Answered step by step

Verified Expert Solution

Question

1 Approved Answer

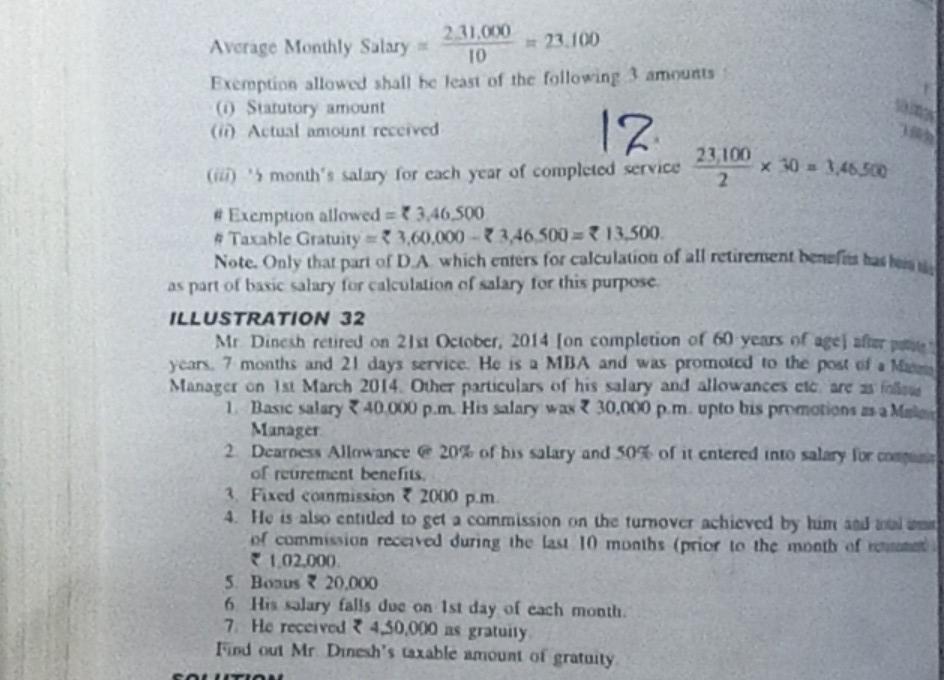

10 12 2.31.000 Average Monthly Salary 23.100 Exemption allowed shall he least of the following 3 amounts (1) Statutory amount (it) Actual amount received 23.100

10 12 2.31.000 Average Monthly Salary 23.100 Exemption allowed shall he least of the following 3 amounts (1) Statutory amount (it) Actual amount received 23.100 x 10 = 1.46.500 (i) 's month's salary for each year of completed service 2 Exemption allowed = 3.46 500 # Taxable Gratuity -3,00.000 - 3.46.500 = 13.500 Note. Only that pari of D. A which enters for calculation of all retirement benefits base as part of basic salary for calculation of salary for this purpose. ILLUSTRATION 32 Mr Dinesh retired on 21st October, 2014 ton completion of 60 years of age) aftur pe years. 7 months and 21 days service. He is a MBA and was promoted to the post of a Manager on 1st March 2014. Other particulars of his salary and allowances etc are so 1. Basic salary 40.000 p.m. His salary wax 30,000 p m upto his promotions as a Marie Manager 2. Dearness Allowance 20% of his salary and 50% of it entered into salary for of reurement benefits. 1. Fixed commission 2000 p.m. 4. He is also entitled to get a commission on the tumover achieved by lum and of commission recared during the last 10 months (prior to the month of 102.000 5. Bonus 20,000 6. His salary falls due on 1st day of each month 7. He received ? 4,30,000 as gratuity Find out Mr Dinesh's taxable amount of gratuity satu

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started