Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10 7 points 03:17:09 A collar is established by buying a share of stock for $64, buying a 6-month put option with exercise price

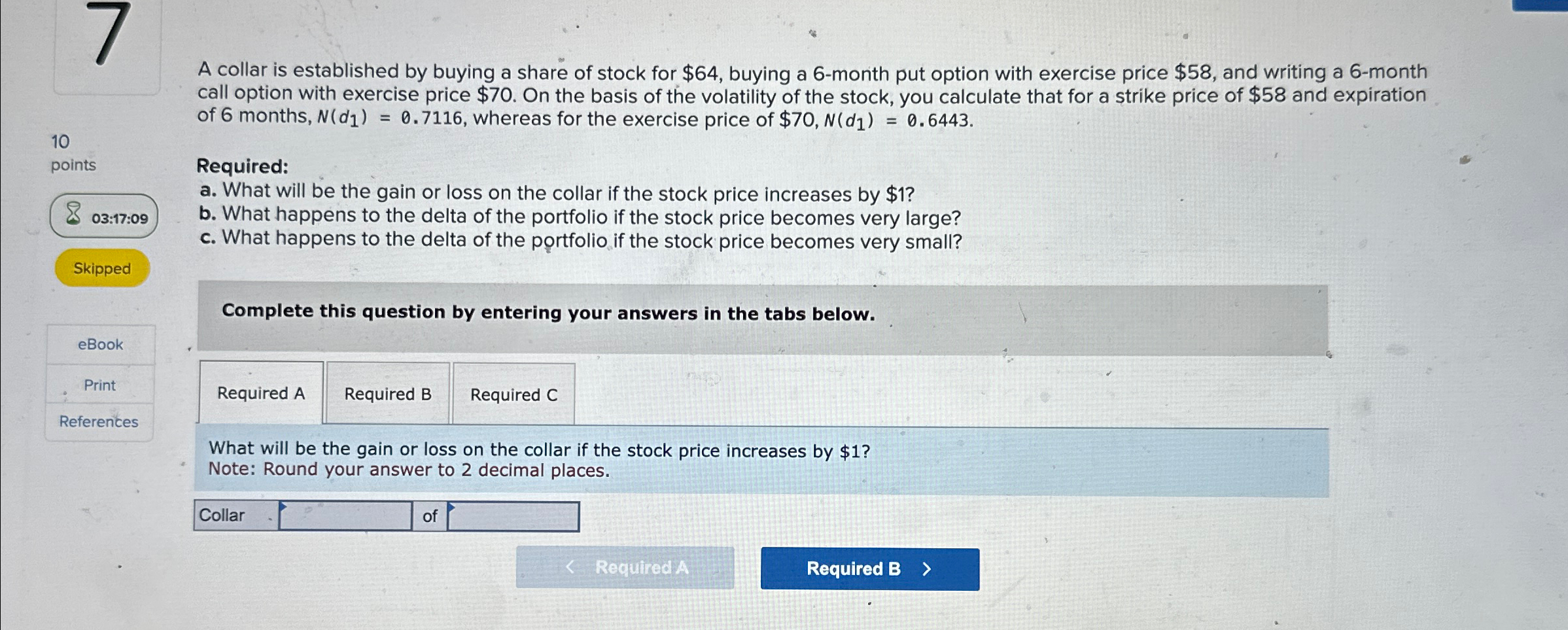

10 7 points 03:17:09 A collar is established by buying a share of stock for $64, buying a 6-month put option with exercise price $58, and writing a 6-month call option with exercise price $70. On the basis of the volatility of the stock, you calculate that for a strike price of $58 and expiration of 6 months, N(d1) = 0.7116, whereas for the exercise price of $70, N(d1) = 0.6443. Required: a. What will be the gain or loss on the collar if the stock price increases by $1? b. What happens to the delta of the portfolio if the stock price becomes very large? c. What happens to the delta of the portfolio if the stock price becomes very small? Skipped Complete this question by entering your answers in the tabs below. eBook Print Required A Required B Required C References What will be the gain or loss on the collar if the stock price increases by $1? Note: Round your answer to 2 decimal places. Collar of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started