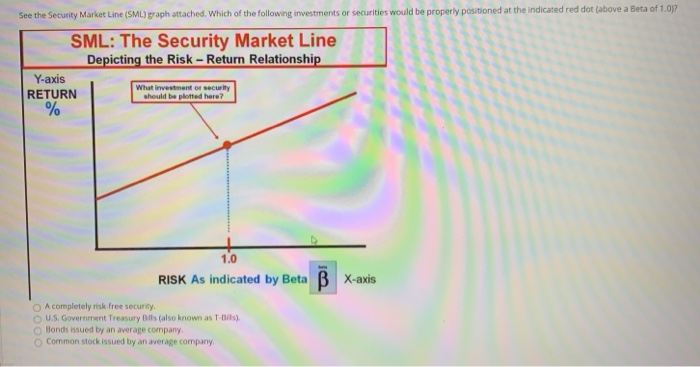

See the Security Market Line (SML) graph attached. Which of the following investments or securities would be properly positioned at the indicated red dot (above a Beta of 1.012 SML: The Security Market Line Depicting the Risk - Return Relationship Y-axis What investment of security RETURN should be plotted here? % 1.0 RISK As indicated by Beta B X-axis A completely risk free security U.S. Government Treasury Bits (also known as T.Bits). Bonds issued by an average company Common stock issued by an average company See the Security Market Line (SML) graph attached. Which of the following investments or securities would be best positioned at the indicated purple dot (far to the right on the SML)? SML: The Security Market Line Depicting the Risk - Return Relationship Y-axis RETURN % What Security Would Most Likely Appear Here on the SML? 1.0 RISK As indicated by Beta B X-axis U.S. Treasury Bills (also known as T-bills which are short-term debt instruments issued by the U.S. government) Common stock of FirstEnerity- an electric utility company Common stock of SiriusXM - a young, hi-tech company in the field of satellite radio Common stock issued by an average company See the Security Market Line (SML) graph attached. Which of the following investments or securities would be best positioned at the indicated black dot (beyond a Beta of 1 on the SML)? SML: The Security Market Line Depicting the Risk - Return Relationship Y-axis RETURN % What Security Would Most Likely Appear Here on the SML? 1.0 RISK As indicated by Beta B X-axis U.S. Treasury Bills (also known as T-Bils which are short-term debt instruments Issued by the US government) Common stock of FirstEnergy - an electric utility company Common stock of Ford Motor - an automobile manufacturer Common stock issued by an average company. estion 13 See the Security Market Line (SML) graph attached. Which of the following investments or securities would be best positioned at the indicated purple dot (far to the left on the SMLI? SML: The Security Market Line Depicting the Risk - Return Relationship Y-axis RETURN % What Security Would Most Likely Appear Here on the SML? 1.0 RISK As indicated by Beta B X-axis U.S. Treasury Bilis (also known as Bills which are short-term debt instrumented by the US government Common stock of SiriusXM - a young hi-tech company in the field of satelite radio Common stock of Ford Motor an automobile manufacturer Common stock issued by an average company